Exploring High Insider Ownership In US Growth Companies

Amid a backdrop of weakening manufacturing signals and fluctuating market sentiments, the U.S. stock market presents a complex landscape for investors. In such uncertain times, growth companies with high insider ownership can be particularly noteworthy as these insiders may have a vested interest in the company's long-term success, aligning their goals closely with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 85.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

We're going to check out a few of the best picks from our screener tool.

Establishment Labs Holdings

Simply Wall St Growth Rating: ★★★★★☆

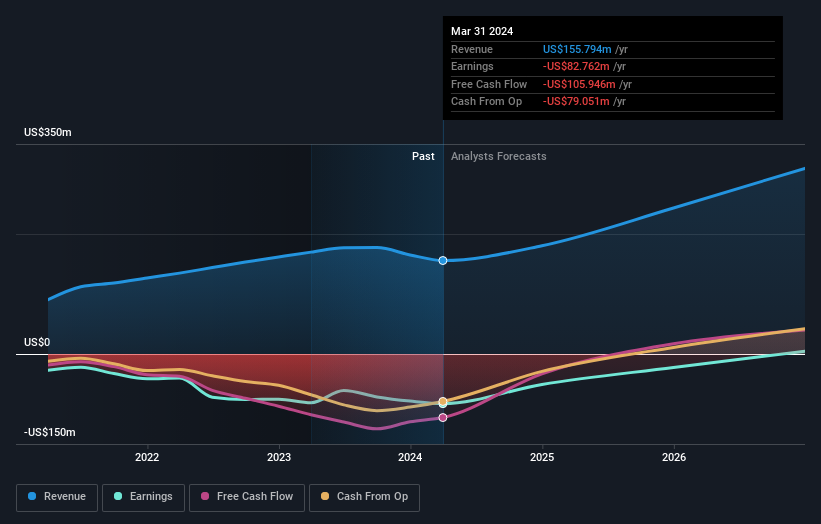

Overview: Establishment Labs Holdings Inc. is a medical technology company that specializes in manufacturing and marketing medical devices for aesthetic and reconstructive plastic surgery, with a market capitalization of approximately $1.44 billion.

Operations: The company generates its revenue primarily from the sale of medical products, totaling $155.79 million.

Insider Ownership: 10.6%

Earnings Growth Forecast: 68.2% p.a.

Establishment Labs Holdings is navigating a challenging phase with a recent decline in quarterly sales to US$37.17 million from US$46.52 million year-over-year and an increased net loss of US$16.2 million. Despite these setbacks, the company projects revenue growth for 2024 between 5% to 11% over the previous year, suggesting some recovery potential. Analysts remain optimistic, anticipating a significant stock price rise and forecasting robust annual profit growth as ESTA approaches profitability within three years, supported by expected high revenue growth rates of 23% per year.

Medpace Holdings

Simply Wall St Growth Rating: ★★★★☆☆

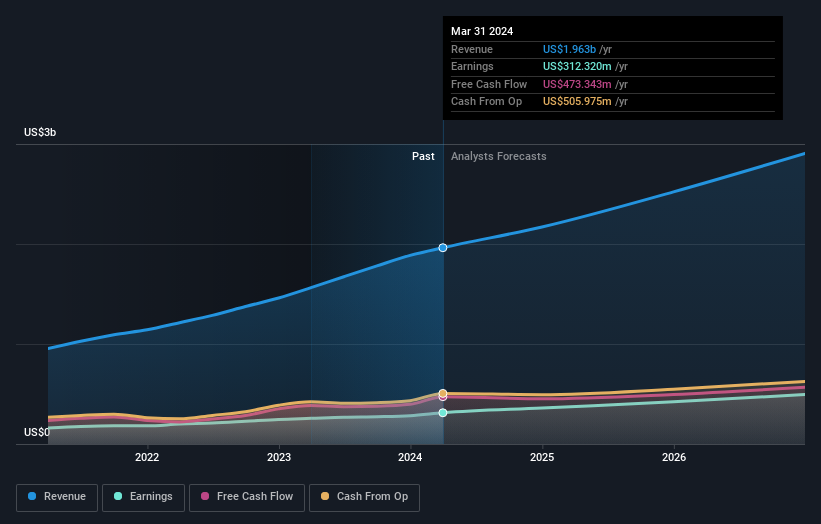

Overview: Medpace Holdings, Inc. operates as a full-service clinical contract research organization, offering drug and medical device development services across North America, Europe, and Asia, with a market capitalization of approximately $11.94 billion.

Operations: The company generates its revenue primarily from the development, management, and execution of clinical trials, totaling $1.96 billion.

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.9% p.a.

Medpace Holdings, Inc. has shown robust financial performance with a recent quarterly revenue of US$511.04 million and net income of US$102.59 million, marking significant year-over-year growth. Despite no substantial insider purchases recently, the company's strong earnings growth forecast and high return on equity suggest solid fundamentals. However, insider selling and trading at 30.7% below estimated fair value raise cautionary flags about its market valuation and insider confidence.

Estée Lauder Companies

Simply Wall St Growth Rating: ★★★★☆☆

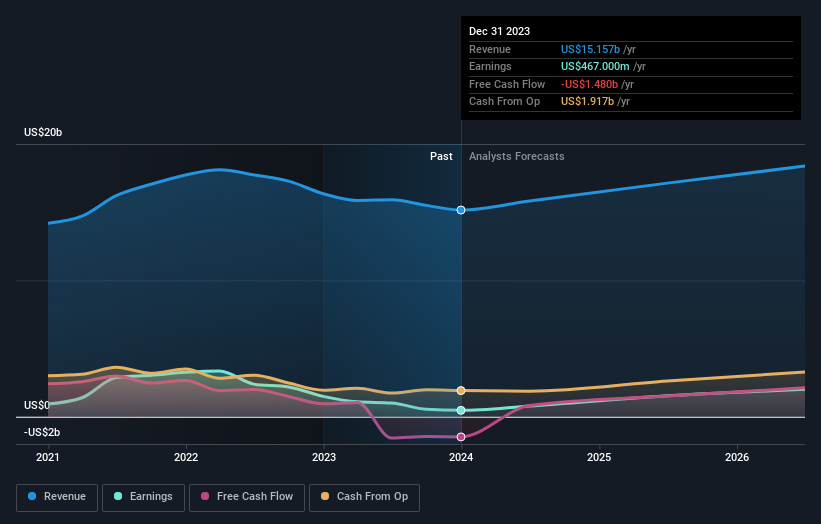

Overview: Estée Lauder Companies Inc. operates globally, specializing in the manufacture, marketing, and sale of skin care, makeup, fragrance, and hair care products with a market capitalization of approximately $44.23 billion.

Operations: The company's revenue is primarily generated from skin care at $7.62 billion, followed by makeup at $4.46 billion, fragrance at $2.55 billion, and hair care contributing $0.63 billion.

Insider Ownership: 11.4%

Earnings Growth Forecast: 32.7% p.a.

Estée Lauder Companies, despite a challenging fiscal year with declining net sales and profit margins, continues to focus on growth through strategic leadership appointments and expansion into new platforms like Amazon's U.S. Premium Beauty store. Recent executive changes, including Shane Wolf's appointment as President of Global Brands Aveda and Bumble and bumble, underscore efforts to enhance their global hair care strategy. However, financial strains are evident with a high level of debt and significant insider selling over the past three months, raising concerns about its financial health despite a promising earnings growth forecast.

Turning Ideas Into Actions

Investigate our full lineup of 178 Fast Growing US Companies With High Insider Ownership right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:ESTA NasdaqGS:MEDP and NYSE:EL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance