Exploring Dividend Stocks: Avoid OC Oerlikon In Favor Of One Better Option

Investors often look to dividend stocks as a reliable source of income. However, it's essential to assess the sustainability of these dividends. Companies like OC Oerlikon, with high payout ratios, may signal a risk that their dividends are not sustainable in the long term. This article will explore why such stocks might be less attractive for investors seeking stable dividend income from Swiss equities.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.50% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.15% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.39% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.32% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.94% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★☆ |

CPH Group (SWX:CPHN) | 5.90% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.13% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.73% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

Meier Tobler Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG specializes in trading and servicing heat generation and air conditioning systems, with a market capitalization of CHF 369.69 million.

Operations: The company generates CHF 104.67 million from services and CHF 441.25 million from distribution activities in the heat generation and air conditioning sector.

Dividend Yield: 4%

Meier Tobler Group's dividend yield stands at 4.07%, slightly below the top quartile of Swiss dividend payers, which averages 4.22%. Despite this, the company maintains a sustainable payout with its earnings and cash flows adequately covering dividends, having payout ratios of 54.8% and 50.7% respectively. However, investors should note the historical volatility in its dividend payments over the past decade and a highly volatile share price recently, which could influence investment stability.

Get an in-depth perspective on Meier Tobler Group's performance by reading our dividend report here.

One To Reconsider

OC Oerlikon

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: OC Oerlikon Corporation AG, operating in Switzerland, the Americas, Asia-Pacific, and Europe, specializes in surface engineering, polymer processing, and additive manufacturing with a market capitalization of CHF 1.62 billion.

Operations: The company generates revenue from two main segments: Manmade Fibers, which brought in CHF 1.17 billion, and Surface Solutions, contributing CHF 1.53 billion.

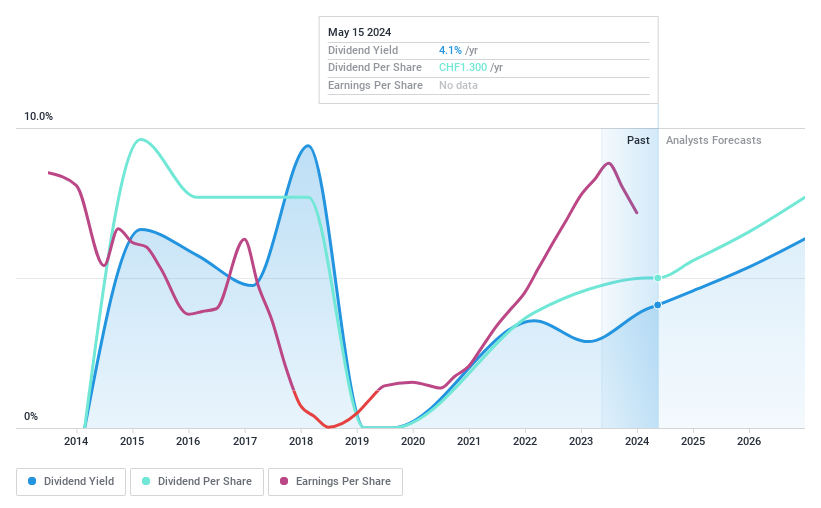

Dividend Yield: 4%

OC Oerlikon's dividend yield of 4.09% trails slightly behind the Swiss market's top dividend payers at 4.22%. However, its dividends raise concerns due to a high payout ratio of 196.8% and a cash payout ratio nearing 97%, indicating that both earnings and cash flows are insufficient to sustain current dividend levels. Additionally, the company has experienced significant share price volatility over the past three months and a downward trend in dividends over the last decade, compounded by shrinking profit margins from 3.1% to 1.2% within a year, signaling potential instability for dividend-focused investors.

Summing It All Up

Explore the 26 names from our Top Dividend Stocks screener here.

Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:MTG and SWX:OERL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance