Erie Indemnity Co (ERIE) Surpasses Analyst Earnings Estimates in Q1 2024

Net Income: $124.6M, up by 44.5% year-over-year from $86.2M, surpassing estimates of $121.67M.

Earnings Per Share (EPS): $2.38, compared to $1.65 in the previous year, exceeding estimates of $2.29.

Operating Income: Increased to $138.8M from $110.5M, a growth of 25.6% year-over-year.

Investment Income: Turned positive at $15.1M, a significant improvement from a loss of $4.7M in the prior year.

Management Fee Revenue - Policy Issuance and Renewal Services: Rose by 19.3% to $107.6M.

Cost of Operations: Commissions increased by $67.0M, driven by growth in direct and affiliated assumed written premium and higher agent incentive compensation.

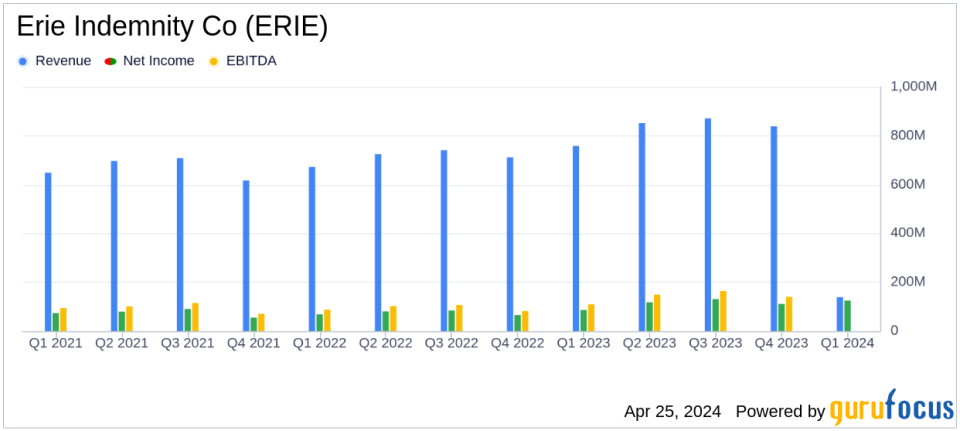

Erie Indemnity Co (NASDAQ:ERIE) released its 8-K filing on April 25, 2024, revealing a robust financial performance for the first quarter of the year. The company reported a net income of $124.6 million, or $2.38 per diluted share, significantly surpassing the analyst estimates of $2.29 per share and a net income of $121.67 million. This performance marks a substantial increase from the $86.2 million, or $1.65 per diluted share, recorded in the same quarter of the previous year.

Company Overview

Erie Indemnity Co primarily offers services on behalf of the Erie Insurance Exchange, focusing on sales, underwriting, and policy issuance. The company's revenue is derived from a management fee, typically 25% of the Exchange's premiums. Erie Indemnity operates exclusively in the United States, providing a range of insurance products including automobile, homeowners, commercial, and workers' compensation insurance.

Financial Highlights and Operational Performance

The first quarter of 2024 saw Erie Indemnity's operating income before taxes increase by 25.6% to $138.8 million, up from $110.5 million in Q1 2023. This growth was primarily fueled by a 19.3% increase in management fee revenue from policy issuance and renewal services, which rose by $107.6 million. Additionally, the company experienced a significant turnaround in its investment income, reporting a gain of $15.1 million compared to a loss of $4.7 million in the prior year's quarter.

Costs associated with operations also saw changes; commissions surged by $67.0 million due to growth in direct and affiliated assumed written premium and an increase in agent incentive compensation. However, the company managed to reduce information technology costs by $3.7 million, reflecting efficient capital management and strategic investments in technology.

Strategic Insights and Future Projections

The impressive results of Q1 2024 can be attributed to Erie Indemnity's strategic focus on enhancing operational efficiency and investing in technology to support its core insurance operations. The company's ability to significantly exceed analyst expectations for net income and earnings per share highlights its operational strength and market adaptability.

Looking ahead, Erie Indemnity is well-positioned to maintain its growth trajectory, supported by its strong relationship with the Erie Insurance Exchange and its strategic focus on leveraging technology to improve service delivery. However, the company remains vigilant of the challenges in the insurance industry, including competitive pressures and regulatory changes, which could impact future performance.

Investors and stakeholders can anticipate continued robust performance from Erie Indemnity, underpinned by its strategic initiatives and strong market position. The scheduled pre-recorded audio broadcast on April 26, 2024, will likely provide further insights into the company's strategies and outlook for the coming quarters.

Conclusion

Erie Indemnity's first-quarter results for 2024 not only surpassed analyst expectations but also demonstrated the company's resilience and strategic acumen in navigating a complex market environment. With a solid start to the year, Erie Indemnity is poised for continued success, driven by its commitment to operational excellence and strategic growth initiatives.

For more detailed information and future updates, investors and interested parties are encouraged to visit Erie Indemnity's official website and stay tuned for the upcoming webcast presentation.

Explore the complete 8-K earnings release (here) from Erie Indemnity Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance