Exploring Better Dividend Options Beyond Rashtriya Chemicals And Fertilizers With One Attractive Alternative

In the dynamic realm of India's equity markets, dividends can serve as a beacon for investors seeking steady income. However, not every company promising dividends guarantees growth or stability in these payouts. For instance, firms like Rashtriya Chemicals and Fertilizers have seen their dividends diminish over time, presenting a less favorable option for those focused on long-term dividend growth.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.01% | ★★★★★★ |

Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.10% | ★★★★★☆ |

D. B (NSEI:DBCORP) | 3.57% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.17% | ★★★★★☆ |

Bharat Petroleum (NSEI:BPCL) | 6.85% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.17% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.41% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.66% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.34% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.58% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

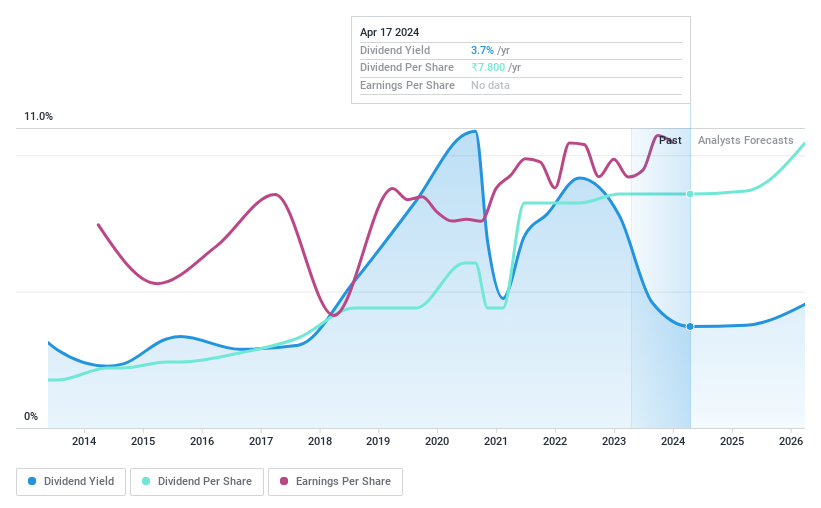

PTC India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited operates in the power trading sector across India, Nepal, Bhutan, and Bangladesh with a market capitalization of approximately ₹64.53 billion.

Operations: The company's revenue is primarily derived from power trading, generating ₹160.12 billion, and a financing business contributing ₹7.67 billion.

Dividend Yield: 3.6%

PTC India's dividend yield of 3.58% ranks in the top 25% of Indian dividend payers, contrasting sharply with companies experiencing declining dividends. Despite a volatile dividend history over the past decade, PTC's dividends are well-supported by both earnings and cash flows, with a payout ratio of 54% and a cash payout ratio of only 9.4%. Recent executive changes and regulatory actions add an element of uncertainty to its management stability.

Dive into the specifics of PTC India here with our thorough dividend report.

The valuation report we've compiled suggests that PTC India's current price could be quite moderate.

One To Reconsider

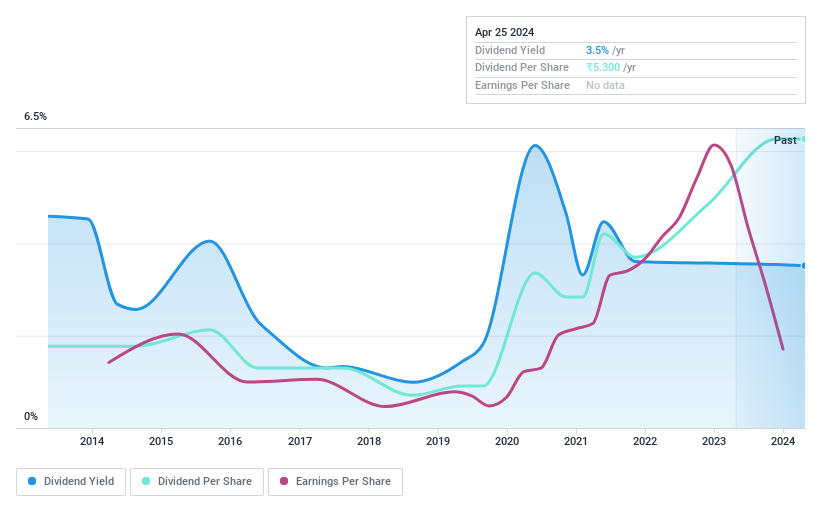

Rashtriya Chemicals and Fertilizers

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Rashtriya Chemicals and Fertilizers Limited, operating in India, is engaged in the manufacturing, marketing, and selling of fertilizers and industrial chemicals, with a market capitalization of approximately ₹112.51 billion.

Operations: The company's revenue is derived from trading (₹42.62 billion), fertilizers (₹109.97 billion), and industrial chemicals (₹17.10 billion).

Dividend Yield: 0.6%

Rashtriya Chemicals and Fertilizers (RCF) faces challenges with its dividend strategy, marked by a declining trend in dividend payments over the past decade and a current yield of 0.61%, which is below the top quartile of Indian dividend payers at 1.11%. Additionally, RCF's dividends are not well supported by earnings or cash flow, indicating potential sustainability issues. Recent senior management changes could inject uncertainty into strategic directions, further complicating its appeal as a stable dividend stock.

Summing It All Up

Unlock more gems! Our Top Dividend Stocks screener has unearthed 14 more companies for you to explore.Click here to unveil our expertly curated list of 16 Top Dividend Stocks.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:PTC and NSEI:RCF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance