What to Expect From BlackBerry's (BB) Q4 Earnings Release

BlackBerry BB is scheduled to report fourth-quarter fiscal 2023 results on Mar 30.

The Zacks Consensus Estimate is pegged at a loss of 7 cents per share, unchanged over the past 30 days.

In the last reported quarter, the company reported an adjusted loss per share of 5 cents against the prior-year quarter’s breakeven earnings. Quarterly total revenues declined 8.2% year over year to $169 million.

This Canada-based firm invests in product development and the go-to-market strategy to drive long-term sustainable growth. It has aligned the software and services business around two key market opportunities — Cyber Security and Internet of Things (IoT).

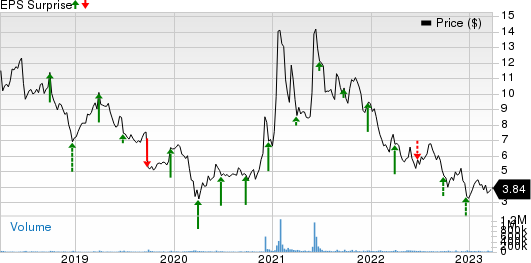

BlackBerry Limited Price and EPS Surprise

BlackBerry Limited price-eps-surprise | BlackBerry Limited Quote

Factors to Note

On Mar 7, BlackBerry released its selected preliminary financial results for the fourth-quarter and fiscal 2023.

The company’s Cybersecurity business was affected by weakness in macro environment. The revenues of this unit are expected to be lower than the outlook provided during the last reported quarter, primarily due to certain large government deals shifting to fiscal 2024. The company has witnessed an elongation in deal cycles in the government vertical, like additional deal reviews and approvals.

Owing to the above-mentioned challenges, BB has taken proactive steps in the fourth quarter to balance investments and costs, and achieve profitable growth.

Moreover, BB’s results will include a material non-cash, one-time goodwill impairment charge for the Spark reporting unit, which is expected to be up to $440 million. This is primarily driven by the drastic stock market decline in 2022 and the corresponding impact on the company’s market capitalization.

For the fourth quarter, the company expects revenues of $151 million, with IoT, Cybersecurity, and licensing and other revenues likely to be $53 million, $88 million and $10 million, respectively. Cybersecurity billings are expected to increase sequentially to $107 million.

For fiscal 2023, BlackBerry expects total revenues of approximately $656 million, with IoT, Cybersecurity, and licensing and other revenues projected to be approximately $206 million, $418 million and $32 million, respectively. Cybersecurity billings are expected to be approximately $401 million.

The IoT business unit closed the year strongly and the company expects to deliver year-over-year revenue growth of approximately 16%, in line with the previous guidance.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for BlackBerry this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

BlackBerry has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around.

Dave & Buster's Entertainment PLAY has an Earnings ESP of +4.59% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dave & Buster's Entertainment is slated to release fourth-quarter fiscal 2022 results on Mar 28. The Zacks Consensus Estimate for earnings is pegged at 73 cents per share, indicating a year-over-year increase of 40.4%. Shares of PLAY have lost 18.1% of their value in the past year.

Walgreens Boots Alliance WBA has an Earnings ESP of +0.12% and a Zacks Rank of 3.

Walgreens Boots Alliance is set to release second-quarter fiscal 2023 results on Mar 28. The Zacks Consensus Estimate is pegged at $1.10 per share, indicating a decline of 30.8% from the prior-year quarter. Shares of WBA have decreased 30.7% in the past year.

Paychex PAYX has an Earnings ESP of +2.25% and a Zacks Rank of 3.

Paychex is scheduled to release third-quarter fiscal 2023 results on Mar 29. The Zacks Consensus Estimate for earnings is pegged at $1.24 per share, indicating a year-over-year increase of 7.8%. Shares of PAYX have lost 16.2% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance