Exploring July 2024's Undervalued Small Caps With Insider Actions In The United States

As the S&P 500 and Nasdaq reach record highs, buoyed by strong performances in tech giants like Nvidia, investors are keenly watching economic indicators such as the upcoming CPI inflation report and Federal Reserve comments. In this climate, identifying undervalued small-cap stocks with insider actions can offer potential opportunities for those looking to diversify their portfolios amidst broader market enthusiasm.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Hanover Bancorp | 8.3x | 1.9x | 49.39% | ★★★★★☆ |

PCB Bancorp | 8.8x | 2.3x | 45.57% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 33.81% | ★★★★★☆ |

Titan Machinery | 3.6x | 0.1x | 30.95% | ★★★★★☆ |

Franklin Financial Services | 8.7x | 1.8x | 38.49% | ★★★★☆☆ |

Papa John's International | 18.8x | 0.7x | 39.45% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 18.98% | ★★★★☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -132.16% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -143.14% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

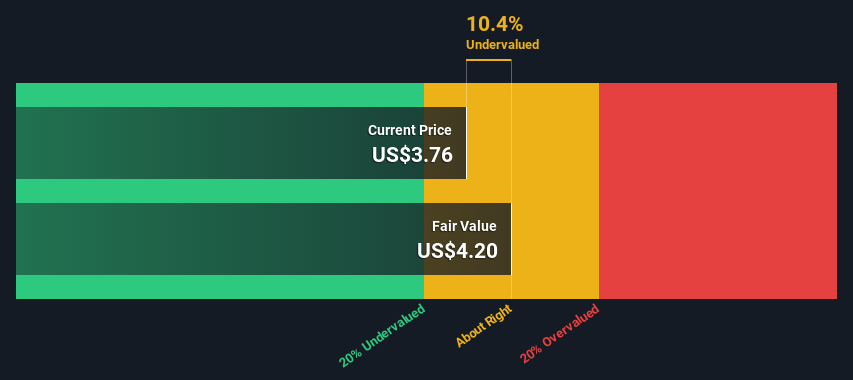

Petco Health and Wellness Company

Simply Wall St Value Rating: ★★★★★☆

Overview: Petco Health and Wellness Company is a specialty retailer that offers various pet-related products and services, with a market capitalization of approximately $4.09 billion.

Operations: Specialty retail generates $6.23 billion in revenue, with a gross profit margin of 37.38% as of the latest reporting period. The cost of goods sold recently amounted to $3.90 billion, reflecting significant operational costs impacting profitability.

PE: -0.7x

Recently, Petco Health and Wellness Company has shown notable insider confidence, with significant share purchases signaling strong belief in the company's potential despite its recent drop from several Russell indexes and addition to the Russell 2000. This shift underscores its appeal as a smaller entity poised for growth. The company is navigating through leadership changes aimed at enhancing operational efficiency and has provided a robust revenue forecast of approximately $1.525 billion for Q2 2024. These strategic moves, combined with insider investments, suggest promising prospects for this underrecognized player in the pet care market.

Chimera Investment

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing on a leveraged basis in a diversified portfolio of mortgage assets, with a market capitalization of approximately $2.91 billion.

Operations: The entity generates revenue primarily through investments in a diversified portfolio of mortgage assets, with recent figures showing a gross profit of $260.12 million and operating expenses amounting to $54.35 million. The net income margin stands at approximately 42.62%.

PE: 8.6x

Chimera Investment recently increased its quarterly dividend, signaling financial stability and a commitment to shareholder returns. Following a reverse stock split, they effectively managed their share structure without diluting shareholder value significantly. Despite forecasts suggesting a slight earnings decline over the next three years, insider confidence remains evident as they have not engaged in recent share repurchases but have maintained a robust buyback history. The company's reliance on external borrowing underscores potential risks yet also reflects an aggressive growth strategy in the competitive real estate finance sector.

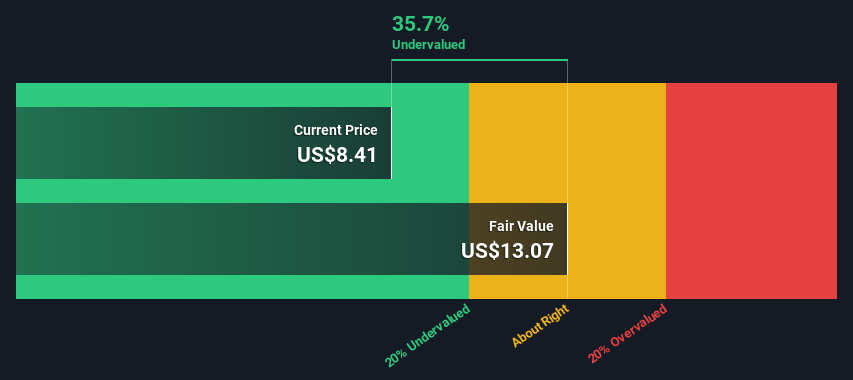

Ready Capital

Simply Wall St Value Rating: ★★★★★☆

Overview: Ready Capital is a real estate finance company that specializes in small business lending and lower middle market commercial real estate, with a market capitalization of approximately $1.07 billion.

Operations: The company generates revenue from various segments including Small Business Lending and Lower Middle Market Commercial Real Estate, with respective revenues of $132.84 million and $164.64 million. It has observed a notable gross profit margin trend, increasing from 9.58% in late 2013 to 85.36% by mid-2024, reflecting significant operational efficiency improvements over the period.

PE: 6.5x

Recently, Ready Capital has demonstrated insider confidence with significant share purchases, totaling 3.74 million shares for US$32.72 million as of April 2024, underscoring a strong belief in the company's value despite its challenging financial quarter where it reported a net loss of US$74.28 million. This action aligns with their proactive approach to shareholder returns, including consistent dividend payments declared in June 2024. These strategic moves suggest potential for growth and recovery, reflecting an attractive entry point for investors looking at overlooked opportunities within the market.

Navigate through the intricacies of Ready Capital with our comprehensive valuation report here.

Assess Ready Capital's past performance with our detailed historical performance reports.

Where To Now?

Get an in-depth perspective on all 61 Undervalued US Small Caps With Insider Buying by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:WOOF NYSE:CIM and NYSE:RC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance