Exelixis (EXEL) Settles Cabometyx Patent Litigation With Cipla

Exelixis, Inc. EXEL entered into a settlement agreement with Cipla, which was looking to market a generic version of Cabometyx (cabozantinib).

Cabometyx is Exelixis’ lead drug. The settlement agreement resolves two patent litigations brought by Exelixis in response to Cipla’s abbreviated new drug application (ANDA).

The ANDA is seeking approval to market generic versions of Cabometyx tablets prior to the expiration of the applicable patents. The first case relates to Cipla’s ANDA for a 60 mg cabozantinib dosage strength. This case was filed on Mar 16, 2023.

The second case was filed on May 9, 2024, and relates to a recent amendment to Cipla’s ANDA for the primary purpose of seeking additional approval for 20 mg and 40 mg cabozantinib dosage strengths.

Per the settlement, Exelixis will grant Cipla a license to market generic versions of Cabometyx in the United States beginning on Jan 1, 2031, upon FDA approval and subject to conditions and exceptions common to agreements of this type.

Both parties will terminate all ongoing Hatch-Waxman litigation between Exelixis and Cipla regarding Cabometyx patents pending in the U.S. District Court for the District of Delaware.

The agreement is confidential and subject to review by the U.S. Federal Trade Commission (FTC) and the U.S. Department of Justice. The lawsuits will be dismissed after some time to allow FTC review.

The settlement bodes well for Exelixis as Cabometyx is its growth engine and an earlier-than-expected generic entry will adversely impact sales.

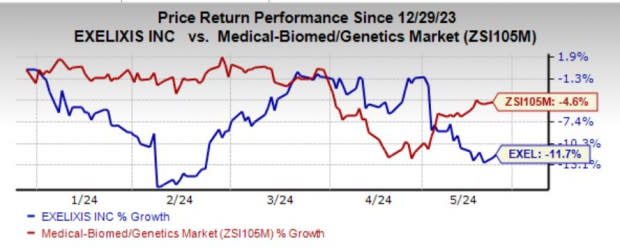

Exelixis’ shares have lost 11.7% year to date compared with the industry’s decline of 4.6%.

Image Source: Zacks Investment Research

Cabometyx (cabozantinib) generated revenues of $376.4 million in the first quarter, falling short of estimates. The drug is approved for advanced renal cell carcinoma and previously treated hepatocellular carcinoma. Typical seasonal headwinds and the implementation of the Inflation Reduction Act adversely impacted Cabometyx sales.

In January 2024, Exelixis announced that it had successfully defended an EU patent for Cabometyx tablets against three opponents in a hearing before the Opposition Division of the European Patent Office (EPO). The three opponents were STADA Arzneimittel AG, Teva Pharmaceuticals TEVA and Generics (U.K.) Ltd.

Exelixis already entered into a settlement and license agreement with Teva Pharmaceuticals, which resolves patent litigation brought by EXEL in response to TEVA’s abbreviated new drug application seeking approval to market a generic version of Cabometyx before the expiration of the applicable patents.

Per the settlement terms, Exelixis will grant Teva Pharmaceuticals a license to market its generic version of the drug in the United States beginning Jan 1, 2031, upon the FDA’s approval.

Zacks Rank & Stocks to Consider

Exelixis currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the healthcare industry are Ligand Pharmaceuticals LGND and ANI Pharmaceuticals ANIP. Both stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 and 2025 earnings per share (EPS) has remained constant at $4.56 and $5.27, respectively. Shares of LGND are up 22.9% year to date.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have improved from $4.43 to $4.44. Shares of ANIP have jumped 12.6% year to date. ANIP’s earnings beat estimates in each of the trailing four quarters, delivering an earnings surprise of 53.90%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance