Everest Re (RE) Q1 Earnings Lag Estimates, Revenues Rise Y/Y

Everest Re Group, Ltd.’s RE first-quarter 2023 operating income per share of $11.31 missed the Zacks Consensus Estimate by 9.4%. However, the bottom line increased 9.7% year over year and beat our estimate of $7.02 per share.

Everest Re witnessed higher premiums across its reinsurance and insurance businesses, improved net investment income and underwriting income, partly offset by higher expenses.

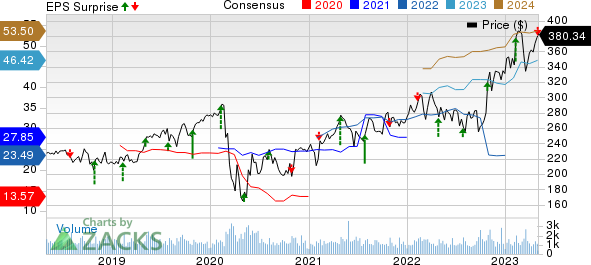

Everest Re Group, Ltd. Price, Consensus and EPS Surprise

Everest Re Group, Ltd. price-consensus-eps-surprise-chart | Everest Re Group, Ltd. Quote

Operational Update

Everest Re’s total operating revenues of nearly $3.3 billion increased 7.5% year over year on higher premiums earned and net investment income and beat our estimate of $3.2 billion. The top line, however, missed the consensus mark by 3.4%.

Gross written premiums improved 17.5% year over year to $3.7 billion. Our estimate was $3.5 billion.

Net investment income was $260 million, which increased 6.9% year over year. The upside was driven by stronger fixed income returns as new money yields remain attractive. It missed our estimate of $263.3 million.

Total claims and expenses increased 10.9% to $2.8 billion primarily due to higher incurred losses and loss adjustment expenses, commission, brokerage, taxes and fees, other underwriting expenses, corporate expenses and interest, and fees and bond issue cost amortization expense. Our estimate was $2.9 billion.

Pre-tax underwriting income was $273 million, which increased 16.2% year over year.

Pre-tax catastrophe losses net of estimated recoveries and reinstatement premiums were $110 million, which was due to the Turkey earthquake as well as the New Zealand floods and cyclone.

The combined ratio improved 40 basis points (bps) year over year to 91.2 in the reported quarter.

Segment Update

The Reinsurance segment generated gross written premiums of $2.6 billion, up 20.6% year over year. The increase was driven by 19.4% growth in property pro-rata, 27.5% growth in property Cat and 22.1% in Casualty pro-rata as a flight to quality continues across various markets. Our estimate was $2.3 billion.

The combined ratio of the Reinsurance segment improved 60 bps to 90.8.

The Insurance segment generated gross written premiums of $1.1 billion, up 10.8% year over year, driven by a diversified mix of property, marine, energy and other specialty lines. Our estimate was $1.1 billion.

The combined ratio deteriorated 50 bps to 92.4 for the Insurance segment.

Financial Update

Everest Re exited the first quarter of 2023 with total investments and cash of $31.4 billion, up 5.2% from the 2022 level. Shareholder equity at the end of the reported quarter increased 6.7% from the figure at 2022 end to $9 billion.

Book value per share was $229.49 as of Mar 31, 2023, up 6.8% from the 2022-end level.

Annualized net income return on equity was 17.2%, up 100 bps year over year.

Everest Re’s cash flow from operations was $1.1 billion in the quarter, up 25.7% year over year.

Everest Re paid common share dividends of $65 million during the quarter.

Zacks Rank

Everest Re currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other P&C Insurers

Chubb Limited CB reported first-quarter 2023 core operating income of $4.41 per share, which outpaced the Zacks Consensus Estimate by 0.9%. This outperformance was driven by higher premium revenues and improved net investment income. The bottom line improved 15.1% from the year-ago quarter. Net premiums written improved 16.6% year over year to $10.7 billion in the quarter. The figure was higher than our estimate of $10.1 billion. Net premiums earned rose 16.1% to $10.1 billion. The figure was higher than our estimate of $9.4 billion. Net investment income was $1.11 billion, up 34.7%. The figure was higher than our estimate of $957.3 million.

Property and casualty (P&C) underwriting income was $1.21 billion, down 5.5% from the year-ago quarter. Global P&C underwriting income, excluding Agriculture, was $1.2 billion, down 1.6%. Chubb incurred an after-tax catastrophe loss of $382 million, wider than the year-ago catastrophe loss of $290 million. The combined ratio deteriorated 200 bps on a year-over-year basis to 86.3% in the quarter under review.

AXIS Capital Holdings Limited AXS posted first-quarter 2023 operating income of $2.33 per share, beating the Zacks Consensus Estimate by 23.2%. The bottom line increased 11.5% year over year. Total operating revenues of $1.3 billion missed the Zacks Consensus Estimate by 6.7%. The top line, however, rose 0.6% year over year on higher net investment income. Net investment income increased 47.2% year over year to $134 million, primarily attributable to an increase in income from fixed maturities due to increased yields.

Total expenses in the quarter under review increased 1.9% year over year to $1.14 billion, attributable to higher interest expense and financing costs. Pre-tax catastrophe and weather-related losses and net of reinsurance were $38 million, primarily attributable to New Zealand floods, Cyclone Gabrielle and other weather-related events. This compares favorably with the year-ago loss of $60 million. AXIS Capital’s underwriting income of $139.4 million increased 0.4% year over year. The combined ratio improved 50 bps to 90.9.

First American Financial Corporation FAF reported first-quarter 2023 operating income per share of 49 cents, which beat the Zacks Consensus Estimate by a cent. The bottom line decreased 58.1% year over year. Operating revenues of $1.4 billion decreased 29% year over year. The top line beat the Zacks Consensus Estimate by 1.5%. The figure was in line with our estimate.

Investment income was $125 million in the first quarter, more than double year over year. The increase was primarily due to rising interest rates, which drove higher interest income from the cash and investment portfolio, escrow balances and tax-deferred property exchange balances. The impact of higher interest rates was partly offset by lower average balances, primarily in the company’s escrow and tax-deferred exchange balances. The figure was lower than our estimate of $144 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance