Etsy (NASDAQ:ETSY) Reports Q1 In Line With Expectations But Stock Drops 15.5%

Online marketplace Etsy (NASDAQ:ETSY) reported results in line with analysts' expectations in Q1 CY2024, with revenue flat year on year at $646 million. It made a GAAP profit of $0.48 per share, down from its profit of $0.52 per share in the same quarter last year.

Is now the time to buy Etsy? Find out in our full research report.

Etsy (ETSY) Q1 CY2024 Highlights:

Revenue: $646 million vs analyst estimates of $646.5 million (small miss)

EPS: $0.48 vs analyst expectations of $0.49 (1.2% miss)

Gross Margin (GAAP): 71%, up from 69.5% in the same quarter last year

Free Cash Flow of $59.32 million, down 79% from the previous quarter

Active Buyers: 96.39 million, up 866,000 year on year

Market Capitalization: $8.05 billion

"Our first quarter performance, while in line with our guidance, was pressured by the challenging environment for consumer discretionary products, which continues to be a headwind to Etsy marketplace growth," said Josh Silverman.

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

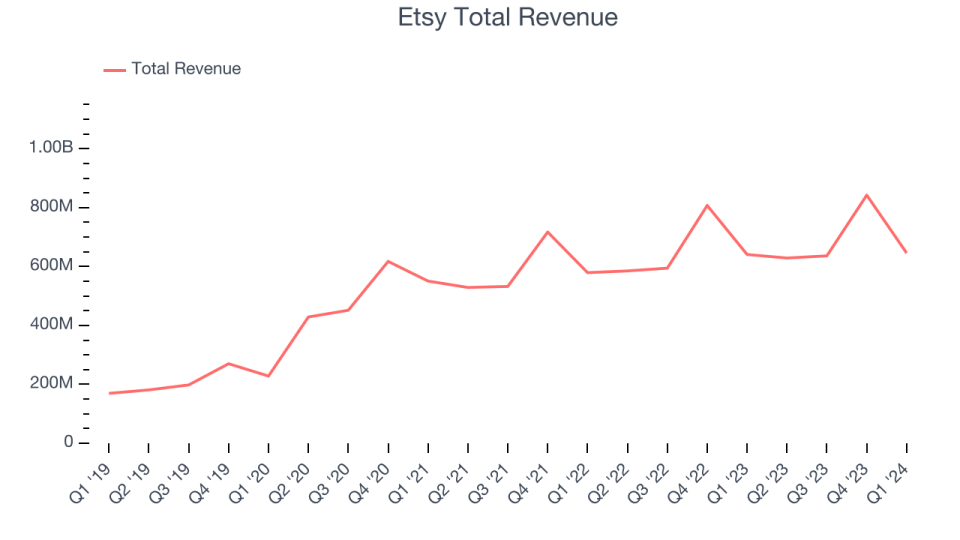

Sales Growth

Etsy's revenue growth over the last three years has been unremarkable, averaging 10.6% annually. This quarter, Etsy reported rather lacklustre 0.8% year-on-year revenue growth, missing analysts' expectations.

Ahead of the earnings results, analysts were projecting sales to grow 4.8% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

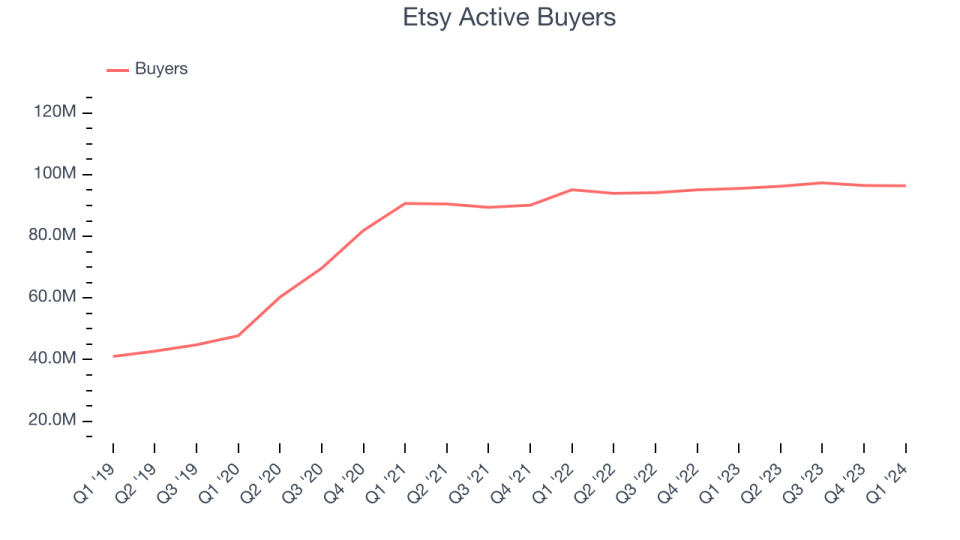

Usage Growth

As an online marketplace, Etsy generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Over the last two years, Etsy's active buyers, a key performance metric for the company, grew 2.9% annually to 96.39 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q1, Etsy added 866,000 active buyers, translating into 0.9% year-on-year growth.

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Etsy because it measures how much the company earns in transaction fees from each buyer. Furthermore, ARPB gives us unique insights as it's a function of a user's average order size and Etsy's take rate, or "cut", on each order.

Etsy's ARPB growth has been decent over the last two years, averaging 5.1%. The company's ability to increase prices while growing its active buyers demonstrates the value of its platform. This quarter, ARPB declined 0.1% year on year to $6.70 per buyer.

Key Takeaways from Etsy's Q1 Results

We struggled to find many strong positives in these results. Its revenue growth regrettably slowed as its gross merchandise sales and active buyers fell short of analysts' estimates. That was slightly offset by the company's better-than-expected take rate, showing it charged higher commissions to offset its worse-than-expected demand.

Etsy's management team noted that Q1 was a challenging environment for consumer discretionary products, which was a headwind to its growth. The company provided ambiguous guidance for the full year as well, spooking investors.

Overall, this was a tough quarter for Etsy. The company is down 15.5% on the results and currently trades at $58.97 per share.

Etsy may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance