Exploring Dundee Precious Metals And Two More Undervalued Small Caps With Insider Buying In Canada

In the first half of 2024, Canadian markets have shown resilience, with the TSX index posting solid gains despite less exposure to the high-flying technology sector that has boosted indices like the S&P 500. This backdrop sets a promising stage for investors to explore opportunities beyond mainstream large caps, particularly in undervalued small-cap stocks where insider buying might indicate unrecognized potential. In current market conditions, a good stock often shows not just fundamental strength but also signs of confidence from those who know the company best—its insiders.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 8.3x | 2.8x | 45.28% | ★★★★★☆ |

Nexus Industrial REIT | 2.4x | 3.0x | 19.86% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.4x | 3.0x | 36.49% | ★★★★★☆ |

Russel Metals | 9.0x | 0.5x | -5.67% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 32.39% | ★★★★☆☆ |

Calfrac Well Services | 2.3x | 0.2x | 6.58% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -96.35% | ★★★★☆☆ |

Trican Well Service | 8.3x | 1.0x | -17.13% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.4x | 3.9x | 1.31% | ★★★☆☆☆ |

Freehold Royalties | 15.4x | 6.6x | 48.46% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

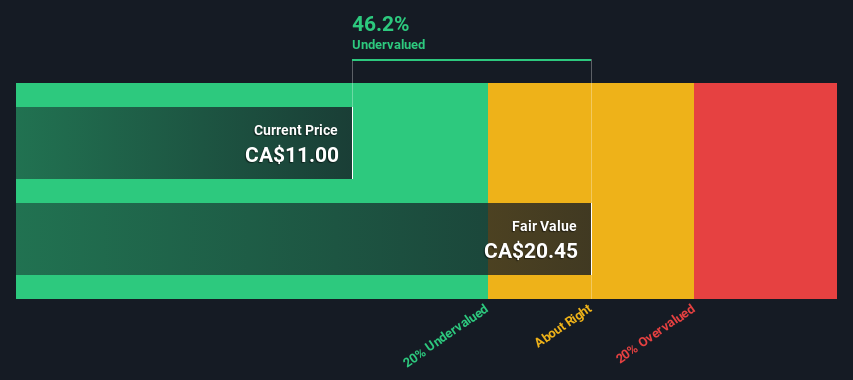

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★☆

Overview: Dundee Precious Metals is a gold and copper mining company with operations at Ada Tepe and Chelopech, boasting a market capitalization of approximately $1.24 billion CAD.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, reflecting the company's diverse operational base. The gross profit margin showed a significant increase over recent periods, reaching 0.53 in the latest quarter, indicating improved efficiency in managing production costs relative to revenue.

PE: 8.3x

Dundee Precious Metals, a notable player in the mining sector, recently appointed W. John DeCooman Jr. as Executive Vice President, enhancing its strategic and operational bandwidth with his extensive background in corporate development. This move aligns with Dundee's reaffirmed production guidance for 2024, projecting robust output levels across key commodities. Highlighting insider confidence, executives have recently purchased shares, signaling strong belief in the company's prospects amidst its strategic expansions and consistent financial performance.

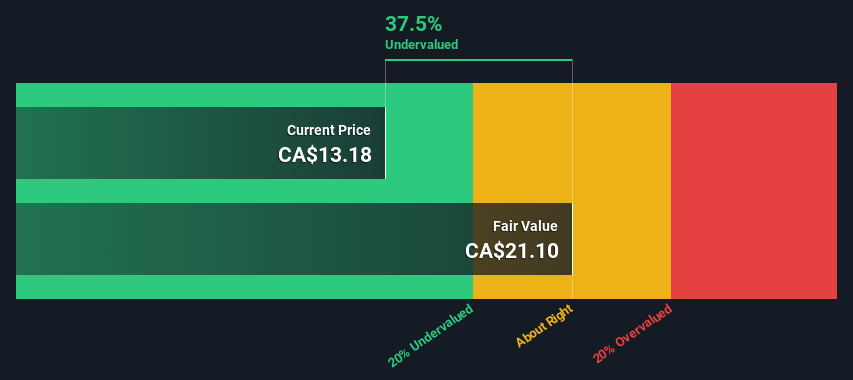

Primaris Real Estate Investment Trust

Simply Wall St Value Rating: ★★★★★☆

Overview: Primaris Real Estate Investment Trust specializes in the ownership, management, and development of investment properties.

Operations: The entity generates revenue primarily through the ownership, management, and development of investment properties, with its latest recorded gross profit being CA$246.07 million on revenues of CA$433.82 million. Over recent periods, it has observed a gross profit margin increase to 56.72%.

PE: 11.4x

Recently, Primaris Real Estate Investment Trust demonstrated a robust financial trajectory with a notable increase in quarterly sales from CAD 96.37 million to CAD 119.22 million and net income rising from CAD 35.59 million to CAD 45.88 million as of March 2024. Despite challenges in debt coverage by operating cash flow, the trust maintained stable distributions and actively repurchased shares, signaling insider confidence through recent acquisitions totaling nearly CAD 3.6 million in shares since January this year alone. This ongoing commitment reflects positively on its prospects amidst a competitive real estate sector.

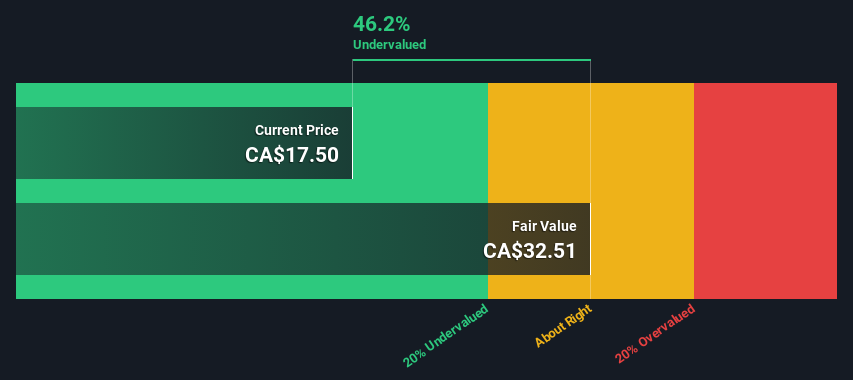

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company that specializes in IT solutions and services, with a market cap of approximately $1.5 billion.

Operations: Direct Marketing generated a revenue of $777.35 million, with a notable gross profit margin increase to 41.82% by mid-2024, reflecting effective cost management and potentially improved operational efficiencies. This segment's consistent growth in gross profit margin from 23.91% in late 2018 to over 41% suggests an increasingly profitable scaling of operations.

PE: 19.7x

Amidst a challenging fiscal landscape, Softchoice has demonstrated resilience with a recent 18% dividend increase and insider confidence underscored by significant purchases in the past year. Despite a dip in Q1 sales to US$169.76 million from US$208.82 million and shifting to a net loss, the company's strategic adjustments are evident at conferences and shareholder meetings, signaling potential for recalibration and growth. Their commitment is further highlighted by maintaining dividends amid financial headwinds.

Take a closer look at Softchoice's potential here in our valuation report.

Gain insights into Softchoice's historical performance by reviewing our past performance report.

Make It Happen

Embark on your investment journey to our 31 Undervalued TSX Small Caps With Insider Buying selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:DPM TSX:PMZ.UN and TSX:SFTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance