Even With A 37% Surge, Cautious Investors Are Not Rewarding Personalis, Inc.'s (NASDAQ:PSNL) Performance Completely

Personalis, Inc. (NASDAQ:PSNL) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

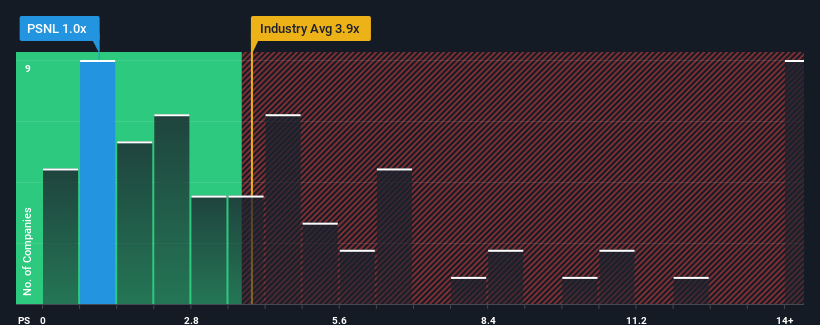

Although its price has surged higher, Personalis may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.9x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Personalis

How Has Personalis Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Personalis has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Personalis will help you uncover what's on the horizon.

Is There Any Revenue Growth Forecasted For Personalis?

Personalis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 8.0% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 4.8% per year growth forecast for the broader industry.

In light of this, it's peculiar that Personalis' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Personalis' P/S?

Personalis' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Personalis' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Personalis (1 is concerning) you should be aware of.

If you're unsure about the strength of Personalis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance