Ex-Deutsche Bank Trader Cleared of Libor Rigging Ends Bank Suit

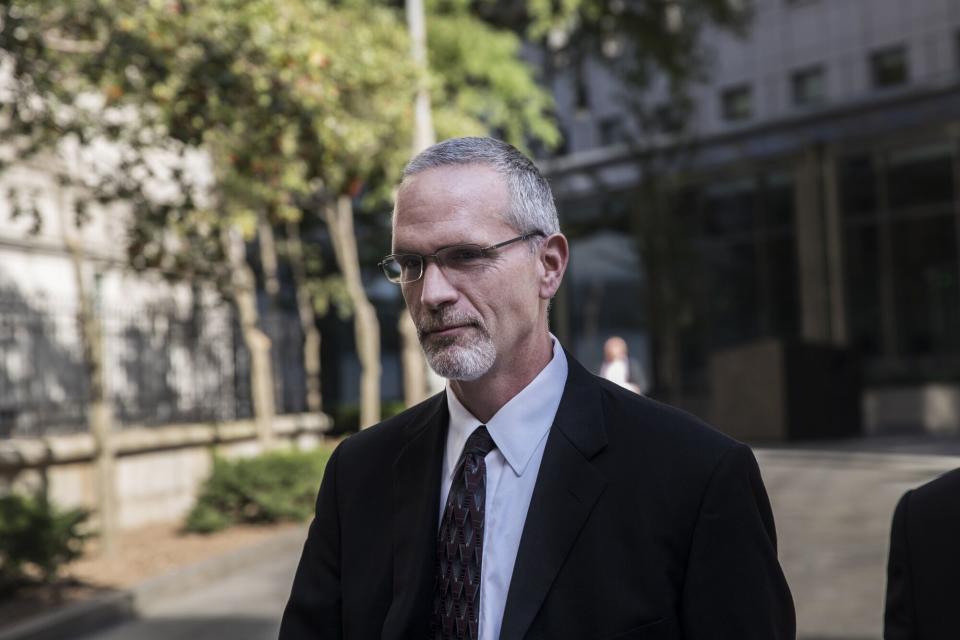

(Bloomberg) -- A former Deutsche Bank AG trader who was convicted and later cleared of charges that he rigged the Libor benchmark rate settled his lawsuit accusing the bank of making false and misleading statements to get him prosecuted.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Kevin Costner, Warner Bros. Cancel ‘Horizon: Chapter 2’ Release

Matthew Connolly and a colleague, Gavin Black, were found guilty in 2018 of wire fraud for allegedly pressuring colleagues to alter Deutsche Bank’s Libor submissions or submit false data to benefit their trading positions. But an appeals court threw out the charges in January 2022, saying prosecutors failed to prove the two men influenced the bank to make bogus or misleading submissions.

Connolly sued the bank in November 2022, accusing it of lying to the US Justice Department to protect senior executives and seeking $150 million in damages. The parties told US District Judge Jesse Furman in a letter Wednesday that they had agreed to drop the case, without disclosing terms of the resolution.

Meredith Zaritheny, a spokesperson for Deutsche Bank, said the matter has been resolved and had no further comment. A lawyer for Connolly didn’t immediately respond to an email seeking comment on the settlement.

Black filed his own suit against Deutsche Bank two months later, seeking at least $30 million in damages for malicious prosecution and abuse of process. The bank has denied his allegations and said any damages were “caused by his own misconduct, breaches of his duty of loyalty, fiduciary duties, employment agreement and/or breaches of Deutsche Bank’s policies and procedures.”

Prosecutors in the US and the UK have sought to hold individual traders responsible for rigging Libor, a key interest rate benchmark used to value trillions of dollars of loans and securities. But while a handful of traders have been convicted and sentenced to prison, others have been cleared of charges.

Tom Hayes, the former star trader who became the face of the Libor scandal, in May lost a first bid to appeal his near decade-old criminal conviction but was given some hope that he could go directly to the UK’s highest court.

Deutsche Bank in 2015 agreed to pay $2.5 billion and fire seven traders, including Black, to resolve probes into its role in the Libor-fixing scandal. At trial, Black and Connolly argued they were being blamed for a practice that was common in the industry and encouraged by the bank’s leaders.

QuickTake: US Dollar Libor Is Dead! What It Was, What Comes Next

The case is Connolly v. Deutsche Bank AG, 22-cv-9811, US District Court, Southern District of New York (Manhattan).

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance