EV Roundup: RIDE's Q4 Results, RIVN's $1.3B Green Bond Offering & More

Electric vehicles (EVs) are the future of mobility. In light of the growing demand for electrification-related sales and services, Stellantis STLA partners with AI-driven tech provider Vehya. Lordstown Motors RIDE — an original equipment manufacturer of electric light-duty vehicles focused on the commercial fleet market — released fourth-quarter 2022 results. The company’s loss widened from the year-ago period. Meanwhile, EV king Tesla TSLA is under investigation after the steering wheel of 2023 Model Y vehicles came off. EV startup Rivian Automotive RIVN also made it to the top stories with its plans to raise $1.3 billion capital via the green bonds offering.

Each of the abovementioned companies carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recap of Last Week’s Most Important Stories

Lordstown incurred fourth-quarter 2022 adjusted loss of 45 cents a share, which deteriorated from a loss of 42 cents per share posted in the comparable year-ago period. The company generated revenues of around $194,000. In the year-ago period, RIDE had not recorded any revenues. The total cost of sales and operating expenses for the quarter under review was $30 million and $74.3 million, respectively. The company’s net loss widened to $102.3 million from $81.2 million a year earlier.

Lordstown exited 2022 with cash and short-term investments of $221.7 million, around $18 million higher than the third quarter of 2022. The company anticipates a sequential decline in the first quarter of 2023 SG&A and R&D costs. It expects to exit the current quarter with $150-$170 million in cash and short-term investments.

Stellantis roped in Vehya to support its 2,600-plus U.S. dealer network help prepare for meeting the evolving needs of consumers. The partnership will bring individual, comprehensive evaluations and electric vehicle integration services to the extensive base of Stellantis dealers. With this announcement, Vehya became the second partner for Stellantis' U.S.-based auto dealers.

Phil Langley, head of Network Development of Stellantis NA, said, "As our partners in the automotive industry transition to electric-vehicle sales and service, our goal is to provide our 2,600-plus U.S. dealers with high quality options that meet their individual EV integration needs within every area of the dealership business. Vehya is equipped with the experience and infrastructure needed to help support our dealers and make this process as straightforward and simple as possible."

Tesla is facing an investigation after the National Highway Traffic Safety Administration ("NHTSA") received two complaints in which steering wheels got detached from the 2023 Model Y while people were driving. The preliminary evaluation, started on Mar 4 by NHTSA, involves more than 120,000 vehicles.

According to NHTSA, when the vehicles were delivered to the owners, the retaining bolt that connects the steering wheel to the steering column was missing from both vehicles. In both cases, the incident occurred at low mileage. The agency said that it will assess the “scope, frequency and manufacturing processes associated with this condition.” After the assessment, the agency will decide if the vehicles need to be recalled.

Rivian announced plans to raise additional capital through the issue of issue $1.3 billion in convertible bonds. The company is billing the issue as “green” bonds. The bonds are due to mature on Mar 15, 2029, post which investors will have the option to convert them to cash or stocks.The institutional investors who purchase bonds at the initial offering could secure up to $200 million in additional bonds within 13 days of the issue.

Rivian is currently struggling with an alarming cash burn rate, and this new bond sale will help the company stay afloat and finance its second-gen “R2” line of vehicles.Per the company’s public statement about the new bond issue, “Rivian intends to use the net proceeds from the offering to finance … current and/or future eligible green projects.” Rivian said these projects could include activities related to clean transportation, renewable energy, circular economy, energy efficiency, and pollution prevention and control.

Price Performance

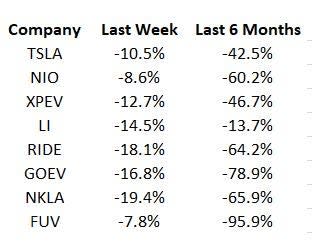

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Lordstown Motors Corp. (RIDE) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance