Exploring M Winkworth And Two Other High Yield Dividend Stocks In The UK

The United Kingdom market has been displaying a strong opening recently, with the FTSE 100 index making a recovery. Despite global markets experiencing some turbulence, London's financial scene seems to be holding its own. In such times, high yield dividend stocks like M Winkworth and two others we will explore can offer investors a steady income stream and potential capital appreciation. Given the current market conditions, a good stock would ideally have consistent dividend payments and robust financial health to weather any economic uncertainties.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.49% | ★★★★★★ |

Keller Group (LSE:KLR) | 4.35% | ★★★★★☆ |

DCC (LSE:DCC) | 3.51% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.65% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.82% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.33% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.19% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.43% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.90% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.41% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

M Winkworth

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M Winkworth PLC, with a market cap of £22.59 million, functions as a franchisor to the Winkworth estate agencies across the United Kingdom.

Operations: M Winkworth PLC, valued at £22.59 million, is a franchisor to the Winkworth estate agencies throughout the UK, however, specific revenue segments for the company are not provided.

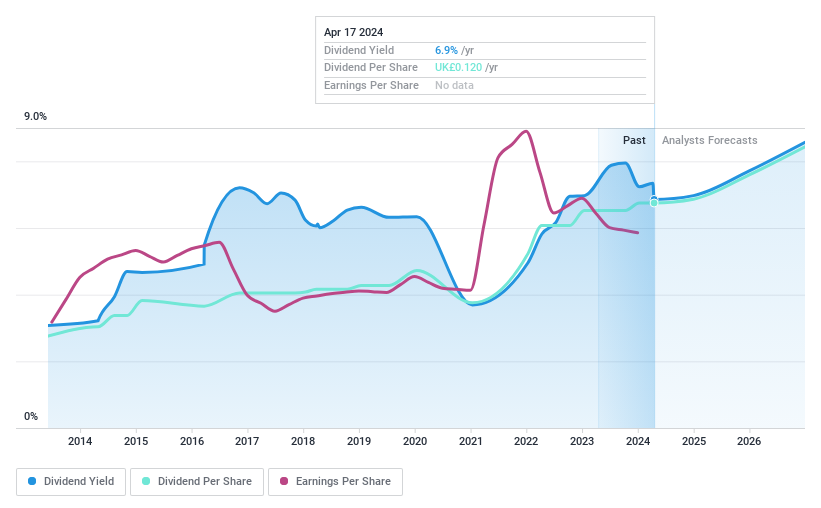

Dividend Yield: 6.9%

M Winkworth's dividend payments have been inconsistent in the past decade, with a high cash payout ratio of 166.7%. However, they have shown growth and offer a yield of 6.86%, placing it in the top tier of UK dividend payers. The company's earnings are forecast to grow by 12.62% per year, but its recent net income was GBP 1.67 million, lower than the previous year's GBP 1.95 million. A Q1 dividend of £0.03 per share has been announced for payment in May.

TClarke

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TClarke plc is a UK-based company, with its subsidiaries, involved in the design, installation, integration and maintenance of mechanical and electrical systems and technologies with a market cap of £82.78 million.

Operations: TClarke plc, a UK-based firm with a market cap of £82.78 million, generates its revenue through the design, installation, integration and maintenance of mechanical and electrical systems and technologies across the United Kingdom.

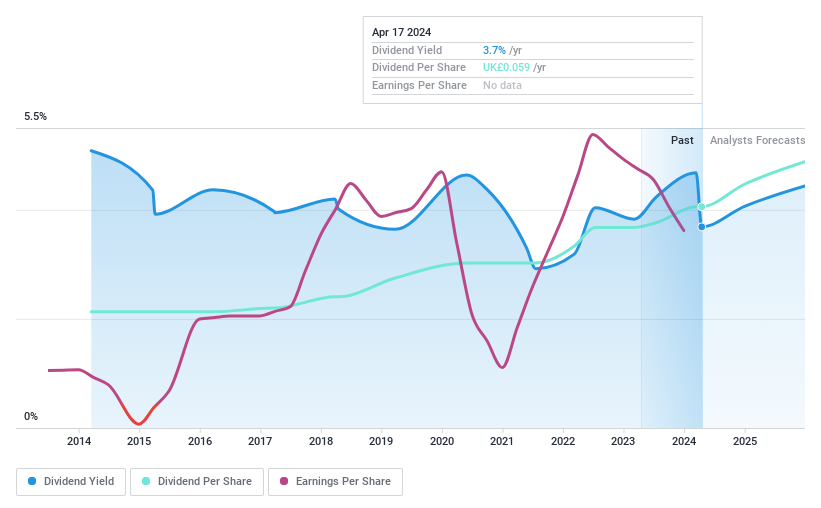

Dividend Yield: 3.7%

TClarke's dividend yield of 3.69% is not top-tier, but the company has shown a decade-long consistency in increasing its dividends. Despite lower profit margins of 1.3%, compared to last year's 2%, TClarke's dividend payments are well covered by earnings with a payout ratio of 42.8%. The company also exhibits stable share price despite recent volatility and is valued reasonably with a Price-To-Earnings ratio of 12.7x, below the UK market average. However, shareholders should note the recent £84.6 million acquisition offer from Regent Acquisitions Limited.

Click to explore a detailed breakdown of our findings in TClarke's dividend report.

Our valuation report unveils the possibility TClarke's shares may be trading at a premium.

Kaspi.kz

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joint Stock Company Kaspi.kz operates in the Republic of Kazakhstan, offering payments, marketplace, and fintech solutions through its subsidiaries with a market cap of $22.83 billion.

Operations: Joint Stock Company Kaspi.kz generates its revenue primarily from three segments in the Republic of Kazakhstan: Fintech, which brings in KZT 1.03 billion; Payments, contributing KZT 478.68 million; and Marketplace, accounting for KZT 448.22 million.

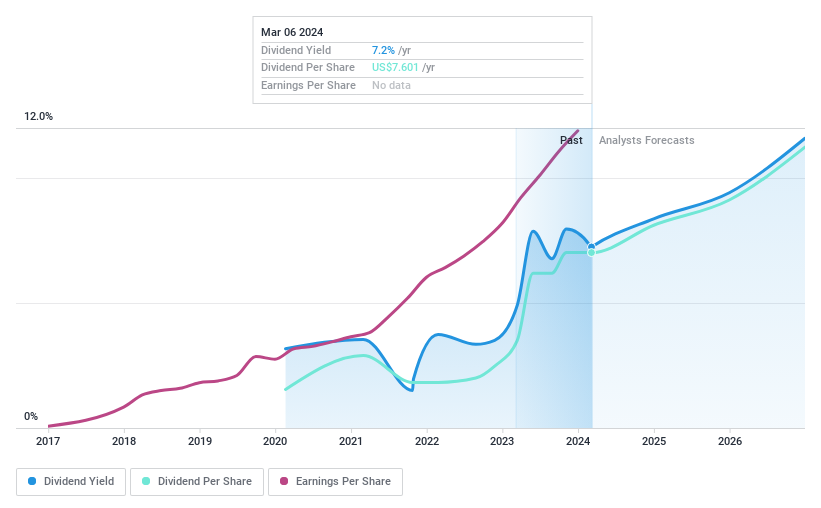

Dividend Yield: 6.3%

Kaspi.kz's dividend yield sits in the top 25% of UK payers at 6.27%. Earnings have grown by 43.8% over the past year, and dividends are well covered by earnings and cash flows, with payout ratios of 72.2% and 61% respectively. However, its dividend track record is unstable with payments being volatile over the last four years. Despite trading at a significant discount to fair value, investors should consider that Kaspi.kz recently delisted from the London Stock Exchange on March 25th, potentially affecting future accessibility.

Seize The Opportunity

Discover the full array of 58 Top Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:WINKLSE:CTOLSE:KSPI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance