Exclusive: Largest rent increases are in swing states. Will it spell trouble for Biden?

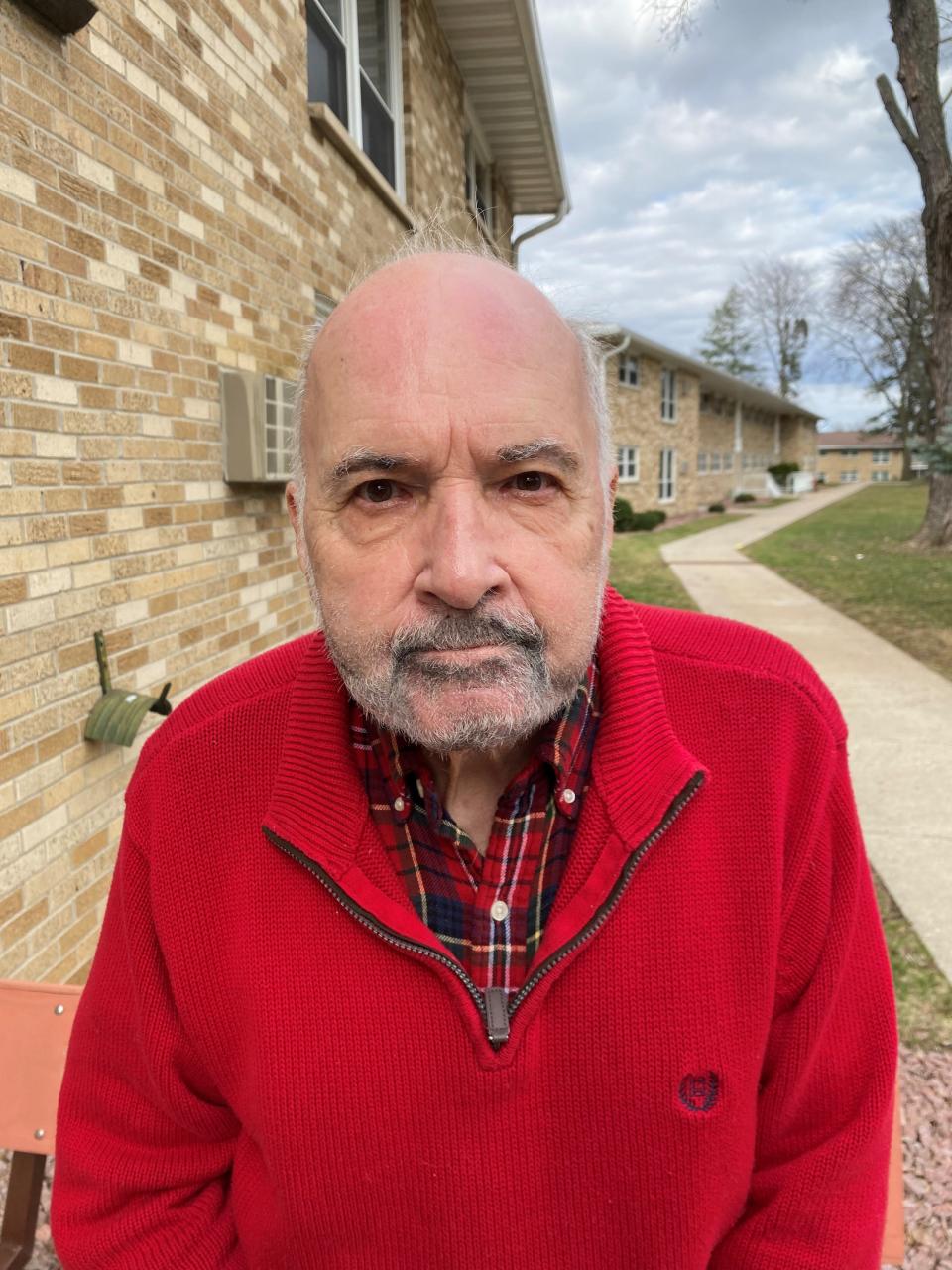

John Pike’s biggest fear is ending up on the street.

For years, the retired 79-year-old Madison, Wisconsin, resident has barely made ends meet, with no discretionary income to speak of. Most of his Social Security check of $1,578 goes toward rent. At $1,220, that's more than 77% of his monthly income. Between the rising cost of food prices since the pandemic and his prescription medication, there’s hardly anything left.

When his lease expires in September, the rent on his apartment, where he’s lived for the past 24 years, will go up to $1,600. That's an amount he cannot afford.

“My big worry is that I may be homeless again,” said Pike, who has held a series of jobs including as a translator and programmer.

His fear is well founded. Pike experienced homelessness in the 1980s after losing his job. Like more than 50% of Americans, he is a paycheck away from a disaster. The U.S. experienced a 12% increase in homelessness from 2022 to 2023 as rents soared and pandemic resources evaporated, according to the Department of Housing and Urban Development.

“I have been very anxiety ridden. I will be honest and tell you I think I have developed PTSD,” Pike said.

Pike, a registered independent, says he has generally voted for Democratic candidates, but this November, he's unsure he'll vote at all, given his experience dealing with skyrocketing rents and economic hardship.

"I don't think the federal government as a whole has done enough for people in my circumstance," he said. "It prioritizes weapons of war and defense spending and does not prioritize the health and welfare of all its citizens."

Inflation and the economy have long worried American voters, polling shows. But as housing costs continue to be the biggest driver of core inflation, renters are feeling increasingly disillusioned with politicians. In some swing states, which are critical to President Joe Biden’s reelection bid, rental costs have more than doubled in the past four years. In fact, 6 out of the top 10 markets and 34 of the top 100 markets with the largest increases are in swing states, according to a USA TODAY analysis of data obtained exclusively from Rent.com.

The states considered for the analysis are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, Wisconsin.

When rent is too high: 'Underpaying rent means losing your home'

Not paying attention to renters' concerns, especially as rent skyrockets in swing states crucial to Biden's reelection bid, could be costly in the November election.

For example, two metro areas in Wisconsin, where Pike lives, rank second and third with higher than 100% rent increases from 2020 to 2024.

The top 10 metro areas with the largest increases are Hickory-Lenoir-Morganton, North Carolina (111%); Oshkosh-Neenah, Wisconsin (106%); Racine, Wisconsin (100%); Waco, Texas (94%); Port St. Lucie, Florida (75%); Fayetteville, North Carolina (75%); Daphne-Fairhope-Foley, Alabama (67%); Burlington, North Carolina (64%); Syracuse, New York (64%); Sierra Vista-Douglas, Arizona (63%).

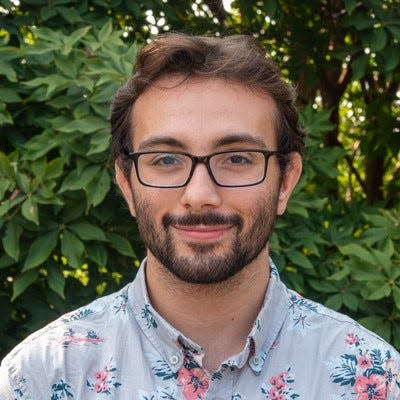

David Rivera-Kohr, a 26-year-old graduate student at the University of Wisconsin at Madison, says the housing crisis is one of the issues that dissuades him from voting for either major political party.

"Rent is the aspect of inflation that concerns me the most," said Rivera-Kohr, one of Pike's neighbors. "People can sometimes find ways to cut back on expenses like gas and groceries, but this is just not an option for rent. Underpaying rent means losing your home."

Housing costs continue to be the single largest driver of core inflation, a measure that excludes volatile food and gas prices. The cost of shelter, which is basically based on rent prices, was up 5.5% in April compared to a year ago, according to the Labor Department's consumer price index.

While there are many positive indicators of how the economy is doing – such as unemployment numbers, jobs report and lowering inflation – it hasn’t brought much solace to households dealing with high rents as well as elevated food and fuel prices.

Consumer sentiment fell to a six-month low in May as inflation expectations rose and marked a one-month decline of 12.7%, according to the preliminary report for the Michigan Consumer Sentiment Index, a monthly survey of consumer confidence levels in the U.S. conducted by the University of Michigan.

“While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions,” said Joanne Hsu, director of consumer surveys at the university. “They expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead.”

Recent polling data also point to the grim reality of Americans' assessment of Biden's economic stewardship on the economy. Forty-six percent of U.S. adults said they have "a great deal" or "a fair amount" of confidence in likely GOP presidential nominee Donald Trump to do or recommend the right thing for the economy, while fewer said the same of Biden (38%), according to a Gallop poll conducted April 1-22.

It's among the lowest Gallup has measured for any president since 2001.

Biden’s top aides say he is laser focused on the “kitchen table” issues voters are most concerned about.

During his State of the Union speech in March, for instance, he directly spoke to the American public about housing challenges and “shrinkflation” and the measures he was proposing to address them. In Biden's budget for fiscal year 2025, he has sought an investment of more than $258 billion to build or preserve more than 2 million housing units to lower rents and make housing more affordable. Years of underbuilding in the aftermath of the Great Recession has contributed to a lack of housing inventory, which has put upward pressure on rents and home prices.

Given current market conditions, renters are bound to stay renters for longer. Low inventory and high mortgage rates have made entry to homeownership more challenging, experts say.

“The number of units did not come close to meeting the demand,” Lael Brainard, Biden's National Economic Council director, told USA TODAY. “Nothing significant was done in the previous administration. We've got this big gap and the increase in rent is a result of that lack of action to address the growing affordable housing gap.”

After the latest CPI numbers were released last week, showing a slight easing of month-over-month inflation but still growing rental inflation, White Press Secretary Karine Jean-Pierre said that while she didn’t have a “progress report” on the plan to increase housing inventory, the president was focused on the issue.

In response to a question posed by USA TODAY during a press briefing last week, Jean-Pierre said taking action "is important and critical to many Americans and their families across the country."

But Jean-Pierre said congressional action was needed to curb rental inflation.

“To address this in a more holistic way, we have to see legislation. We have to see Congress act,” she said.

Brainard says the president's proposed housing plan "meets the moment," by including moving to ban rental junk fees and reducing closing costs for homeowners.

“It addresses one of the areas that pose the greatest affordability challenges for working families, which is a huge priority for the president,” Brainard told USA TODAY.

The Biden administration also pointed to the rental assistance provided to 100,000 additional households and $60 billion invested through the president’s American Rescue Plan deployed to improve housing access. The plan includes rental assistance, homelessness prevention and services, homeowner assistance and affordable housing.

In Saginaw, a city in Michigan’s top bellwether Saginaw County, Charles Allen says he feels stuck.

His rent on a two-bedroom duplex went up from $550 in 2020 to $775 in 2023, after his old landlord sold the building last year. The new owner has refused to give Allen a new lease, and he suspects it’s because they plan to raise the rent again.

Rents in Saginaw, a majority Black city where more than a third of the population lives in poverty, have gone up by 51% from 2020 to 2024, according to the USA TODAY analysis.

“There hasn't been any updates or paint on the walls like since 2017,” he said.

Allen has been searching for a three-bedroom apartment for months so his 6-year-old twin son and daughter can have a room of their own. He says what he could have rented for a little over $1,000 four years ago now goes for $1,500 to $2,000 in the “reasonable part of town.”

“It's a system that's broken, because if I pay $1,500 in rent, where do I save to buy a house? I'm going to be struggling check to check. And that's what I'm trying to avoid,” he said.

Advocates call for rental caps on federally subsidized properties

Last month, the Biden administration instituted a 10% limit on increases at rental properties financed through the Low-Income Housing Tax Credit program.

While housing advocates hailed the move, they said should be expanded.

Rent caps should be attached to every dollar of federal subsidy and financing, including in all properties purchased with federally backed mortgages, says Tenant Union Federation Director Tara Raghuveer.

"High rents disproportionately hurt people under 40, low-income workers and people of color – the very constituencies the president needs to win reelection," Raghuveer told USA TODAY. "The question isn’t whether there’s anything the Biden administration can do, it’s whether they are willing to do what’s needed most: rent regulation."

She added: "The rent is too damn high."

One reason why many of the metros with the highest increases on the list are not the usual suspects such as New York or Los Angeles or even cities such as Austin that experienced price growth during the pandemic is that smaller cities had room to grow, says Daryl Fairweather, the chief economist for real estate company Redfin.

Cities such as Austin, for example, that saw a boom in prices over the pandemic when people were fleeing the traditional big cities are now seeing a correction. Whereas places like Hickory, North Carolina, which topped the charts in the analysis, were previously undiscovered and had room to grow.

"I think that is what's driving the more local trends right now and those leftover places that maybe were overlooked during the pandemic now are the remaining affordable options and are attracting more people and more renters (and driving up prices)," Fairweather said.

Fairweather says the federal government can put carrots and sticks in place to incentivize local governments to change their zoning laws.

"They could directly subsidize new construction, especially for housing that is going to be affordable," she said. With current high interest rates, she suggests providing tax deductions for new construction loans or other incentives to get more construction underway.

Allen, who works as a social organizer and makes $40,000 a year, says he feels like “the working poor." He voted for Biden the last time but says he's feeling a lot less enthusiastic this time.

“I'm hoping that the president understands that he has to earn our vote. My vote. He has to earn it. So, hearing us talking about affordable housing, those are big deals for me,” he said. “We work so hard and then we don't have enough to do more with it. We're just supporting our bills.”

In 2022, half of all U.S. renters were cost burdened, according to America’s Rental Housing 2024, published by the Harvard Joint Center for Housing Studies. Renter households spending more than 30% of their income on rent and utilities rose by 2 million in just three years, to a record high of 22.4 million, according to the report.

Rivera-Kohr said the new property owners have been "massively jacking up prices."

He currently pays $1,225 a month, based on the lease he signed with the old landlord. By September, it will jump to $1,650. As steep as it is, he said, he was more worried about some of his neighbors, including Pike.

"With these new rents, their monthly income is actually going to be less than their rent," said Rivera-Kohr. "Not only can they not afford that, they're going to have to make really impactful sacrifices, but they kind of are stuck because a lot of them are not even physically capable of moving."

In his view, neither Democrats nor Republicans are willing to enact programs that would earnestly address this issue, such as universal basic income and "greatly" expanded subsidized housing.

"Neither party is willing to do what it takes to fund these programs, like impose strict taxes on their super-wealthy corporate donors or cut the military budget," said Rivera-Kohr, a registered Democrat who voted for Biden in 2020.

As of now, he is undecided who will get his vote − but said he was leaning toward Cornell West.

The Biden campaign defended the president's housing record.

"Joe Biden knows how hard middle-class families work to put food on the table — that’s why he has taken aggressive executive action to help build the housing we need and bring down the cost of rent," said Charles Lutvak, a Biden campaign spokesperson.

Meanwhile, the Trump campaign did not offer any specific plans to tackle high rent prices. Trump will "reimplement his America First agenda of low taxes, lower prices, and higher wages," wrote Karoline Leavitt, a national spokeswoman for the Trump campaign, in an email.

After living in the apartment complex in Madison for 24 years, Pike, who will turn 80 this week, has come to the conclusion that he can't afford to live there any more. He is currently looking for an apartment in Stoughton, 23 miles southeast of Madison, where rents are slightly cheaper.

"I have no choice," he said.

Swapna Venugopal Ramaswamy is a White House correspondent for USA TODAY. You can follow her on X, formerly Twitter, @SwapnaVenugopal

This article originally appeared on USA TODAY: High rent increases in swing states leaves crucial voters disenchanted

Yahoo Finance

Yahoo Finance