Exploring ITC And Two More Leading Dividend Stocks In India

The Indian market has shown remarkable growth, rising 8.0% in the last week and achieving a 43% increase over the past year, with earnings expected to grow by 16% annually. In this buoyant environment, dividend stocks like ITC can be particularly appealing for their potential to provide investors with steady income alongside capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.19% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.97% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.26% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.66% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.18% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.61% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.29% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.67% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.39% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.25% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

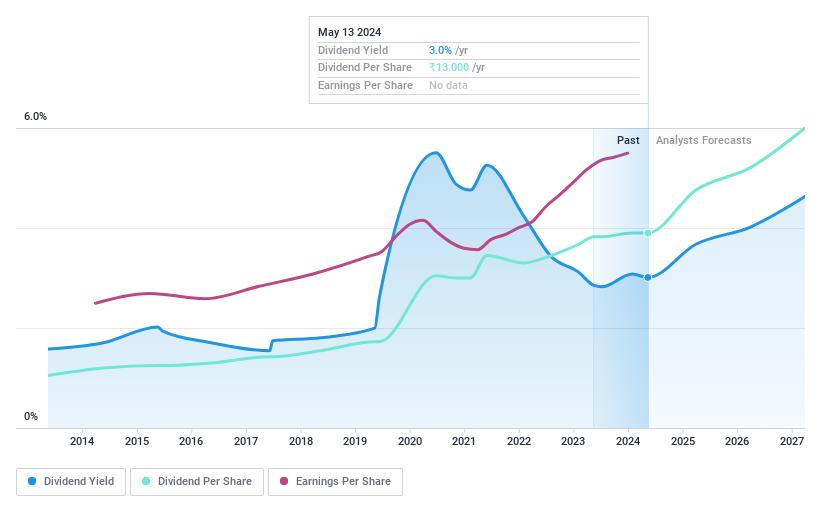

ITC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited operates in various sectors including fast-moving consumer goods, hotels, paperboards and paper, packaging, agriculture, and information technology across India and globally, with a market capitalization of approximately ₹5.41 trillion.

Operations: ITC Limited's revenue is derived from several key segments: FMCG - Cigarettes (₹336.68 billion), FMCG - Others (₹210.02 billion), Agri Business (₹161.24 billion), Paperboards, Paper & Packaging (₹83.44 billion), and Hotels (₹31.03 billion).

Dividend Yield: 3.2%

ITC Limited, a notable player in the Indian market, recently announced a final dividend of INR 7.50 per share for FY 2024, reflecting its consistent dividend policy. The company reported a year-over-year revenue increase to INR 795.68 billion and net income growth to INR 204.59 billion for the full year ended March 2024. Despite these positive earnings trends, concerns arise from its high payout ratio of 83.7% and cash payout ratio of 126.1%, indicating potential stress on future dividend sustainability without adequate cash flow coverage.

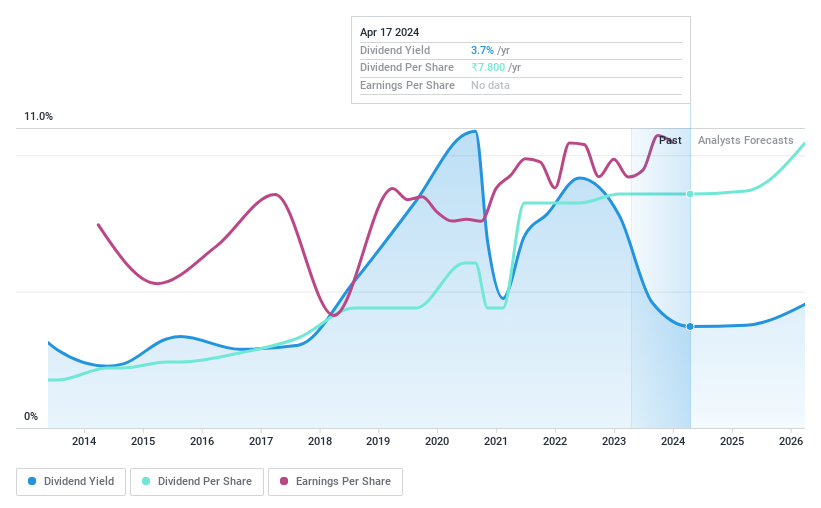

PTC India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited operates in the trading of power across India, Nepal, Bhutan, and Bangladesh, with a market capitalization of approximately ₹60.95 billion.

Operations: PTC India Limited generates revenue primarily through its power trading segment, which contributed ₹160.12 billion, and its financing business, which added ₹7.67 billion.

Dividend Yield: 3.7%

PTC India, despite a volatile dividend history over the past decade, maintains a 54% earnings payout ratio and a low 9.4% cash payout ratio, suggesting dividends are well-covered by both earnings and cash flows. Recent financials show a decline in quarterly net income to INR 862.6 million from INR 1,165.9 million year-over-year but an overall annual increase to INR 4,768.8 million from INR 4,456 million. The board recommended a final dividend of INR 7.80 per share on June 7, reflecting confidence in ongoing payouts amidst fluctuating performance.

Click here and access our complete dividend analysis report to understand the dynamics of PTC India.

The valuation report we've compiled suggests that PTC India's current price could be quite moderate.

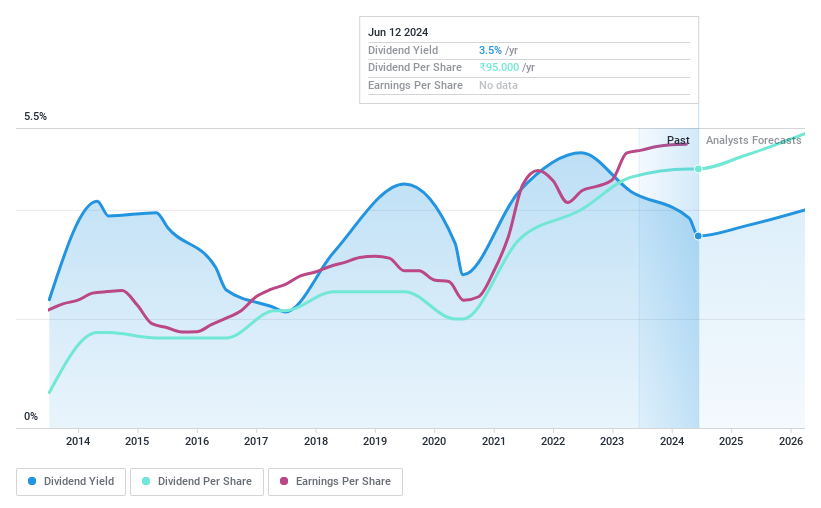

Swaraj Engines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹32.04 billion.

Operations: Swaraj Engines Limited generates its revenue primarily from the sale of diesel engines, components, and spare parts, totaling ₹14.19 billion.

Dividend Yield: 3.5%

Swaraj Engines, with a P/E ratio of 23.8x below the Indian market average, shows potential value. Despite a dividend yield of 3.52% ranking in the top quartile, its dividends have demonstrated volatility over the past decade and are not well-covered by cash flows, given a high payout ratio of 122%. Recent financials indicate stable earnings growth with net income reaching INR 1,378.7 million for FY2024. The company announced a substantial dividend increase to INR 95 per share for FY2024.

Turning Ideas Into Actions

Investigate our full lineup of 19 Top Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:ITC NSEI:PTCNSEI:SWARAJENG and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance