Exploring Dividend Stocks For May 2024

As global markets experience a phase of easing inflation and interest rate concerns, with major U.S. indices like the Dow Jones Industrial Average reaching new heights, investors may find dividend stocks particularly appealing. These stocks can offer potential income stability amidst fluctuating market conditions, making them a noteworthy consideration for those looking to diversify their investment portfolios in light of current economic trends.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Guaranty Trust Holding (NGSE:GTCO) | 8.02% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.33% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.16% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.46% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.45% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.36% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

Innotech (TSE:9880) | 4.01% | ★★★★★★ |

Click here to see the full list of 1857 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alexandria Mineral Oils

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alexandria Mineral Oils Company operates in the production of oil products both domestically in Egypt and on an international scale, with a market capitalization of approximately EGP 10.59 billion.

Operations: Alexandria Mineral Oils Company generates its revenue primarily from the oil and gas refining and marketing segment, which recorded EGP 27.77 billion in sales.

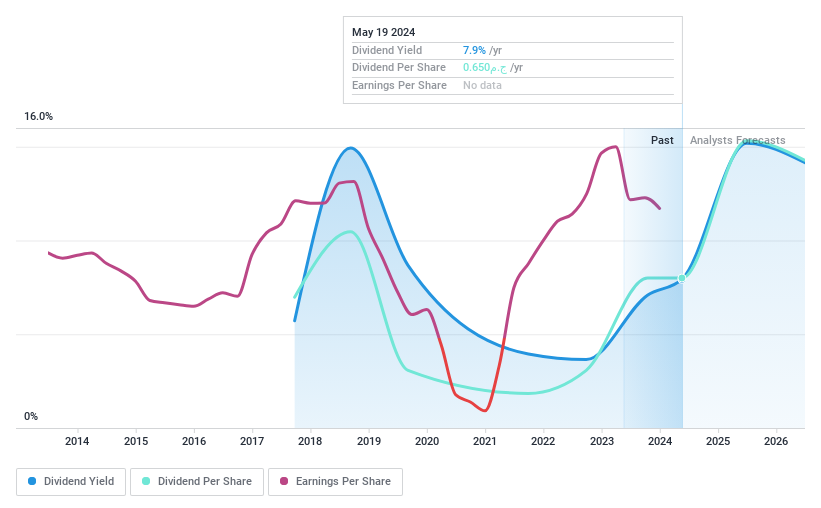

Dividend Yield: 7.9%

Alexandria Mineral Oils (AMOC) offers a dividend yield of 7.93%, placing it in the top 25% of dividend payers in the Egyptian market. However, its history with dividends is marked by instability, having paid dividends for only seven years with significant volatility in payments. Despite this, both earnings and cash flows adequately cover current payouts, with a payout ratio at 75.3% and a cash payout ratio at 36.9%. Analysts predict potential stock price growth of 31.4%, but profit margins have dipped from last year's 7.2% to this year's 4%.

Dubai Refreshment (P.J.S.C.)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) operates as the sole bottler and distributor of Pepsi Cola International products in Dubai, Sharjah, and the other Northern Emirates of the UAE, with a market capitalization of AED 2.07 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates its revenue primarily through the bottling and distribution of Pepsi Cola International products across Dubai, Sharjah, and the Northern Emirates of the UAE.

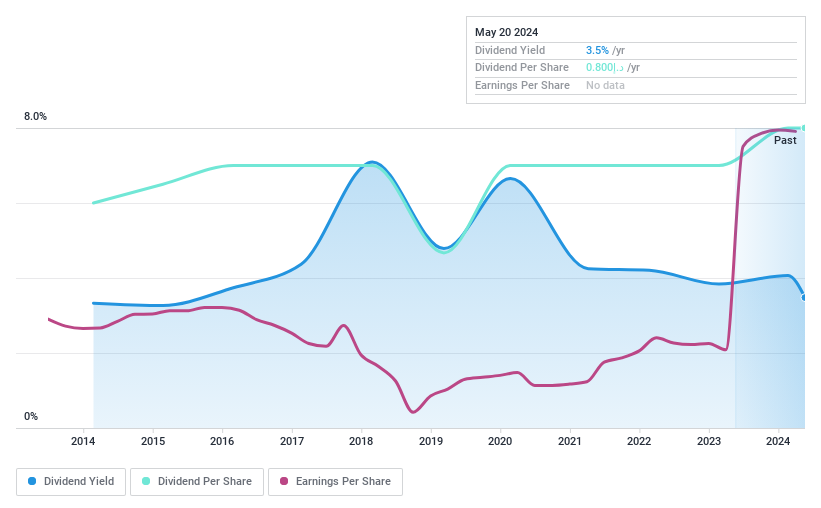

Dividend Yield: 3.5%

Dubai Refreshment (P.J.S.C.) has a modest dividend yield of 3.48%, which is lower than the top quartile in its market. Despite this, dividends are well-supported with a low payout ratio of 20.2% and a cash payout ratio of 56.6%. Earnings have surged by 279.2% over the past year, enhancing its valuation, now trading at 17.5% below estimated fair value. However, dividend reliability is questionable due to volatility over the last decade and overall illiquidity in share trading.

National Life Insurance

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Life Insurance Company Limited offers a range of life insurance products and services in Bangladesh, with a market capitalization of approximately BDT 13.36 billion.

Operations: National Life Insurance Company Limited generates BDT 21.58 billion from its life and health insurance segment.

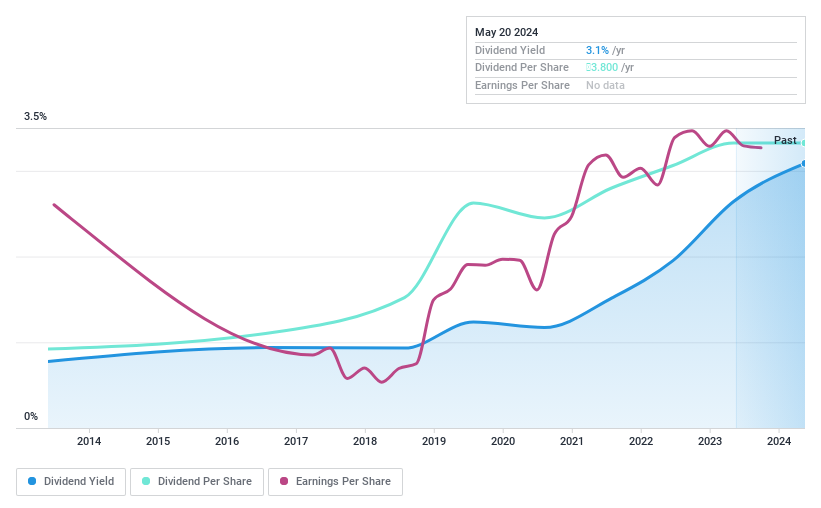

Dividend Yield: 3.1%

National Life Insurance offers a stable dividend yield of 3.09%, underpinned by a low payout ratio of 9% and cash payout ratio of 12.6%, ensuring dividends are well-covered by both earnings and cash flows. Over the past decade, the company has demonstrated reliable growth in dividend payments without significant volatility. However, its dividend yield is modest compared to the top performers in its market, which currently stands at 4.29%. Additionally, recent financial data is outdated, being over six months old.

Summing It All Up

Explore the 1857 names from our Top Dividend Stocks screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CASE:AMOCDFM:DRCDSE:NATLIFEINS and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance