Exploring Big Yellow Group And Two Other High Yielding Dividend Stocks In The UK

The UK market has been buzzing with activity recently, with the FTSE 100 opening on a high note amid speculation of a potential interest rate cut by the Bank of England. Meanwhile, Asian stocks have also started positively, and there's anticipation about corporate earnings reports from major players in the global economy. In such an environment, high-yielding dividend stocks like Big Yellow Group and others can offer stable income opportunities for investors looking for consistent returns in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.57% | ★★★★★★ |

Dunelm Group (LSE:DNLM) | 8.07% | ★★★★★☆ |

Keller Group (LSE:KLR) | 4.30% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.42% | ★★★★★☆ |

DCC (LSE:DCC) | 3.45% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.86% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.34% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.15% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.23% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.43% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

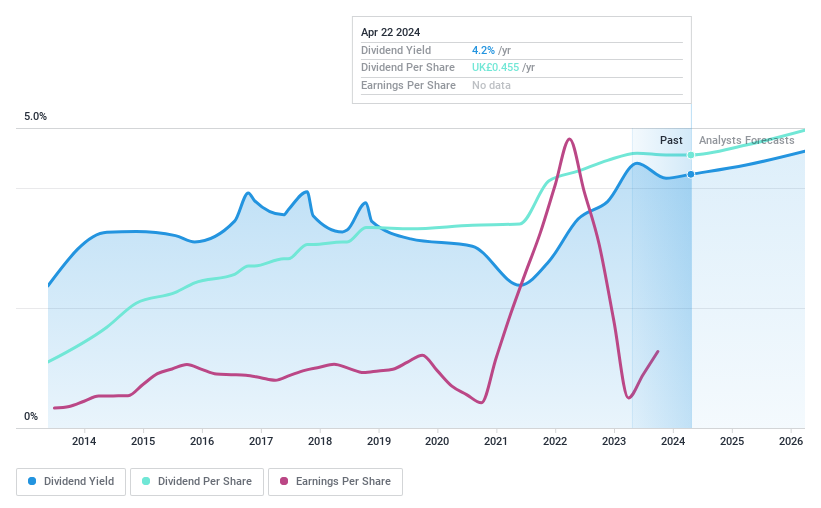

Big Yellow Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group, operating as the UK's brand leader in self-storage, has a market capitalization of approximately £2.10 billion.

Operations: Big Yellow Group generates its revenue primarily from the provision of self-storage and related services, which amounted to approximately £194.58 million.

Dividend Yield: 4.2%

Big Yellow Group's dividend yield of 4.23% is lower than the top tier of UK dividend payers, however, it has remained stable over the past decade. The company's dividends are covered by both earnings and cash flows with payout ratios at 75.9% and 82% respectively. Despite a forecasted average decline in earnings by 4.1% per year for the next three years, revenue is expected to grow by 5.27%. The stock is currently trading at a slight discount to its estimated fair value.

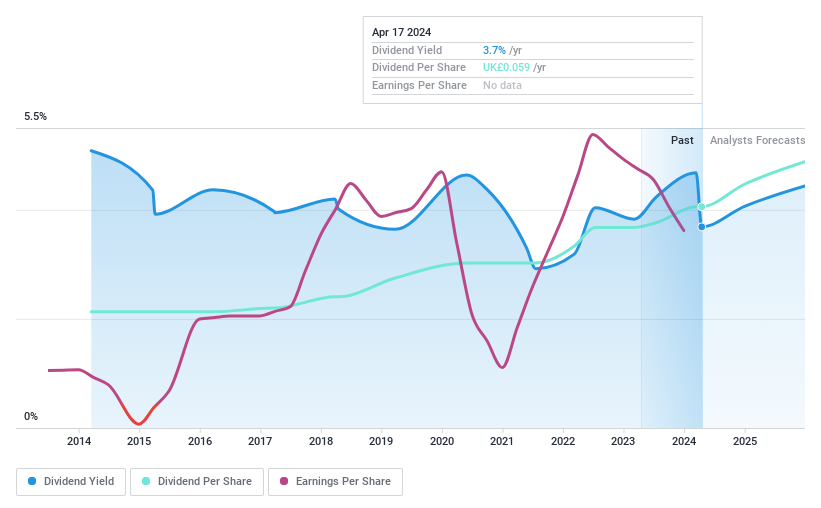

TClarke

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TClarke plc is a UK-based company that, along with its subsidiaries, specializes in the design, installation, integration and maintenance of mechanical and electrical systems and technologies, boasting a market cap of £83.86 million.

Operations: TClarke plc, a UK-based mechanical and electrical systems specialist, generates its revenue primarily from Electrical and Mechanical Contracting and Related Services, which brought in £491 million.

Dividend Yield: 3.7%

TClarke's dividend yield of 3.69% is lower than the top quartile of UK dividend payers, but has been stable over the past decade. The company's dividends are well covered by earnings with a payout ratio of 42.8%, and also by cash flows with a cash payout ratio of 37.7%. Despite recent volatility in share price, TClarke's earnings are forecasted to grow at an annual rate of 34.81%. The firm recently agreed to a £84.6 million acquisition offer from Regent Acquisitions Limited.

Dive into the specifics of TClarke here with our thorough dividend report.

The valuation report we've compiled suggests that TClarke's current price could be inflated.

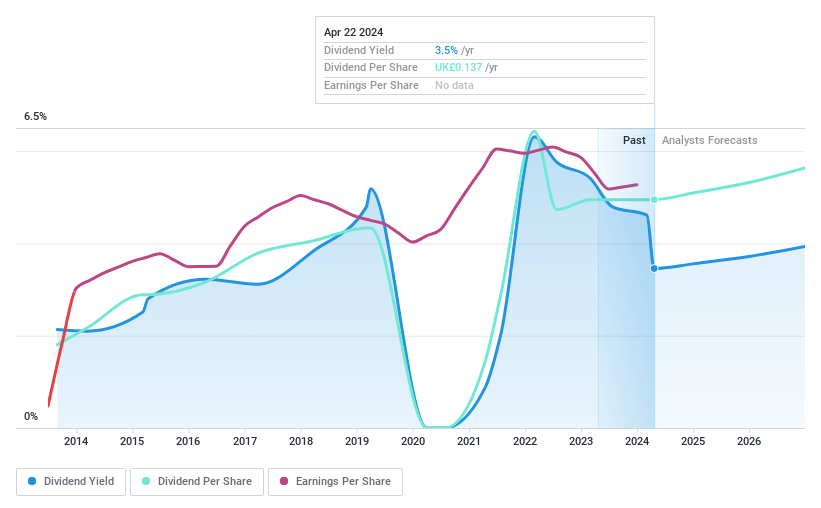

Tyman

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tyman plc, with a market cap of £772.87 million, is a company that designs, manufactures and supplies engineered fenestration components and access solutions to the construction industry.

Operations: Tyman plc, a key player in the construction industry, generates its revenue from three primary geographic segments: £97.5 million from the UK & Ireland, £129.8 million internationally, and a significant £434.5 million from North America.

Dividend Yield: 3.5%

Tyman's dividend payments, backed by a payout ratio of 69.9% and cash payout ratio of 28.7%, have seen growth over the past decade despite volatility. However, with a yield of 3.46%, it falls short compared to top UK dividend payers (6.02%). Recent events indicate Tyman will be acquired by Quanex Building Products Corporation, with shareholders receiving £2.40 per share in cash and 0.05715 New Quanex Share for each Tyman share held, leading to delisting from the London Stock Exchange.

Click here and access our complete dividend analysis report to understand the dynamics of Tyman.

Our expertly prepared valuation report Tyman implies its share price may be too high.

Make It Happen

Unlock our comprehensive list of 60 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BYG LSE:CTO and LSE:TYMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance