Exploring MyState And Two More ASX Dividend Stocks

Amid a generally positive trend in the Australian market, with the ASX200 recently closing up by 1.6% and most sectors showing gains, investors may be looking for stable investment opportunities. Dividend stocks, such as MyState and others on the ASX, can offer potential avenues for steady income in this dynamic economic landscape. In considering what makes a good dividend stock, factors like consistent performance across various market conditions and strong underlying financial health become particularly relevant. These characteristics can provide some resilience against market volatility and contribute to reliable dividend payouts.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Fiducian Group (ASX:FID) | 3.97% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.72% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.65% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.41% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.49% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.50% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.20% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.98% | ★★★★☆☆ |

Macquarie Group (ASX:MQG) | 3.31% | ★★★★☆☆ |

Australian United Investment (ASX:AUI) | 3.56% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

MyState

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MyState Limited operates in Australia, offering banking, trustee, and managed fund services with a market capitalization of approximately A$397.06 million.

Operations: MyState Limited generates revenue primarily from its banking segment, which amounted to A$129.43 million.

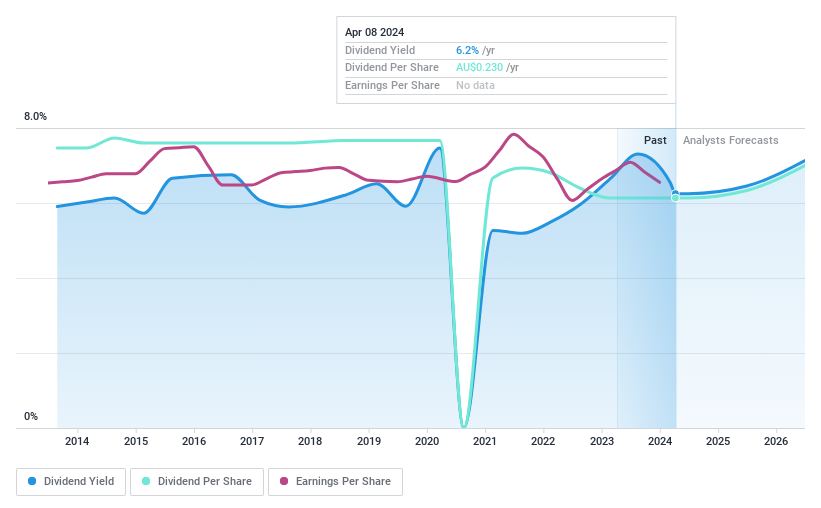

Dividend Yield: 6.4%

MyState's dividend yield stands at 6.41%, ranking in the top 25% of Australian dividend payers. Despite a volatile history with dividends falling over the past decade, recent affirmations show a stable fully franked interim dividend of A$0.115 per share, maintaining a payout ratio of 72.6%. Trading at 26.2% below its estimated fair value and with earnings forecast to grow by 7.23% annually, MyState offers potential for investors seeking income with moderate growth prospects despite past inconsistencies in payouts.

Super Retail Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited, operating in Australia and New Zealand, specializes in the retail of auto, sports, and outdoor leisure products with a market capitalization of approximately A$3.04 billion.

Operations: Super Retail Group Limited generates its revenue through several key segments: Rebel with A$1.30 billion, Super Cheap Auto (SCA) at A$1.48 billion, and Boating, Camping and Fishing (BCF), excluding Macpac, which contributes A$876 million; Macpac itself adds another A$220.60 million.

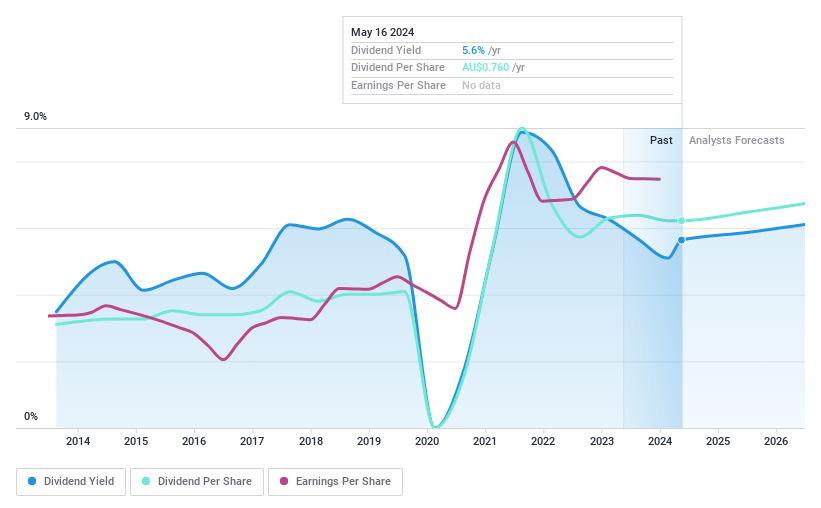

Dividend Yield: 5.6%

Super Retail Group's recent dividend of A$0.32 per share aligns with its historical pattern of fluctuating dividends, reflecting a payout ratio of 65.5% and cash payout ratio of 28.6%. Despite an unstable dividend track record over the past decade, current dividends are supported by earnings and cash flows. The company's stock trades at a significant discount to estimated fair value, offering relative value in comparison to industry peers. Recent management changes could influence future performance, as noted with Anna Sandham's appointment as Company Secretary on March 25, 2024.

Southern Cross Electrical Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, operating in Australia, specializes in electrical, instrumentation, communication, and maintenance services with a market capitalization of approximately A$419.83 million.

Operations: Southern Cross Electrical Engineering Limited generates its revenue primarily through the provision of electrical services, amounting to A$464.88 million.

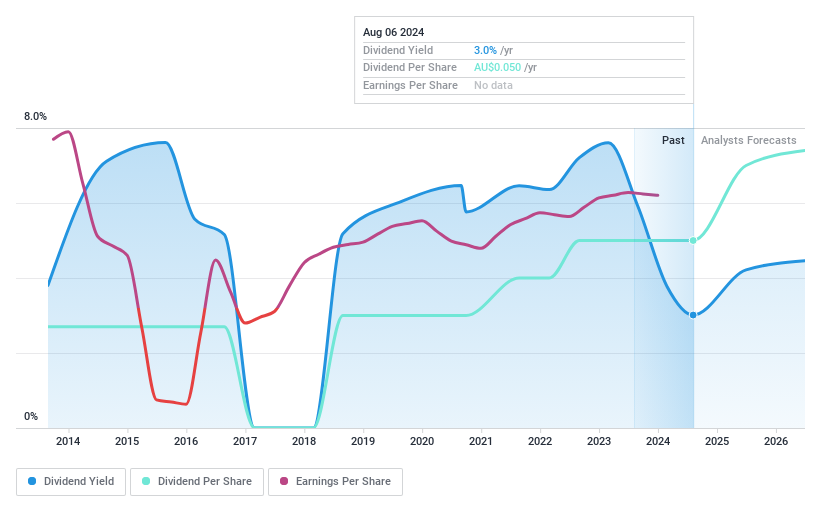

Dividend Yield: 3.1%

Southern Cross Electrical Engineering has demonstrated inconsistent dividend reliability, with a history of volatile payments over the past decade. Despite this, its current dividends are supported by a payout ratio of 66.5% and a cash payout ratio of 78.2%, indicating coverage by both earnings and cash flows. However, its dividend yield of 3.13% is relatively low compared to the top Australian dividend payers at 6.27%. Recent inclusion in the S&P/ASX All Ordinaries and Emerging Companies Indexes may influence investor perception but does not directly impact dividend stability or growth.

Next Steps

Click here to access our complete index of 31 Top ASX Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:MYS ASX:SUL and ASX:SXE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance