Ether-Bitcoin Ratio Slides to Lowest Since April 2021. Here's Why

The ether-bitcoin ratio slides to a three-year low, extending year-to-date losses to nearly 16%.

Several factors, such as uncertainty about the launch of spot ETH ETF in the U.S. and the growth of Ethereum-killers like Solana, are responsible for ether’s underperformance.

The ratio between ether {{ETH}} and bitcoin’s {{BTC}} dollar-denominated prices continues to slide, extending year-to-date losses as suggested by the bearish death cross pattern a month ago.

ETH/BTC slipped to 0.04563 on crypto exchange Binance soon before press time, reaching the lowest since April 2021, according to charting platform TradingView. This year, the ratio has declined nearly 16%, indicating a bias for bitcoin or the leading cryptocurrency by market value.

The slide to three-year lows follows reduced demand for exchange-traded products (ETPs) tied to ether.

According to Bloomberg data quoted by ETC Group in its weekly report, global ether ETPs registered net outflows of around $63.5 million last week, with Hong Kong-listed exchange-traded funds (ETFs) losing the most. Meanwhile, bitcoin ETPs raked in $92.5 million last week.

Several factors, including competing layer 1s and lingering uncertainty about the debut of spot ETH approvals in the U.S, are likely responsible for ETH falling out of investor favor.

“The approval of spot bitcoin ETFs in the U.S. has reinforced bitcoin’s store-of-value narrative and its status as a macro asset. On the other hand, open questions about ETH’s fundamental positioning within the crypto sector remain. Competing layer-1s (L1s) like Solana detract from Ethereum’s positioning as the 'go-to' network for decentralized app (dApp) deployment,” Coinbase Institutional’s Research analyst David Han said in a note Wednesday.

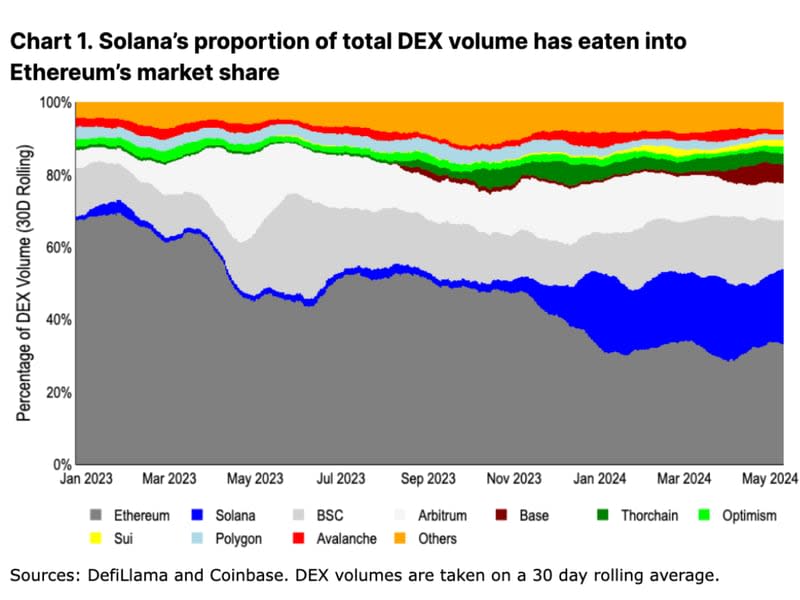

Solana’s share in total decentralized exchange volumes has grown tenfold from 2% to 21% in one year, eating into Ethereum's market share.

The U.S. Securities and Exchange Commission (SEC) green-lighted nearly a dozen spot BTC ETFs in January. Since then, these funds have drawn roughly $12 billion in net inflows, according to data source Farside Investors.

Approval of spot ETFs tied to ether will open a similar pool of capital for Ethereum’s native token, although it’s unclear when the SEC will approve it.

Traders on decentralized betting platform Polymarket see just a 10% chance of the SEC approving a spot ETF on or before May 31. The regulator has until May 23 to decide whether to approve or reject VanEck’s application to launch a spot Ethereum ETF. The deadline for BlackRock’s application is June 23.

According to finance lawyer Scott Johnsson, the SEC is looking for reasons to deny ETH ETF applications by BlackRock and others on grounds that they have been improperly filed as commodity-based trust shares and do not qualify if they hold a security.

I'm aware this is widely considered a possibility, but this is your official notice that the SEC is considering the security question for ETH in this upcoming spot ETF order. Note that this question was never (afaict) asked regarding a spot/futures BTC ETF product. pic.twitter.com/TwhqmTnJfC

— Scott Johnsson (@SGJohnsson) May 14, 2024

Ilan Solot, co-head of digital assets at Marex Solutions, said ether is a "lightning rod" for negative sentiment from crypto native and external players and has several weak spots.

“Capital gets fragmented. There are proportionally greater numbers of ways to get exposure to the ecosystem through the many Layer 2s tokens (OP, ARB…) and native protocol tokens in each one. The capital gets fragmented," Solot said in an email.

Solot added that strong anti-ETH sentiment from [rival] Solana community and Bitcoin propounders is driving negative ether narratives and the high beta cryptocurrency is a "perfect vehicle" for external players to express bearish view given it trades on traditional exchanges such as the Chicago Mercantile Exchange.

Lastly, Ether recently turned inflationary, reversing the bullish deflationary supply trend seen consistently since its parent network Ethereum transitioned to a proof-of-stake consensus ecosystem in September 2022.

Yahoo Finance

Yahoo Finance