Everest Group Ltd's Dividend Analysis

Insights into Everest Group Ltd's Upcoming Dividend and Historical Performance

Everest Group Ltd recently announced a dividend of $2 per share, payable on June 14, 2024, with the ex-dividend date set for May 29, 2024. As investors anticipate this forthcoming payment, it's crucial to delve into the company's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this article explores Everest Group Ltd's dividend performance and evaluates its sustainability.

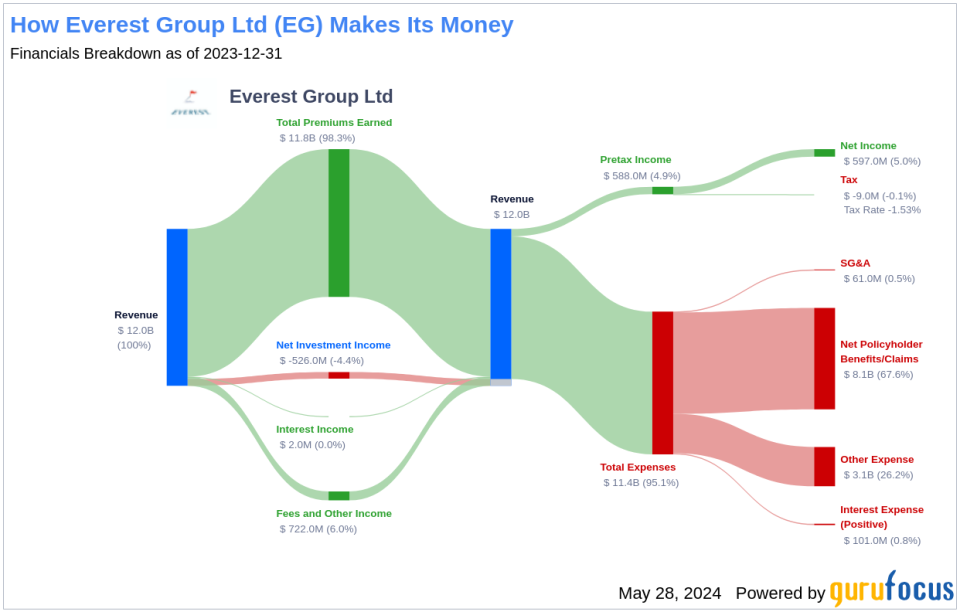

What Does Everest Group Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Everest Group Ltd operates primarily in the insurance sector, offering services across the U.S., Bermuda, and other international markets. Its Reinsurance division handles property, casualty, and specialty lines on both a treaty and facultative basis, engaging with reinsurance brokers and directly with ceding companies. The Insurance segment provides property and casualty insurance through direct channels, brokers, surplus lines brokers, and general agents within the U.S., Bermuda, Canada, Europe, and South America.

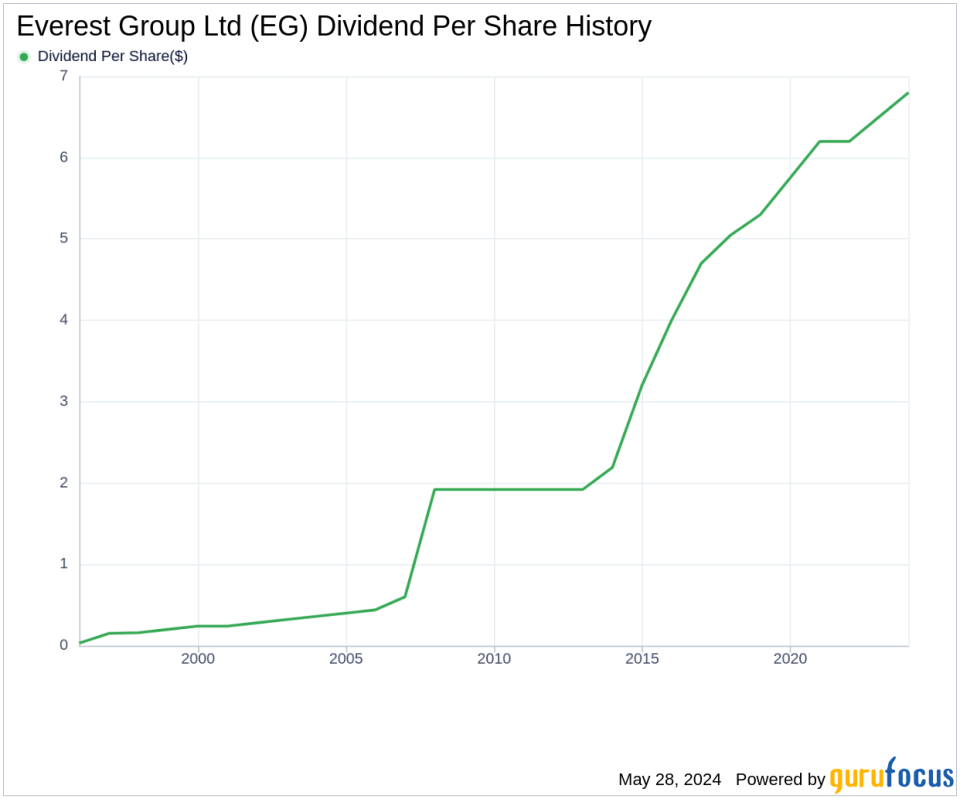

A Glimpse at Everest Group Ltd's Dividend History

Everest Group Ltd has upheld a steady dividend payment record since 1995, distributing dividends quarterly. The company has increased its dividend annually since 1995, earning it the status of a dividend aristocrata title awarded to companies that have raised their dividends for at least 29 consecutive years.

Breaking Down Everest Group Ltd's Dividend Yield and Growth

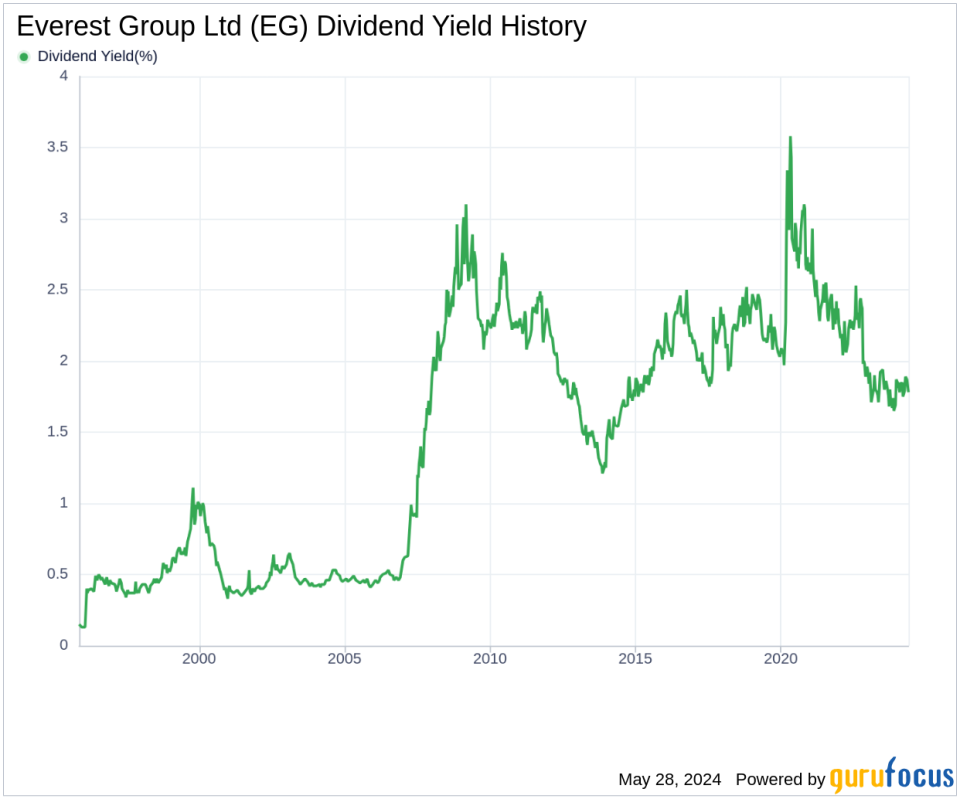

As of today, Everest Group Ltd boasts a 12-month trailing dividend yield of 1.76% and a forward dividend yield of 2.04%, indicating expected dividend increases over the next year. Over the past three years, the annual dividend growth rate was 3.10%, which rose to 4.70% over five years, and reached 10.00% over the past decade. Currently, the 5-year yield on cost for Everest Group Ltd stock is approximately 2.21%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio, sitting at 0.10 as of March 31, 2024, suggests that Everest Group Ltd retains a significant portion of its earnings for future growth and to buffer against downturns. The company's profitability rank of 7 out of 10, combined with a decade of positive net income, underscores its strong profitability.

Growth Metrics: The Future Outlook

Everest Group Ltd's growth rank of 7 indicates a promising growth trajectory. Its revenue per share and 3-year revenue growth rate of 13.40% annually outperform approximately 71.31% of global competitors. The company's 3-year EPS growth rate of 67.60% annually and a 5-year EBITDA growth rate of 58.60% further highlight its capacity to sustain dividends.

Conclusion: Assessing Everest Group Ltd's Dividend Sustainability

Considering Everest Group Ltd's consistent dividend increases, robust payout ratio, and strong growth metrics, the company appears well-positioned to maintain its dividend payments. This analysis suggests that Everest Group Ltd remains an attractive option for dividend-seeking investors. For those looking to explore further, GuruFocus Premium offers tools like the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance