Exploring High Insider Ownership Growth Companies On The Chinese Exchange

Amid a backdrop of recovery optimism in China, marked by a recent uptick in holiday spending and positive trade data, the Chinese stock market has shown signs of robust activity. In this context, exploring growth companies with high insider ownership on the Chinese exchange could provide insights into firms potentially poised for resilience and informed strategic direction.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.7% | 43.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's review some notable picks from our screened stocks.

Runben Biotechnology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd., a company listed on the Shanghai Stock Exchange under the ticker SHSE:603193, specializes in the research, production, and sale of mosquito repellent products, baby care products, and essential oil products, with a market capitalization of approximately CN¥8.29 billion.

Operations: The company generates its revenue primarily through the sale of mosquito repellent, baby care, and essential oil products.

Insider Ownership: 33.1%

Earnings Growth Forecast: 22.4% p.a.

Runben Biotechnology, a growth-oriented firm with high insider ownership in China, has demonstrated robust financial performance with a significant 69.4% increase in earnings over the past year. While its earnings growth of 22.43% per year is slightly below the broader Chinese market forecast of 23.2%, its revenue growth at 25.5% per year surpasses the market's 14.1%. Recent financial reports for Q1 2024 show sales rising to CNY 166.68 million from CNY 151.5 million last year, and net income improving to CNY 35.47 million from CNY 21.12 million, indicating sustained profitability and operational efficiency.

Wetown Electric Group

Simply Wall St Growth Rating: ★★★★★★

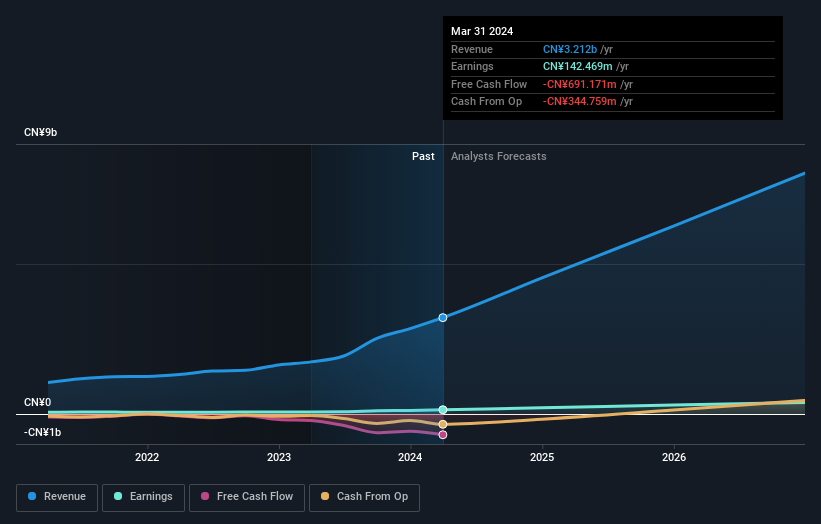

Overview: Wetown Electric Group Co., Ltd. is a company based in China that focuses on the research, development, production, and sale of electrical products both domestically and internationally, with a market capitalization of approximately CN¥3.19 billion.

Operations: Wetown Electric Group primarily generates its revenue from the research, development, production, and sale of electrical products across both domestic and international markets.

Insider Ownership: 22.3%

Earnings Growth Forecast: 34.2% p.a.

Wetown Electric Group, a Chinese company with high insider ownership, posted a strong financial performance, doubling its earnings over the past year. Recent results show first-quarter sales nearly doubled to CNY 794.94 million from CNY 430.45 million year-over-year, with net income rising to CNY 35.29 million from CNY 13.29 million. Despite robust revenue growth forecasts of 31.7% annually and earnings expected to grow by 34.22% per year, the firm's dividends are poorly covered by cash flows and debt is inadequately supported by operating cash flow.

Sinofibers TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinofibers Technology Co., Ltd. specializes in the research, development, production, and sales of high-performance carbon fibers and fabrics, with a market capitalization of approximately CN¥12.42 billion.

Operations: The company generates revenue primarily from the New Material Manufacturing Industry, totaling CN¥500.45 million.

Insider Ownership: 13.5%

Earnings Growth Forecast: 33.5% p.a.

Sinofibers Technology Co.,Ltd., a growth-oriented company with substantial insider ownership in China, is trading at 43.7% below its estimated fair value. While its return on equity is expected to remain modest at 10.5%, the company's earnings and revenue are forecasted to grow significantly by 33.5% and 27.4% per year, respectively, outpacing the Chinese market averages. However, recent financials indicate a downturn with net income and revenue dropping significantly compared to the previous year. Additionally, Sinofibers has initiated a share repurchase program valued at CNY 30 million to boost shareholder value and support equity incentives.

Taking Advantage

Explore the 407 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603193 SHSE:688226 and SZSE:300777.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance