EUR/USD Daily Forecast – Volatility Slows in Holiday-Thinned Trading

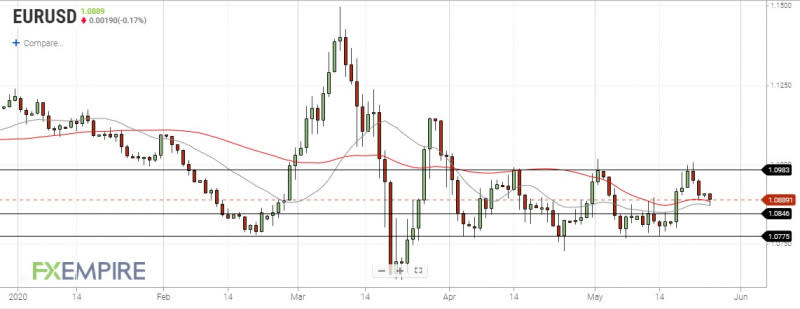

EUR/USD eased lower in the second half of last week and is seen trading within a tight range near the 1.0900 handle to start the new week.

Volatility is subdued as a result of the Spring Break holiday in the UK and the Memorial Day holiday in the US.

GDP figures from Germany showed a 2.2% contraction in the first quarter which marked the largest decline in output since the financial crisis. As it is the second consecutive quarterly decline, Germany has officially entered a recession.

The report showed a small increase in employment although there was a sharp drop in the average number of hours worked as a large portion of the German workforce has moved to reduced hours because of the virus outbreak.

EUR/USD was lifted higher last week from a notable technical area after leaders from Germany and France proposed a stimulus plan to aid the Euro member states hit hardest by the Coronavirus.

The exchange rate rallied nearly 2% in the first half of the week after pulling back from an important resistance level.

Technical Analysis

Resistance near the 1.1000 handle has now served to hold the exchange rate lower on three distinct attempts since the middle of April. The pair has pulled back to erase about half of the gains as measured from the low posted around the middle of the month.

There is a confluence of support that has come into play on a daily chart stemming from the 20 and 50-day moving averages. This stands to keep the pair supported in the session ahead.

While there have not been any strong signs of buyers as of yet, the prospect of further stimulus in Europe stands to keep the pair bid.

In this context, EUR/USD bulls will want to see the pair hold above horizontal support at 1.0846 in the week ahead, in the event the pair falls below the mentioned moving average support.

Bottom Line

It’s been a slow start to the new week and volatility is likely to remain subdued for the rest of the day with US traders on holiday in observance of Memorial Day.

A second consecutive quarterly contraction in GDP growth for Germany has sent their economy into a recession.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance