Euronext Paris Highlights: 3 Growth Companies With Up To 19% Insider Ownership

Amid a backdrop of political shifts and moderate economic challenges in Europe, France's market has shown resilience, with the CAC 40 Index climbing significantly. This environment underscores the potential value of growth companies, particularly those with substantial insider ownership which can signal strong confidence in the company’s prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

Adocia (ENXTPA:ADOC) | 11.9% | 59.8% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.2% |

Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 70.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Let's dive into some prime choices out of from the screener.

Exclusive Networks

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market capitalization of approximately €2.14 billion.

Operations: Exclusive Networks generates its revenue from three primary geographical segments: €420 million from APAC, €4.04 billion from EMEA, and €689 million from the Americas.

Insider Ownership: 13.2%

Exclusive Networks, a French growth company with significant insider ownership, showcases robust forecasts with earnings expected to grow by 28.44% annually. Despite a slight decline in Q1 2024 revenue to €393 million from €399 million the previous year, the company maintains an optimistic sales growth outlook of 10-12%. However, its anticipated Return on Equity is relatively low at 14.3%, signaling potential concerns about future profitability efficiency. Recent changes include appointing KPMG as its new auditor until 2030.

Lectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions targeting the fashion, automotive, and furniture sectors across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.12 billion.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, amounting to €170.33 million and €110.28 million respectively.

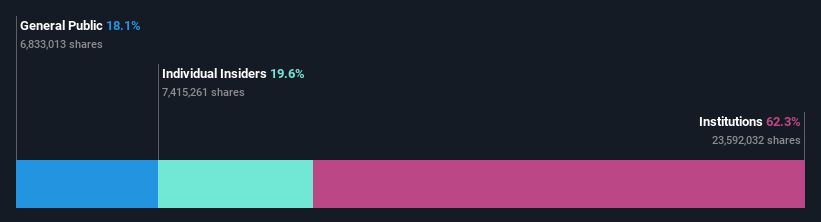

Insider Ownership: 19.6%

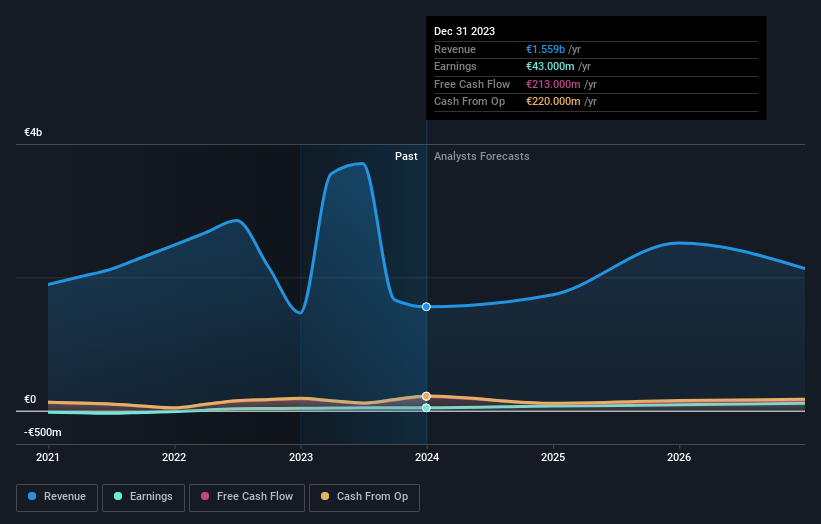

Lectra, a French company with notable insider ownership, is trading at 32.8% below its estimated fair value, signaling potential undervaluation. Despite a slight dip in Q1 2024 earnings to €7.17 million from €7.63 million the previous year, Lectra anticipates robust future growth with earnings expected to increase by 28.6% annually and revenue projected to grow at 11.3% per year—both rates surpassing market averages. However, its forecasted Return on Equity of 13.3% suggests some concerns about efficiency in capital utilization.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.21 billion.

Operations: The company generates €801.96 million from installing and maintaining electronic shelf labels.

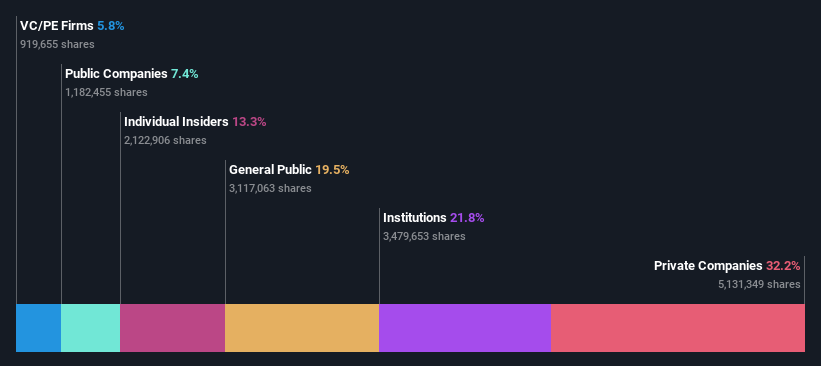

Insider Ownership: 13.5%

VusionGroup S.A., a French growth company with high insider ownership, has shown substantial financial progress. Over the past year, earnings surged by 320.8%, with revenue forecasted to grow annually at 21.9%, outpacing the French market's 5.7%. Analysts predict a significant stock price increase of 40.5% and expect earnings to expand by 25.2% per year, exceeding market expectations of 10.8%. Despite its highly volatile share price recently, VusionGroup's robust performance indicators suggest promising growth potential.

Key Takeaways

Discover the full array of 22 Fast Growing Euronext Paris Companies With High Insider Ownership right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:EXNENXTPA:LSS ENXTPA:VU and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance