European politics and US consumers — What you need to know this week in markets

After a busy week of data in the US economy, this week will be more of a mixed bag as elections on Sunday in Europe and reports on the state of the US consumer will be in focus.

Last week, we learned the US economy continues to add jobs at an encouraging clip as the unemployment rate fell to a new post-crisis low.

This week, reports on consumer confidence and the state of the services sector — as well as the monthly report on job openings — will headline the data slate. Services account for about 85% of GDP and capture most all of the consumer spending data that powers the US economy.

In markets, stocks will look to bounce back after snapping a three-week winning streak.

Economic calendar

Monday:

Markit services PMI (54.8 expected; 54.7 previously)

ISM non-manufacturing (55.5 expected; 54.8 previously)

Labor market conditions index (-0.2 expected; 0.7 previously)

Tuesday:

Trade balance, October (-$42 billion expected; -$36.4 billion previously)

Nonfarm productivity (+3.3% expected; +3.1% previously)

Factory orders (+2.5% expected; +0.3% previously)

Wednesday:

Job openings and labor turnover survey (5.445 million expected; 5.486 million previously)

Consumer credit ($18.5 billion expected; +19.3 billion previously)

Thursday:

Initial jobless claims (255,000 expected; 268,000 previously)

Friday:

University of Michigan consumer sentiment (94.4 expected; 93.8 previously)

Week in review

The US labor market is still in great shape.

In November, the economy added 178,000 jobs while the unemployment rate fell to 4.6%, the lowest since August 2007.

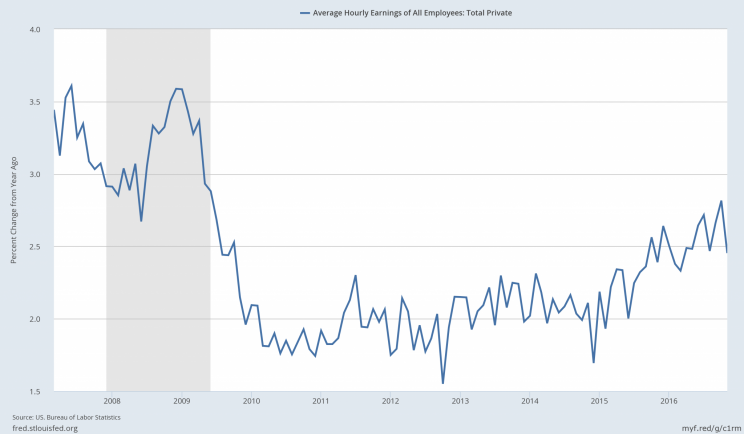

Inside this report — which serves as the highlight of the economic calendar each month — we did get some disappointing data on wage growth, as hourly earnings rose, on average, 2.5% over the prior year. This was a decline from October’s 2.8% improvement in wages.

A rise in wages is seen as a leading indicator of inflation pressures picking up in the economy, a dynamic that could press the Federal Reserve to be more aggressive in raising interest rates. Friday’s data indicate wages are rising near their fastest pace since the recession, but could cast some doubt on the idea the Fed will fall “behind the curve,” or be forced to quickly raise rates in response to rising inflation pressures. Others are less sure that’s the right conclusion.

“On the face of it, the combination of falling unemployment and sluggish-looking wage numbers appears to support the idea that perhaps the Fed can allow the economy to run hotter for longer without taking undue inflation risks,” wrote Ian Shepherdson at Pantheon Macroeconomics. “But we are very skeptical.”

At issue in the November report is the calendar. The BLS survey week for the jobs report is the week that contains the 12th of the month. In November, this fell on a Saturday. The 15th, when many workers are paid, was the following Tuesday, meaning that the month-on-month decline in wages — and the disappointing annual number — will likely reverse sharply in December, when the 15th falls during the survey month. These sorts of monthly quirks have happened before and will happen again, which is why no one jobs report tells the whole story.

Elsewhere in economic data last week we got another update on how American businesses are responding to the results of the election.

The Dallas Fed’s monthly report on business conditions in Texas showed that at least in the Lone Star State, business execs are pretty excited about Trump’s win.

“There is a great deal of optimism from our customers that the new pro-growth and lower-tax focus by the incoming administration will be a positive change from the past eight years,” said one executive in the fabricated metal business.

Other executives in the state were a bit more direct in their optimism about the future, and their criticism of what’s been going wrong, as one manufacturing executive said bluntly, “We are looking forward to the end of the disastrous socialist policies of the last eight years.”

Consumer confidence has also held up strong, with the Conference Board’s latest reading on consumer confidence rising to a nine-year high last week.

“A more favorable assessment of current conditions coupled with a more optimistic short-term outlook helped boost confidence,” said Lynn Franco, Director of Economic Indicators at The Conference Board.

“And while the majority of consumers were surveyed before the presidential election, it appears from the small sample of post-election responses that consumers’ optimism was not impacted by the outcome.”

The University of Michigan’s final reading on consumer confidence in November, released before Thanksgiving, indicated that the election had a positive impact on consumers. “The upsurge in favorable economic prospects is not surprising given Trump’s populist policy views,” that report said, “and it was perhaps exaggerated by what most considered a surprising victory as well as by a widespread sense of relief that the election had finally ended.”

On Friday, we’ll get the preliminary reading on consumer sentiment in November from the University of Michigan.

European politics

The week in markets starts early as votes in Austria and Italy taking place Sunday have the attention of US investors.

By 2:00 p.m. ET on Sunday, it looked as though Austria’s far-right candidate for president would not win, putting an end to fears the country would elect its first far-right populist since since World War II. Following the Brexit vote and Donald Trump’s election in the US, all bets had seemed off when it came to populist candidates taking surprise victories. The next big vote in Europe to potentially extend this theme will be next spring’s French presidential election.

In Italy, a referendum vote on constitutional reforms proposed by Matteo Renzi was set to take place Sunday. A “no” vote on these measures is expected, and Renzi has said he would resign following this result.

The concerns here are that uncertainty regarding the future of the Italian government could put the country’s fragile banking system in further peril.

But as a Bloomberg report published late last week outlined, markets have been bracing for a “no” vote and potential instability in Italian politics, cutting down on the likelihood this vote meaningfully throws markets a curveball.

Here’s Bloomberg:

The nation’s political leaders, the Bank of Italy and the European Central Bank could take steps, if necessary, to keep the financial system from collapsing, including making state aid available, said Nicolas Veron, a senior fellow at Bruegel, a Brussels-based think tank. “It’s hard to see a scenario that leads to Armageddon in the Italian banking sector even if Renzi does step down,” he said.

Finance Minister Pier Carlo Padoan has held discussions with the European Commission on how the government can help Monte Paschi raise capital without breaking rules on state aid, Corriere della Sera reported Friday. Italy also asked the EU to authorize a nationalization of the bank should it become necessary, the newspaper said.

And as Citi strategists wrote in a recent note to clients, “The referendum is not a make-or-break moment for Italian politics.”

The firm added:

Although important, near-term risks stemming from the referendum outcome may be overstated. A No vote would maintain the (perhaps not ideal, but well-known) institutional status quo, although it could lead to government resignations. We reckon on balance the reform is positive for Italy’s future political stability and ability to implement reforms, but experts’ views, which are increasingly diverging on its merits suggest that investors should be cautious in drawing firm conclusions either way.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance