Everybody goes to Washington: Morning Brief

Wednesday, July 29, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Tech hearings, Fed meetings, and a very DC day.

On Wednesday, the attention of the business world will be focused on the nation’s capitol.

Amid ongoing negotiations for a new stimulus plan to support workers and small businesses, the House Judiciary Committee will hold a widely-anticipated hearing with the CEOs of the world’s biggest tech companies just hours before the Federal Reserve announces its latest monetary policy decision.

The House hearing is set to being at 12:00 p.m. ET. Fed Chair Jerome Powell is set to begin a press conference at 2:30 p.m. ET. It is possible these two blockbuster events will overlap.

The tech hearing is where we expect much of the action to take place.

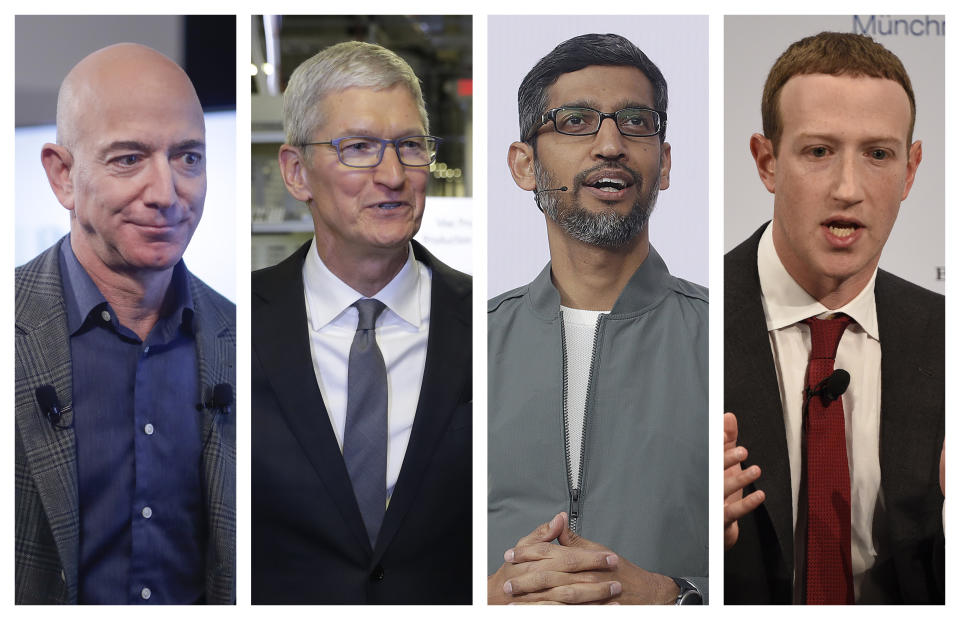

When the CEOs of Facebook (FB), Apple (AAPL), Amazon (AMZN), and Google (GOOGL, GOOG) appear on Capitol Hill, Greg Valliere, chief U.S. policy strategist at AGF Investments, expects that a “public flogging” will follow.

“Tech companies have loud critics on both sides of the aisle who believe [Wednesday’s] hearing will produce damaging evidence,” Valliere said. “We agree that ‘headline risk’ for the industry has increased, but a break-up is unlikely. The real risk for the tech giants is higher taxes.”

But any talk about what is more likely for these companies — forced break-ups or higher taxes — misses the significance of this hearing happening in the first place.

As Yahoo Finance Editor-in-chief Andy Serwer wrote over the weekend, “this hearing could mark a new beginning in the tug and pull between big business and society in America.”

Committee member Congresswoman Pramila Jayapal (D-WA) told Serwer that “this is the end of a one-year investigation where we’ve looked at these big tech platforms to examine antitrust, anti-competitive and monopolistic behavior.”

So while Facebook CEO Mark Zuckerberg and Google chief Sundar Pichai have appeared before lawmakers over the last couple of years, those earlier appearances focused on data privacy, platform security, bias, and China. Those questions are important, but different from what must be answered today.

As Ben Thompson at Stratechery noted Tuesday, this hearing is being hosted by the House Judiciary’s Subcommittee on Antitrust, Commercial, and Administrative Law. First and foremost, this is a hearing about competition.

There will doubtless be lines of questioning directed towards Zuckerberg — and potentially Pichai — about the role their platform plays in disseminating disinformation, and what responsibility Facebook has in moderating this content, ensuring election integrity, and so on. But as Thompson notes, these challenges come back to competition.

“Generally speaking the idea is that more competition should address harms — and that increased regulation, in contrast, reduces competition,” Thompson wrote. “This tradeoff ought to be at the forefront of Congress’s thinking as they consider tech company regulation.”

And while investors — and the general public — are broadly skeptical that lawmakers are interested in serious challenges to companies that are popular with consumers and have such an entrenched position in our daily lives, this subcommittee is at least barking up the right tree.

Because whether a company’s tax rate goes up or down a few percentage points is less important for the overall trajectory of these businesses than if Amazon or Google faces new, stringent rules on how it ranks products in search.

Would it be a challenge for Facebook if Congress required they spin-off Instagram? Sure. But it’d be a bigger problem for the company if new regulations deemed the process for selling ad inventory across their platforms anticompetitive.

Elsewhere in DC on Wednesday, Yahoo Finance’s Brian Cheung writes that the Fed meting isn’t likely to bring investors much new information about the central bank’s current efforts to support the economy through the pandemic and recession.

But when the world’s most important central banker speaks, markets listen.

Meanwhile, lawmakers continue negotiations on a new stimulus package after Senate Majority Leader Mitch McConnell (R-Ky.) unveiled a new $1 trillion plan that would send another round of $1,200 checks to Americans. However, enhanced unemployment benefits may be sliced to $200 per week, from the current $600 per week.

And while the future of monetary policy and tech regulation will get top billing today, it is this stimulus that will be most important in setting the near-term trajectory for the nascent economic recovery.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

7:00 a.m. ET: MBA Mortgage Applications, week ended July 24 (4.1% prior week)

8:30 a.m. ET: Advance goods trade balance, June (-$75.1 billion expected, -$74.3 billion in May)

8:30 a.m. ET: Wholesale inventories MoM, June preliminary (-0.3% expected, -1.2% in May)

8:30 a.m. ET: Retail inventories MoM, June (-6.1% in May)

10:00 a.m. ET: Pending home sales MoM, June (14.5% expected, 44.3% in May)

2:00 p.m. ET: Federal Open Market Committee rate decision

Earnings

Pre-market

6:20 a.m. ET: General Electric (GE) is expected to report an adjusted loss of 9 cents per share on revenue of $17.23 billion

6:00 a.m. ET: Six Flags Entertainment Corp (SIX) is expected to report an adjusted loss of $1.02 per share on revenue of $50.59 million

7:00 a.m. ET: Automatic Data Processing (ADP) is expected to report adjusted earnings of 96 cents per share on revenue of $3.3 billion

7:00 a.m. ET: CME Group (CME) is expected to report adjusted earnings of $1.63 per share on revenue of $1.2 billion

7:00 a.m. ET: Shopify (SHOP) is expected to report adjusted earnings of 4 cents per share on revenue of $511.96 million

7:30 a.m. ET: Boeing (BA) is expected to report an adjusted loss of $2.39 per share on revenue of $12.99 billion

7:30 a.m. ET: Wingstop (WING) is expected to report adjusted earnings of 29 cents per share on revenue of $62.44 million

7:30 a.m. ET: T Rowe Price Group (TROW) is expected to report adjusted earnings of $2.17 per share on revenue of $1.4 billion

7:30 a.m. ET: General Motors (GM) is expected to report an adjusted loss of $1.66 per share on revenue of $17.14 billion

6:00 a.m. ET: Spotify (SPOT) is expected to report an adjusted loss of 45 euro cents per share on revenue of 1.92 billion euros

After-market

4:00 p.m. ET: Qualcomm (QCOM) is expected to report adjusted earnings of 70 cents per share on revenue of $4.8 billion

4:05 p.m. ET: Ameriprise Financial (AMP) is expected to report adjusted earnings of $2.48 per share on revenue of $2.79 billion

4:05 p.m. ET: Teladoc Health (TDOC) is expected to report an adjusted loss of 23 cents per share on revenue of $220.36 million

4:10 p.m. ET: ServiceNow (NOW) is expected to report adjusted earnings of $1.01 per share on revenue of $1.05 billion

4:15 p.m. ET: PayPal (PYPL) is expected to report adjusted earnings of 88 cents per share on revenue of $5 billion

4:15 p.m. ET: Cheesecake Factory (CAKE) is expected to report an adjusted loss of $1.12 per share on revenue of $305.61 million

4:30 p.m. ET: O’Reilly Automotive (ORLY) is expected to report adjusted earnings of $4.19 per share on revenue of $2.62 billion

4:35 p.m. ET: Apache (APA) is expected to report an adjusted loss of $1.01 per share on revenue of $700.75 million

Top News

European stocks tread water ahead of Fed meeting [Yahoo Finance UK]

Starbucks posts loss as coronavirus bites, but stock pops on 'steadily recovering' business [Yahoo Finance]

Both Democrats, GOP are now on board for a second wave of PPP loans [Yahoo Finance]

AMD forecasts current-quarter sales above estimates [Reuters]

YAHOO FINANCE HIGHLIGHTS

'Un-investable'? Airlines could double in a year, fund manager says

Will Harley-Davidson still make electric motorcycles?

U.S. homeownership rate hits highest level in 12 years — but it could be a fluke

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance