Estee Lauder (EL) Gains From Emerging Market Presence Amid Risks

The Estee Lauder Companies Inc. EL has been benefiting from its strong online business, which has enabled it to expand its presence across several markets. The company has been implementing new technology and digital experiences, including online booking for each store appointment, omnichannel loyalty programs and high-touch mobile services. It remains focused on improving its omnichannel capabilities to support flexible and convenient shopping options for consumers. These initiatives have been boosting the company’s online sales.

The company’s presence across multiple end markets helps it mitigate the adverse impact of weakness in one end market with strength across others. EL has been investing to strengthen its manufacturing, innovation, distributional and marketing capabilities in several emerging markets like Thailand, India, Russia and Brazil.

In third-quarter fiscal 2023, several developed markets performed impressively, with the Americas and Asia/Pacific returning to organic sales growth and emerging markets continuing to prosper.

The Estee Lauder Companies remains on track to expand its consumer reach and expand its brands into new markets. In the fiscal third quarter, the company continued to grow its prestige beauty brand share across several markets, including China and Western Europe. In December 2022, it opened the China Innovation Labs to fuel its expanding business in China. Going forward, the company’s partnership with brands like Tom Ford and Balmain Beauty is also likely to be beneficial.

EL is also committed to rewarding shareholders through share repurchase programs and dividend payouts. For the first nine months of fiscal 2023, the company returned $945 million to shareholders through dividends and share repurchases.

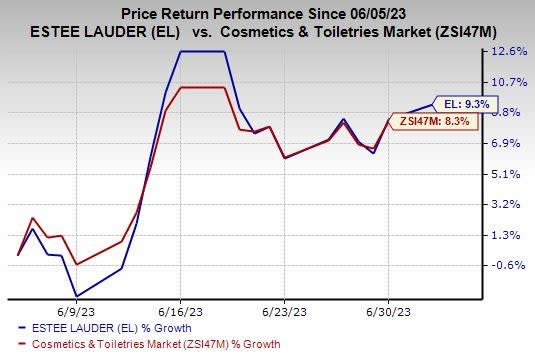

The Zacks Rank #3 (Hold) company’s shares have gained 9.3% in the past month compared with the industry’s 8.3% growth.

Image Source: Zacks Investment Research

However, the company has been witnessing greater volatility in the recovery from the pandemic across Asia in travel retail. In the fiscal third quarter, its organic net sales declined by 8% due to weakness in Asia’s travel retail business in Hainan and Korea.

While it experienced recovery in many markets worldwide, its Asia travel retail business remained under pressure due to a slower-than-expected recovery from the COVID pandemic. For fiscal 2023, EL projects net sales to decline in the band of 10-12% year over year, including an unfavorable currency impact.

The Estee Lauder Companies has also been grappling with higher operating costs and expenses. In the fiscal third quarter, its cost of goods sold increased by 17% from the year-ago quarter to $1,159 million. In the fiscal third quarter, its gross profit margin contracted to 69.1% from 76.6% reported in the year-ago quarter.

Key Picks

Some better-ranked stocks are Coty Inc. COTY, Ingredion Incorporated INGR and Helen of Troy Limited HELE. While COTY and INGR sport a Zacks Rank #1 (Strong Buy), HELE carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Coty specializes in the retail and wholesale of beauty products worldwide. The Zacks Consensus Estimate for COTY’s current financial-year sales suggests 3.1% growth from the year-ago reported figure. The company has a trailing four-quarter earnings surprise of 145%.

Ingredion is a producer and distributor of sweeteners, nutrition ingredients and biomaterial solutions. The Zacks Consensus Estimate for INGR’s current financial-year earnings per share is expected to rise by 22.1% from the corresponding year-ago reported figure.

Helen of Troy is a provider of consumer products in the United States, Europe, Canada, the Middle East, Africa and the Asia Pacific. The Zacks Consensus Estimate for HELE’s current financial-year sales and earnings per share suggests a decline of 3.2% and 6.9%, respectively, from the corresponding year-ago reported figures. The company has a trailing four-quarter earnings surprise of 9.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance