Expedia Group Looks Like a Bargain

Expedia Group Inc. (NASDAQ:EXPE) looks like a bargain currently. It was hit hard during the pandemic and its free cash flow turned negative. The shares hit a peak of $214.22 in February 2022, but it is still below that price at $137.04 as of March 26.

Since then, the company's revenue and FCF have rebounded significantly. However, the stock has not yet fully recovered, even though it is up from a low of $93.08 on Oct. 23, 2023.

This undervaluation is even more apparent after Expedia's management implied in its latest earnings call on Feb. 8 that FCF could rebound this year.

This analysis will delve into the company's outlook and why I think the stock could be worth almost 50% more.

Fundamentals and outlook

Expedia makes money from its online travel platform by earning commissions or ticketing fees, as it likes to call them, from travel suppliers or directly from travelers. It also generates a little bit from advertising.

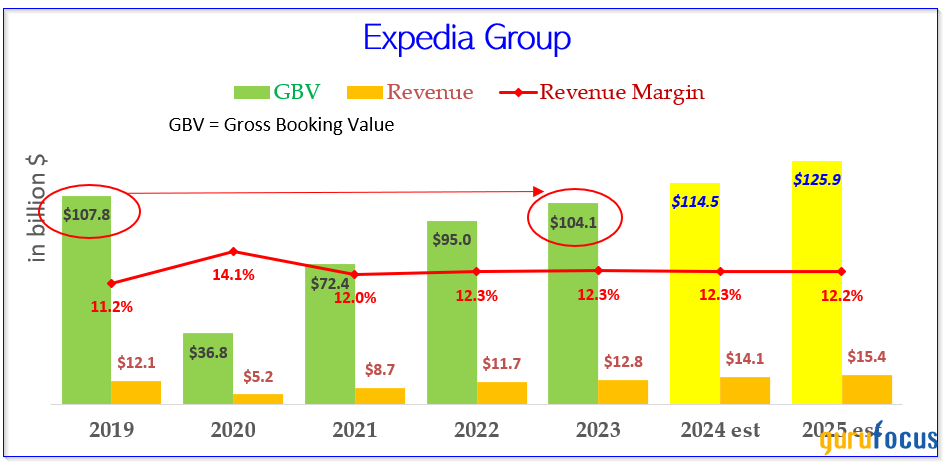

For example, last year the company produced a little over $104 billion in gross bookings value, from which it generated $12.80 billion in revenue. So that works out to a commission rate of 12.30% on each booking.

This revenue margin was flat from 2022, but up from the 11.90% rate it made in 2021. However, in 2020 its revenue margin was 14.10%. Moreover, as can be seen in the table below, the company's bookings have now just reached the same level as before the pandemic in 2019.

Source: Hake, from Expedia's 10-K filings and Refinitiv revenue estimates.

The good news is that travel and related bookings continue to rebound, though airline prices are falling. Nevertheless, the company said on its earnings call that it expects to see a 9.50% to 10% gain in GBV this year and a related 10% increase in revenue.

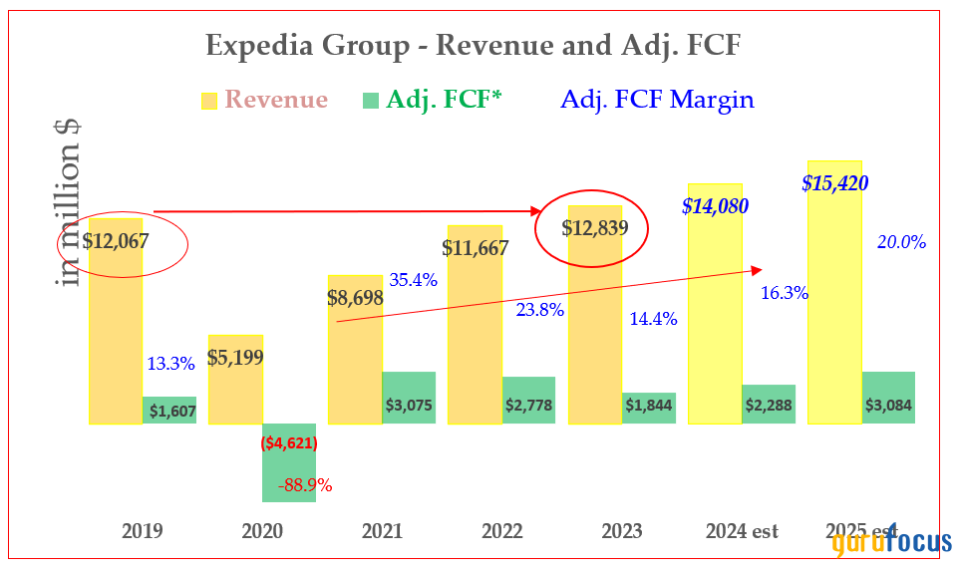

Moreover, the company is now generating significant amounts of free cash flow. Expedia's FCF is now higher than before the pandemic, though it is lower than in recent years. For example, as seen in the table below, Expedia generated over $1.60 billion in FCF in 2019. This turned negative in 2020, but quickly rebounded in 2021 to over $3 billion. However, it dipped to $1.80 billion last year.

Source: Hake, taken from 10-K filings and Refinitiv revenue estimates.

This was largely due to working capital needs shifts as well as higher capital expenditure spending by Expedia to re-platform its operations. Moreover, the company has been shedding workers and reducing overhead, which cut into cash flow.

FCF Margins Should Rise

The good news is that going forward this will likely lead to higher FCF as capex spending falls and overhead is reduced.

As a result, I project Expedia's FCF margins will rise from a low of 14.40% last year to 16.5% in 2024 and 20% in 2025.

For example, 33 analysts surveyed by Refinitiv, as seen on Yahoo Finance's analysis page, forecast an average revenue of $14.08 billion for 2024. And for 2025, they project $15.28 billion. However, I think that may be too low and I project a 9.50% rise to $15.42 billion in 2024.

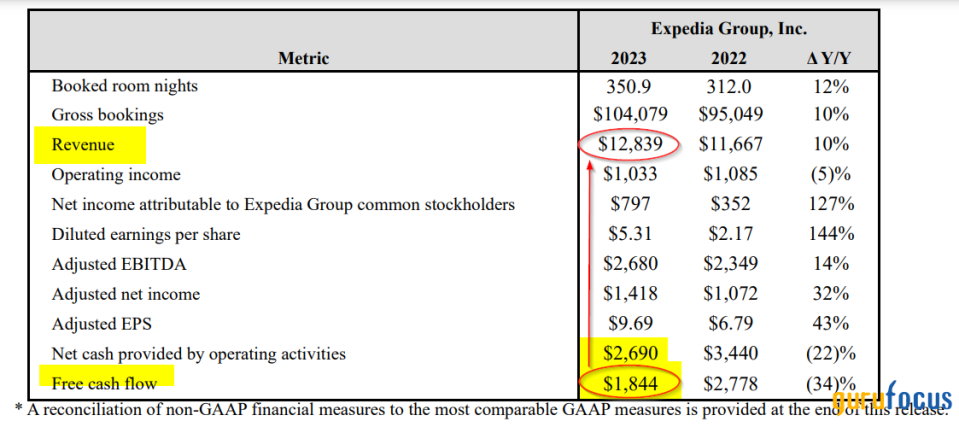

Moreover, last year the company generated $2.69 billion in FCF on $12.83 billion in revenue, as seen in the table below from the company's earnings release. From this, it spent $844 million in capital expenditures to generate $1.84 billion in free cash flow.

Source: Expedia's earnings release

That implies its operating cash flow margin was 21%. Given that management says capex spending will fall in 2024, we can use its prior year capex amount of $662 million in 2024 (i.e., $3.44 billion in operating cash flow minus $2.77 billion in FCF during 2022).

Here is how that works out:

$14.08 billion sales forecast for 2024 x 20.95% - 2022 capex level =

$2.950 billion - $662 million capex =

$2.228 billion FCF, or 16.3% FCF margin in 2024

In other words, the 2024 FCF estimate of $2.23 billion works out to 16.30% of the $14.08 billion sales forecast for 2024. That is higher than the 14.4% FCF margin in 2023.

Moreover, I project the margin will rise to 20% in 2025, so its FCF could rise to $3.08 billion (i.e., $15.42 billion x 20% = $3.08 billion FCF).

Price target

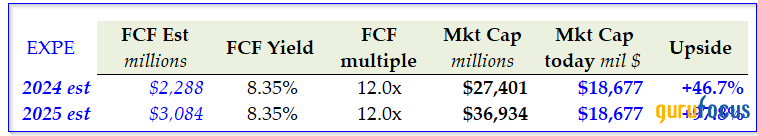

This allows us to forecast a price target for Expedia's stock. For example, theoretically, the company could pay out 100% of its FCF as a dividend. If that were to happen, the stock would likely have at least an 8.35% dividend yield.

Moreover, this is the same as multiplying FCF by a multiple of 12. That is because 1/0.0835 = 12.

In other words, the inverse of an 8.35% FCF yield is a multiple of 12. Using this, we can see the company's market cap will be worth $27.40 billion.

Source: Hake

That implies the stock is worth 46.70% more than its close on March 26 price of $137.04 per share, or $201 per share.

And if we use the $3 billion FCF estimate for 2025, the stock could be worth almost double today's price.

Buybacks could act as a catalyst

Expedia spent over $2 billion last year, its highest ever, to repurchase 19 million shares. That provides a powerful 10.70% buyback yield to shareholders.

The company can afford to do this as I have shown it is likely to generate $2.30 billion in FCF this year as well. Management said on the earnings call it has a new $5 billion share repurchase authorization. That implies that at today's price, the company could buy back over 36 million shares going forward.

Since there are 136.20 million shares outstanding, that works out to a potential reduction of over 26% in the share base. That could act as a major catalyst to push Expedia's stock to its price target. For example, if it takes two years, that represents a 13% annual buyback yield for existing shareholders.

The bottom line is Expedia looks undervalued as its revenue, FCF margins and valuation improve.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance