European Cocoa Grinds Show Surprise Jump Despite Surging Prices

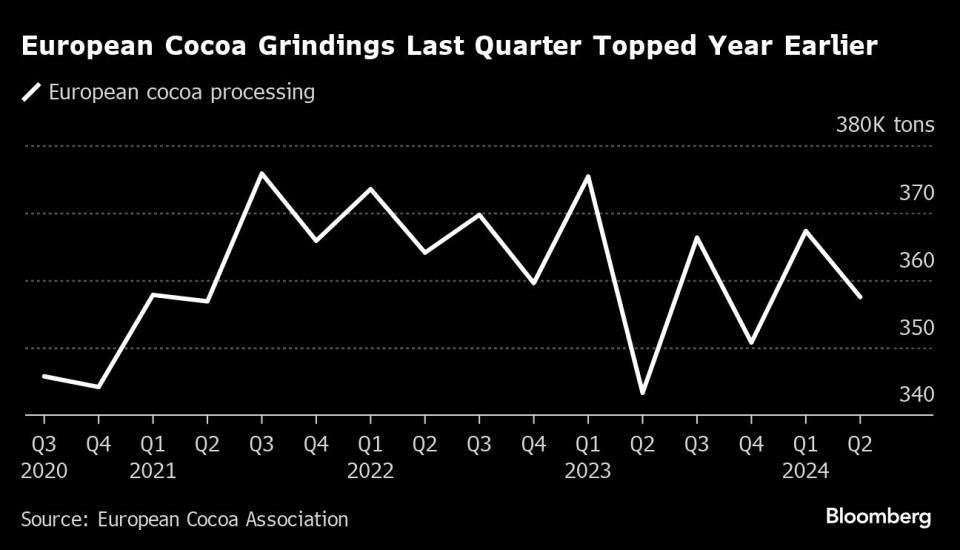

(Bloomberg) -- Cocoa processing in Europe unexpectedly rose in the second quarter, even as chocolate makers face pressure from higher bean prices.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

While chocolate demand is expected to weaken in the second half, after cocoa prices more than doubled from a year ago, the grindings show some market resilience. Cocoa futures in New York climbed as much as 4.3%, while prices in London gained as much as 3.1%.

Processing in Europe, the top consuming region, rose 4.1% in the second quarter from a year earlier, the European Cocoa Association said Thursday. Analysts and traders surveyed by Bloomberg expected the region’s cocoa processing to slow down slightly.

The grindings figure is “much stronger than expected and was probably a big surprise to market participants,” said Dixon Poh, assistant vice president of soft commodities for Asia at broker StoneX. “Such strong data should lead to more trading volume being pumped into the market and a boost in prices.”

The surprise increase is likely due to companies tapping stockpiles secured before the worst of the crunch took hold, sending cocoa prices to a record this year. That could take a turn in coming months as low inventories force processors to replenish supplies at higher prices — something that’s expected to weigh on grindings in the second half of this year.

Already, there are signs that chocolate demand is weakening as consumers balk at rising prices.

Barry Callebaut AG, the world’s largest bulk chocolate maker, reported a decline in sales volumes in the third quarter of its fiscal year. Cocoa powder demand has remained “robust,” it said. Chief Financial Officer Peter Vanneste said “supply turbulence” and rising cocoa prices will add to challenges ahead. The company’s shares fell by as much as 12% in Zurich trading.

New York cocoa futures hit an all-time high of more than $11,000 a ton in April as poor West African harvests curbed output. Prices have since eased, but are still more than double what they were this time last year.

--With assistance from Ilena Peng.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance