Exploring Chinese Exchange Stocks With Estimated Discounts Ranging From 39.3% To 49.3%

Amid a backdrop of global economic shifts, Chinese stocks have shown some weakness as highlighted by recent slight declines in major indices like the Shanghai Composite and CSI 300. These market movements come at a time when investors are increasingly vigilant about the impact of economic slowdowns and foreign selling pressures. In such an environment, identifying undervalued stocks can offer potential opportunities for those looking to invest in assets that may be priced below their intrinsic value due to temporary market conditions or short-term challenges.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Uni-Trend Technology (China) (SHSE:688628) | CN¥32.77 | CN¥59.40 | 44.8% |

Shenzhen Sunlord ElectronicsLtd (SZSE:002138) | CN¥27.46 | CN¥54.15 | 49.3% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.08 | CN¥22.02 | 49.7% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.13 | CN¥19.81 | 48.9% |

GemPharmatech (SHSE:688046) | CN¥10.22 | CN¥19.45 | 47.5% |

INKON Life Technology (SZSE:300143) | CN¥7.53 | CN¥14.64 | 48.6% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥34.210778 | CN¥62.13 | 44.9% |

China Film (SHSE:600977) | CN¥10.76 | CN¥20.20 | 46.7% |

Quectel Wireless Solutions (SHSE:603236) | CN¥46.73 | CN¥89.94 | 48% |

Levima Advanced Materials (SZSE:003022) | CN¥13.71 | CN¥25.55 | 46.3% |

Here we highlight a subset of our preferred stocks from the screener

Beijing Yuanliu Hongyuan Electronic Technology

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. is a company that specializes in electronic technology, with a market capitalization of approximately CN¥7.86 billion.

Operations: The company generates revenue through its specialized electronic technology operations.

Estimated Discount To Fair Value: 40.1%

Beijing Yuanliu Hongyuan Electronic Technology, with its recent earnings report showing a decline in net income and EPS, still holds potential based on cash flow analysis. Despite revenue and earnings per share decreases in the first quarter of 2024, the stock is trading at CNY 34.1, significantly below the estimated fair value of CNY 56.94. Forecasted annual revenue growth at 21.8% surpasses China's market average, and earnings are expected to grow by a robust 33.45% annually. However, concerns include a low forecast Return on Equity at 10.9% and unstable dividend track record.

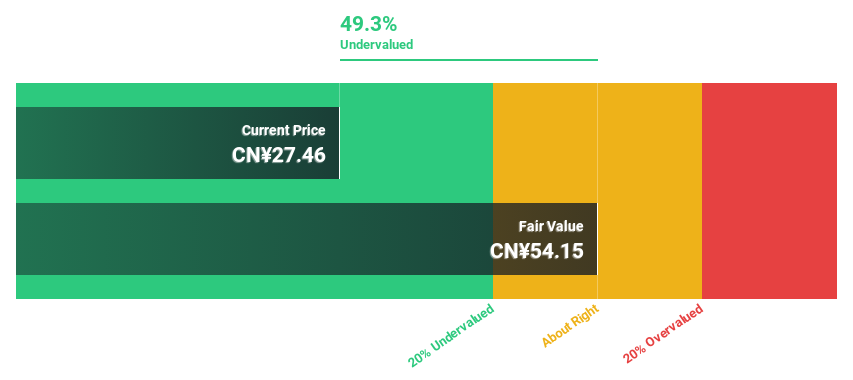

Shenzhen Sunlord ElectronicsLtd

Overview: Shenzhen Sunlord Electronics Co., Ltd. specializes in the development, manufacture, and sale of various chip electronic components, with a market capitalization of approximately CN¥21.75 billion.

Operations: The company generates approximately CN¥5.24 billion in revenue from its chip electronic components segment.

Estimated Discount To Fair Value: 49.3%

Shenzhen Sunlord Electronics Ltd. reported a substantial increase in net income and revenue for Q1 2024, reflecting a positive earnings trend with net income nearly doubling year-over-year. Analysts forecast a strong annual earnings growth of 22.3% over the next three years, outpacing the Chinese market's average. However, despite trading at 49.3% below estimated fair value and showing promising revenue growth forecasts of 18.7% annually, concerns arise from its high debt levels and low expected Return on Equity at 15.6%. Additionally, its dividend coverage by cash flows appears weak.

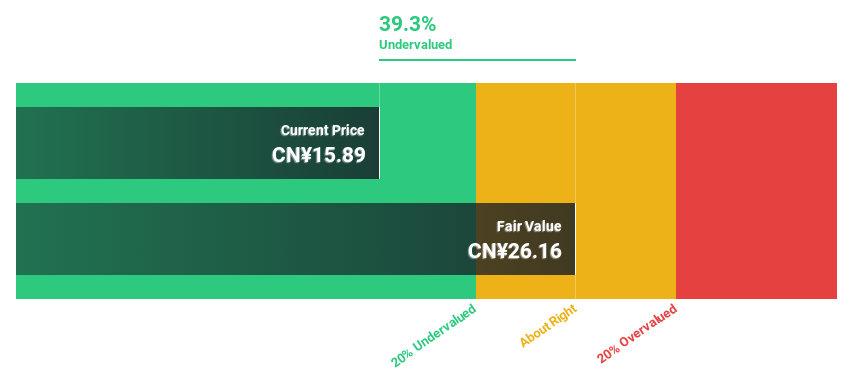

Gaona Aero Material

Overview: Gaona Aero Material Co., Ltd. is a Chinese company specializing in the research, development, production, and sale of materials such as intermetallic compounds and aluminum-magnesium-titanium, with a market capitalization of approximately CN¥12.32 billion.

Operations: The company generates CN¥3.59 billion primarily from the extraction of nonferrous metals.

Estimated Discount To Fair Value: 39.3%

Gaona Aero Material Co., Ltd. is significantly undervalued based on cash flows, with its current price of CN¥15.89 well below the estimated fair value of CN¥26.16, indicating a 39.3% undervaluation. The company's earnings have increased by 5.6% over the past year and are expected to grow by 26.52% annually over the next three years, surpassing the Chinese market's growth rate. Despite this robust growth and a promising revenue increase from CN¥620.97 million to CN¥798.6 million in Q1 2024, concerns linger due to its unstable dividend track record and a forecasted low Return on Equity of 15%.

Seize The Opportunity

Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 97 more companies for you to explore.Click here to unveil our expertly curated list of 100 Undervalued Chinese Stocks Based On Cash Flows.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603267 SZSE:002138 and SZSE:300034.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance