EUR/USD Mid-Session Technical Analysis for May 22, 2019

The Euro is trading steady-to-higher on Wednesday as investors prepare for the release of the minutes from the U.S. Federal Reserve’s May meeting at 18:00 GMT. Lower Treasury yields are also making the U.S. Dollar a less-attractive investment.

At the meeting, policymakers left interest rates unchanged and signaled little appetite to adjust them any time soon. Earlier in the week, Fed Chairman Jerome Powell cautioned against the need for an interest rate cut. Euro traders will be most interested in whether policymakers discussed what it would take for them to get to lower rates.

At 12:12 GMT, the EUR/USD is trading 1.1168, up 0.0007 or +0.06%.

Daily Technical Analysis

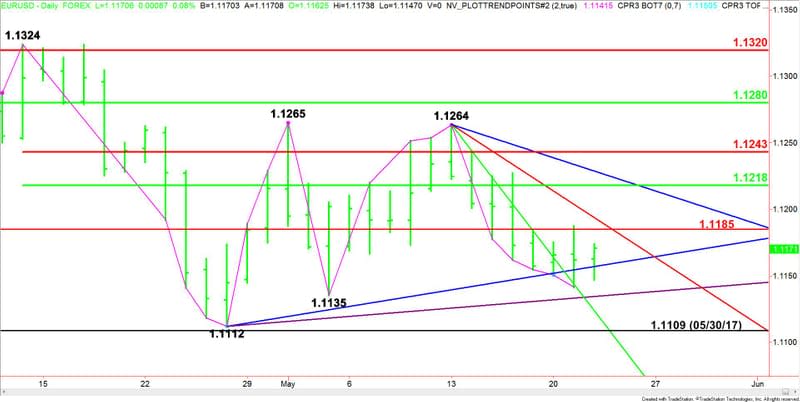

The main trend is down according to the daily swing chart. A trade through 1.1135 will signal a resumption of the downtrend. This could lead to a test of the April 26 main bottom at 1.1112 and the May 30, 2017 main bottom at 1.1109.

On the upside, the nearest resistance is the long-term Fibonacci level at 1.1185. This is followed by a 50% level at 1.1218.

Daily Technical Forecast

Based on the early price action, the direction of the EUR/USD the rest of the session is likely to be determined by trader reaction to the uptrending Gann angle at 1.1157.

Bullish Scenario

A sustained move over 1.1157 will indicate the presence of buyers. If this creates enough upside momentum then look for the rally to extend into 1.1185, followed by the downtrending Gann angle at 1.1194.

Bearish Scenario

A sustained move under 1.1157 will signal the presence of sellers. The first target is yesterday’s low at 1.1142, followed by a support cluster at 1.1135. Look for a technical bounce on the first test of this price level.

If 1.1135 fails then look for the selling to extend into 1.1112 to 1.1109.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance