Euro Traders Should be Nervous of What the ECB Will Do

Euro Traders Should be Nervous of What the ECB Will Do

Fundamental Forecast for US Dollar: Bearish

Italian election ends in gridlock that threatens to turn core member off austerity drive

Euro-area unemployment rate hits a fresh record high

Euro sees critical turn in speculative positioning, what do technicals suggest?

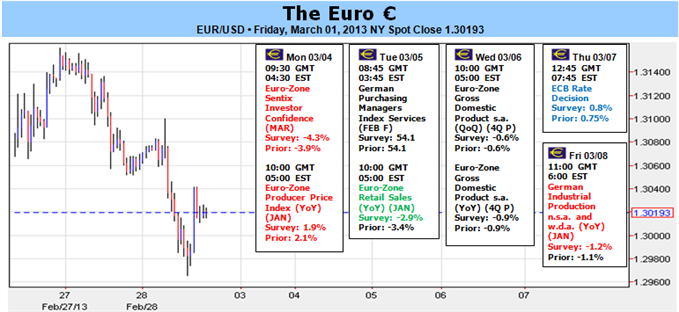

Like many of its largest counterparts, the Euro is at a critical fundamental fork in the road. On the one hand, there is a tangible – though somewhat passive – bullish driver to be found in the European Central Bank’s (ECB) passive stimulus reduction. Alternatively, the willful disregard of the region’s deepening recession and the growing risk of a return to financial crisis is growing particularly difficult to maintain. There are many events in the upcoming week that can stir traders on both sides of the market; but to fully engage the currency, we need something that is activity and persuasive for changing speculative positioning. Given the spotlight on regional risk and willingness to cede to volatility, the market may cast its vote with a decisive catalyst – like the ECB rate decision.

Though the central bank’s policy gatherings have been hit-or-miss over the past few years, there has certainly been a growing market interest in the ECB’s decisions and remarks over the past three months. In this time, we have seen significant downgrades on growth and inflation forecasts as well as an articulated concern about the pressure that the euro’s recovery adds to the fragile state of the economy and financial market. Yet, through it all, the policy authority has remained hands off on the stimulus front.

Nowadays, a hands off approach to stimulus is a remarkable position. With the Fed indulging in an $85 billion-per-month QE3 buying program and the Bank of Japan on course for something even more grandiose, abstaining from building the central bank balance sheet is actually seen as a hawkish (and currency bullish factor). In fact, in the ECB’s policy of keeping steady at the helm, the balance sheet is contracting as regional banks continue to pay off their LTRO (Long-Term Refinancing Operation) loans taken at the height of the liquidity crisis. Between the repayments on both LTRO1 and LTRO2, banks have already committed to paying down €225 billion in the stimulus. This means that the ECB’s balance sheet has actually dropped by that amount (technical, it is a larger amount due to asset maturity).

Why does this boost the currency? Competitive stimulus is a direct contributor to exchange rate changes – just look at what the BoJ has accomplished these past five months. With the ECB going in exactly the opposite direction as its trade partners, we’ve seen benchmark euro rates rise and attract investment capital back to the region. (What is a Currency War? Who is engaging in one right now? How is it impacting your trading? Take our free course and find out.)

Yet, that reduction of support carries with it a cost – as does the higher currency. With a regional economy in recession – and certain Eurozone members in a certain depression – a withdrawal is a dangerous position to take. By the ECB’s own admission, the growth outlook looks troubled and financial conditions are prone to sudden shocks. Upping the stakes, we have seen Italy – the Euro-region’s third largest economy – find itself in a political dilemma. When the vote was tallied, no party won a majority necessitating either a reelection or grand coalition to establish a functional government that can pass tough laws. Yet, we have heard from the anti-austerity groups (particularly the Five Star Movement, headed by Beppe Grillo) that they do not plan on replicating the productive composition that Mario Monti held.

In a gridlock, the effort to reduce Italy’s massive deficits will stall and the recession will continue to ravage the economy all the same. And, if the market is looking for threats, they can once again come back to lingering threats like Spain’s banking system, Cyprus’ stalled rescue, Greece’s increasingly costly bailout, not to mention a region-wide recession. It is perhaps an unfortunate time for the Troika to visit Greece as well as Portugal next week.

Looking to the week ahead, fundamental imbalance for the Euro-region will ensure the ECB decision draws activity. If President Draghi and crew decide to remain ‘hands off’, it could prove a short-term boost for the currency as there is some level of anticipation for easing through rates, stimulus or verbal guidance. Yet, through the medium-term, investors will see it as a sign that the central bank will leave the market’s exposed. Alternatively, a boost in support would realize bears’ fears and would still catch many off guard. – JK

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance