Expensive Cocoa Supply Is About to Hit Chocolate Makers, Spurring Demand Pullback

(Bloomberg) -- Cocoa processing likely slowed a bit last quarter, but a steeper slump is looming as chocolatiers start to really feel the pinch of pricey beans.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

NYC Penthouse Sells for $135 Million in Priciest Deal Since 2022

Despite an historic shortage sending cocoa prices to a record this year, that has yet to fully filter through to chocolate makers. That’s because many of the beans that they’ve been grinding into the butter and powder used in confectionery were secured before the worst of the crunch took hold.

But as those inventories run low, processors will have to replenish supplies at higher prices — something that’s expected to weigh on grindings in the second half of this year. A Nestle SA executive last month warned that as manufacturers pay more for beans, they’ll inevitably have to pass the cost onto consumers, prompting shoppers to cut back on chocolate.

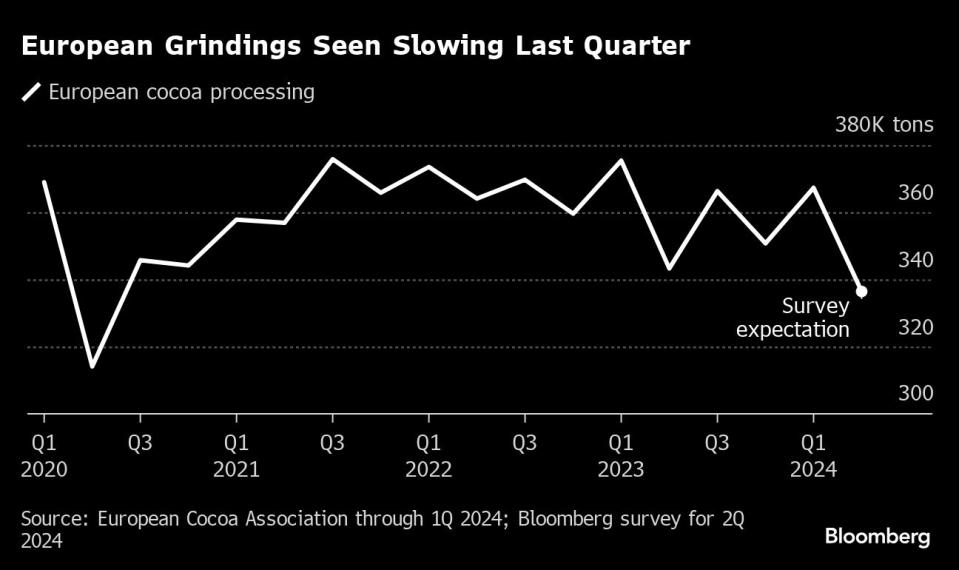

Second-quarter grindings globally probably fell from a year earlier, according to six analysts and traders surveyed by Bloomberg. Processing in top consumer Europe likely slipped 2%, the average estimate showed, which would mark a four-year low. All six expect a larger global decline in the second half.

“The cheap stuff is beginning to drop off, and the expensive stuff is coming in,” said Jonathan Parkman, head of agricultural sales at broker Marex Group. “The worst of input inflation will affect the second half of this year.”

European grinding data are due Thursday, and Asia and North America will report next week. While the numbers have long been used as a consumption guide, it has become harder to gauge how much they reflect demand amid worries tight supplies are distorting the figures.

Why Cocoa Prices Spiked, What It Means for Consumers: QuickTake

New York cocoa futures hit an all-time high of more than $11,000 a ton in April as poor West African harvests curbed output. Even after easing since then, they’re still more than double what they were this time last year.

Bloomberg Intelligence said in April that higher cocoa prices will keep grindings subdued into next year. The crunch has already forced some processors to shutter factories in West Africa and elsewhere.

“We are more likely to see a significant change in the grind number in the second half of the year,” said Darren Stetzel, vice president of soft commodities for Asia at broker StoneX. He also said the market has been forced to adapt to the scarcity of beans, which should ease some demand pressure, and pointed to chocolate makers using substitutes such as palm oil.

In addition to grind data, traders will also keep a close eye on earnings reports from chocolate companies — such as Barry Callebaut AG’s release due Thursday — for clues on supply and demand.

--With assistance from Anuradha Raghu.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance