Escalade Inc (ESCA) Reports Mixed 2023 Financial Results Amidst Softer Consumer Demand

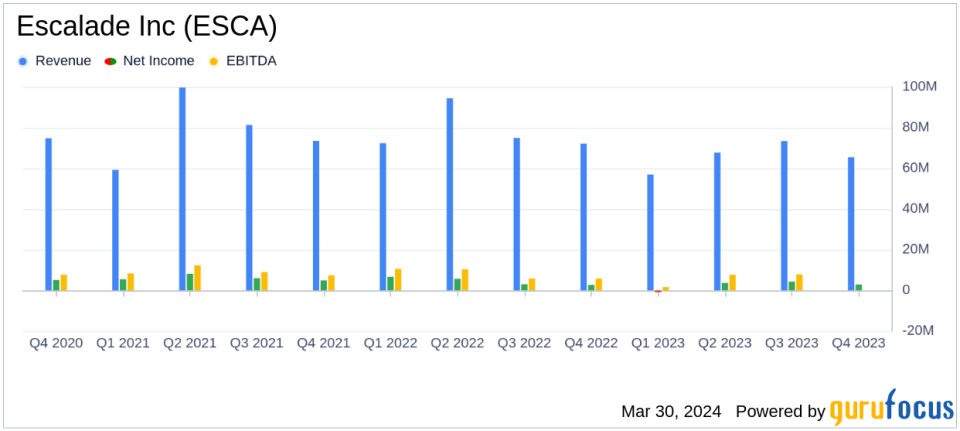

Net Sales: Decreased by 9.2% in Q4 and 16.0% for the full year.

Gross Margin: Improved by 192 basis points in Q4, despite a full-year decline of 3 basis points.

Operating Income: Increased by 1.6% in Q4 but decreased by 32.3% for the full year.

Net Income: Q4 net income rose to $2.9 million from $2.7 million in the prior year.

Cash Flow: Cash provided by operations surged to $20.6 million in Q4, up from $14.3 million.

Debt Reduction: Reduced debt by $21.1 million in Q4, lowering net debt to EBITDA ratio to 2.2x.

Dividend: A quarterly dividend of $0.15 per share announced, payable on April 22, 2024.

On March 29, 2024, Escalade Inc (NASDAQ:ESCA) released its 8-K filing, revealing its financial results for the fourth quarter and full year of 2023. The company, a prominent manufacturer and distributor of sporting goods and indoor/outdoor recreational equipment, experienced a downturn in net sales but demonstrated an improvement in gross margin and operating cash flow in the fourth quarter.

Escalade Inc operates primarily in North America and Europe, offering a wide range of products under well-known brand names. Despite facing softer consumer demand across most product categories, the company managed to improve its gross margin in the fourth quarter by 192 basis points to 24.3%, attributing this to price discipline, a favorable sales mix, and reduced freight and storage costs.

Financial Highlights and Challenges

While net sales for the fourth quarter fell by 9.2% to $65.5 million, and by 16% to $263.6 million for the full year, Escalade Inc's focus on inventory reduction and cost management led to a notable increase in operating income and EBITDA during the same quarter. The company's net income for the fourth quarter rose slightly to $2.9 million, or $0.21 per diluted share, compared to $2.7 million, or $0.20 per diluted share, in the previous year.

Escalade Inc's cash flow from operations in the fourth quarter was particularly strong, increasing by over 43.9% to $20.6 million. This financial achievement is crucial for the company as it allows for debt reduction and strengthens the balance sheet. In fact, the company reduced its debt by $21.1 million in the fourth quarter, resulting in a net debt to trailing twelve-month EBITDA ratio of 2.2x, a significant improvement from 2.8x at the end of 2022.

Management's Strategic Response to Market Conditions

President and CEO Walter P. Glazer, Jr. commented on the company's performance, stating:

We delivered a strong finish to the year, highlighted by improved gross margin, robust cash generation, and a significant reduction in net leverage. During a period of softer consumer demand driven by changes in discretionary spending, we successfully maintained our price discipline on in-line product while clearing excess inventory acquired during the Covid era supply chain disruptions, reduced both fixed and variable costs, and continued to drive a more favorable sales mix, culminating in fourth quarter growth in earnings per share and cash flow despite lower sales.

The company's strategic focus on working capital discipline led to a nearly $13 million reduction in total inventories, resulting in improved working capital efficiency. Glazer also highlighted the company's exit from Mexico, which involved winding down most operations and incurring severance and other shut-down costs.

Looking ahead, Escalade Inc remains optimistic about creating value in the upcoming year, with a strong portfolio of recreational brands that position the company to navigate the current macroeconomic environment successfully.

Investor Relations and Future Outlook

Escalade Inc will hold a conference call on April 1, 2024, to review its financial results and discuss recent events. The company has also provided a reconciliation of GAAP Net Income to Non-GAAP EBITDA in its earnings release, emphasizing the importance of non-GAAP measures as a supplement to U.S. GAAP measures of performance.

Investors and interested parties are encouraged to review the full financial details in the earnings release and to participate in the upcoming conference call to gain further insights into Escalade Inc's financial performance and strategic initiatives.

Explore the complete 8-K earnings release (here) from Escalade Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance