Evertz Technologies And Two More TSX Dividend Stocks To Consider

As the Canadian economy experiences a moderation in inflation rates and the Bank of Canada signals potential rate cuts, investors might find this an opportune time to consider stable income-generating assets. Dividend stocks, known for their regular payouts and potential resilience in varied economic climates, could be particularly appealing under these current conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.84% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.32% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.50% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.47% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.42% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.01% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.59% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.39% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.31% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.22% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Evertz Technologies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited specializes in designing, manufacturing, and distributing video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications sectors globally, with a market cap of approximately CA$1.17 billion.

Operations: Evertz Technologies Limited generates its revenue from the design, manufacture, and distribution of video and audio infrastructure solutions across various sectors including production, post-production, broadcast, and telecommunications worldwide.

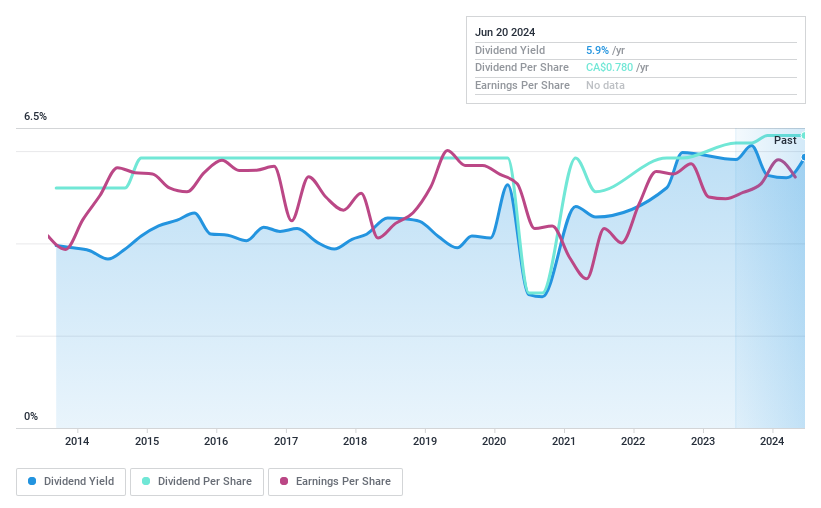

Dividend Yield: 5.9%

Evertz Technologies has demonstrated a mixed performance in dividend reliability, with a history of volatility over the past decade. Despite this, its dividends are currently well-supported by both earnings and cash flows, with payout ratios at 78.3% and 44% respectively. Recent financial results show an increase in annual sales to CA$514.62 million and net income to CA$70.17 million, reflecting steady growth. However, the dividend yield of 5.87% trails behind the top Canadian dividend payers.

Peyto Exploration & Development

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin, with a market capitalization of CA$2.81 billion.

Operations: Peyto Exploration & Development Corp. generates its revenue primarily from the exploration and production of oil and gas, totaling CA$876.26 million.

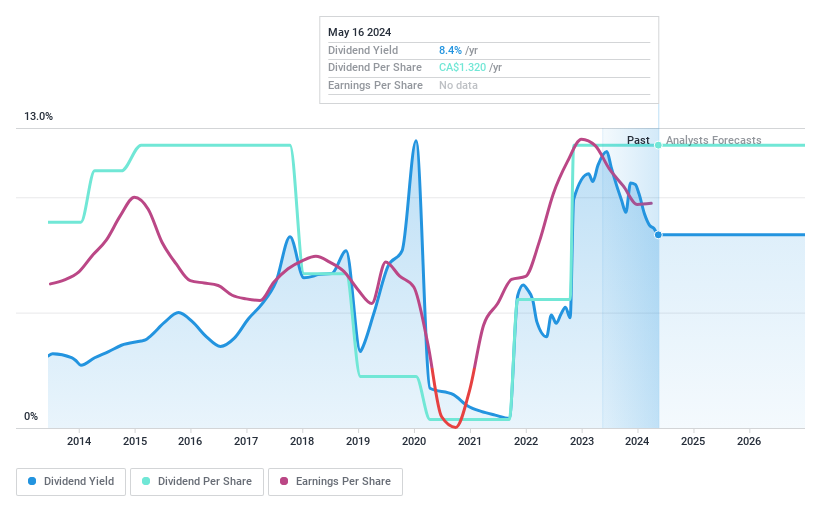

Dividend Yield: 9.2%

Peyto Exploration & Development exhibits a challenging dividend profile with a high cash payout ratio of 102.7%, indicating dividends are not fully covered by cash flows. Despite this, the company has managed to maintain its monthly dividend payments, recently confirming a CA$0.11 per share for June 2024. Additionally, Peyto has secured its financial stability through an extended $1 billion credit facility, enhancing its liquidity and ability to sustain operations amidst volatile earnings and dividends over the past decade.

Royal Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada, with a market capitalization of CA$200.40 billion, operates globally as a diversified financial services company.

Operations: Royal Bank of Canada generates revenue through segments including Personal & Commercial Banking (CA$20.92 billion), Wealth Management (CA$17.47 billion), Capital Markets (CA$10.70 billion), and Insurance (CA$5.91 billion).

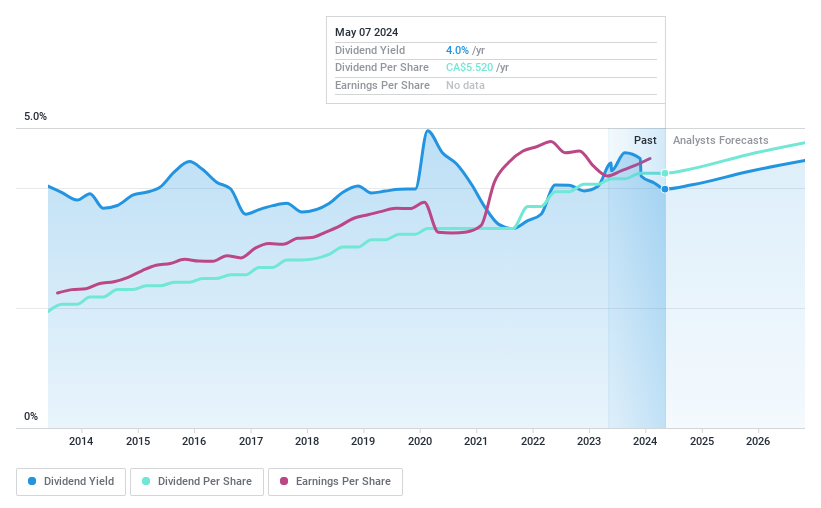

Dividend Yield: 4%

Royal Bank of Canada's recent fixed-income offerings and preferred stock buybacks underscore its proactive capital management strategy. On June 14, 2024, the bank announced multiple senior notes offerings with varying terms and rates, enhancing its financial flexibility. Additionally, on June 10, RBC declared a significant share repurchase program aiming to buy back up to 30 million shares by June 2025. These actions reflect RBC's robust financial health and commitment to returning value to shareholders while maintaining a stable dividend payout evidenced by the recent increase in quarterly dividends to CA$1.42 per share effective August 2024.

Make It Happen

Investigate our full lineup of 33 Top TSX Dividend Stocks right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ET TSX:PEY and TSX:RY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance