Estee Lauder (EL) on Track With Profit Recovery Amid Hurdles

The Estee Lauder Companies Inc. EL is reaping benefits from sturdy presence in emerging markets, where demand appears to be growing. The company boasts a strong online business. This beauty company’s Profit Recovery Plan looks promising.

Let’s delve deeper.

Online Business: Key Driver

Estee Lauder boasts a strong online business. It is implementing new technology and digital experiences, including online booking for each store appointment, omnichannel loyalty programs and high-touch mobile services. These initiatives and its digital-first mindset have been aiding Estee Lauder’s online sales. The company is expanding its omnichannel capabilities to aid flexible and convenient shopping options for consumers.

Solid Emerging Market Presence

Estee Lauder generates significant revenues from emerging markets like Thailand, India, Russia and Brazil. This encourages it to make distributional, digital and marketing investments in these countries. The company is well insulated from macroeconomic headwinds in developed nations.

Management is building infrastructure across emerging regions that helps generate consistent growth. It is expanding its reach across high-growth channels while strategically introducing brands into new countries.

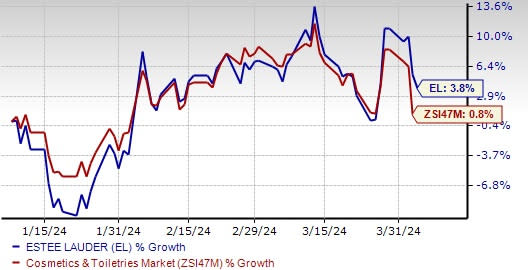

Image Source: Zacks Investment Research

Hurdles on the Way

EL continues to operate in a challenging macroeconomic environment and geopolitical tensions across certain parts of the world. It is bearing the brunt of weakness in Asia travel retail and a slower-than-anticipated recovery in prestige beauty across mainland China. In the Asia-Pacific region, organic net sales fell 7%, due to persistent challenges in Mainland China. EL’s solid international presence keeps it exposed to unfavorable currency fluctuations.

Profit Recovery Plan on Track

All being said, management is on track to operationalize Profit Recovery Plan for fiscal 2025 and 2026 amid such hurdles. The company recently announced expansion of this plan to include the restructuring program. The plan is focused on rebuilding stronger and more sustainable profitability alongside supporting sales growth. The program aims to better the gross margin, and reduce cost base and overhead expenses while increasing investments in consumer-facing activities.

Shares of the Zacks Rank #3 (Hold) company have risen 3.8% in the past three months compared with the industry’s 0.8% growth.

Better-Ranked Staple Stocks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings indicates growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings implies growth of 17.5% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance