Erdogan Wins Over Foreign Investors, But Turks Pay the Price

(Bloomberg) -- It doesn’t take long for a conversation among professionals in Istanbul or Ankara to turn to restaurants and grocery stores. Yet these days, people don’t say much about the food on offer, only prices.

Most Read from Bloomberg

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

Hedge Fund Talent Schools Are Looking for the Perfect Trader

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Manchester United’s Jim Ratcliffe Fears for Future of Premier League

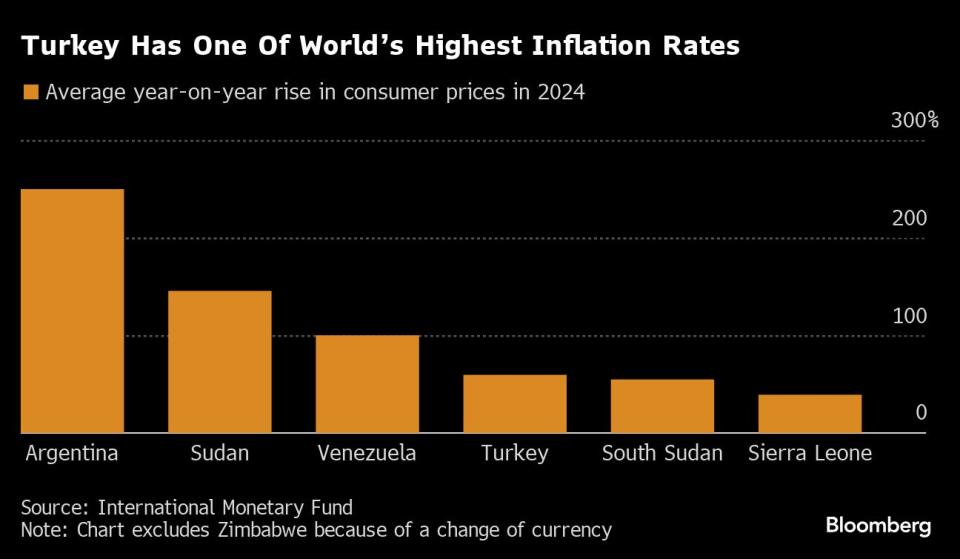

Turkey has endured some of the highest inflation in the world in recent years as President Recep Tayyip Erdogan abandoned economic orthodoxy by pursuing growth at any cost. A little over a year since he cemented his grip on power with another election win, a policy U-turn is now helping lure back some of the foreign investors who fled as the currency, the lira, plummeted.

Any great turnaround story in emerging markets, though, inevitably has a flipside. Despite promises by officials that the worst is over, many Turkish households reckon inflation is going to accelerate further while they’re being saddled with higher borrowing costs.

Erdogan and his successive governments have lifted millions of Turks out of poverty and into the middle class over more than two decades. The risk now is that the citizens who benefited from a credit boom end up being squeezed so much that the $1 trillion economy takes a hit at a critical juncture.

Inflation accelerated to almost 76% in May from a year earlier. The central bank anticipates the pace of price increases will be half that by the end of the year, but Turks don’t share the optimism. Food prices have been rising by more than 50% year-on-year since the start of 2022.

Elif Bulut is one of the millions of Turks allowed to retire early as a pre-election giveaway to boost Erdogan’s popularity. The 54-year-old, who supplements her income as a secretary at a decorating firm, now calls herself “collateral damage.” She works 10 hours a day to make just over the minimum wage and try to keep up with rising prices.

“We are the ones forced to swallow the bitter pill,” said Bulut, who lives in Ankara, the capital. “I am not buying the lies about the so-called turnaround in the economy. I don’t feel it in any way. Maybe foreign investors do.”

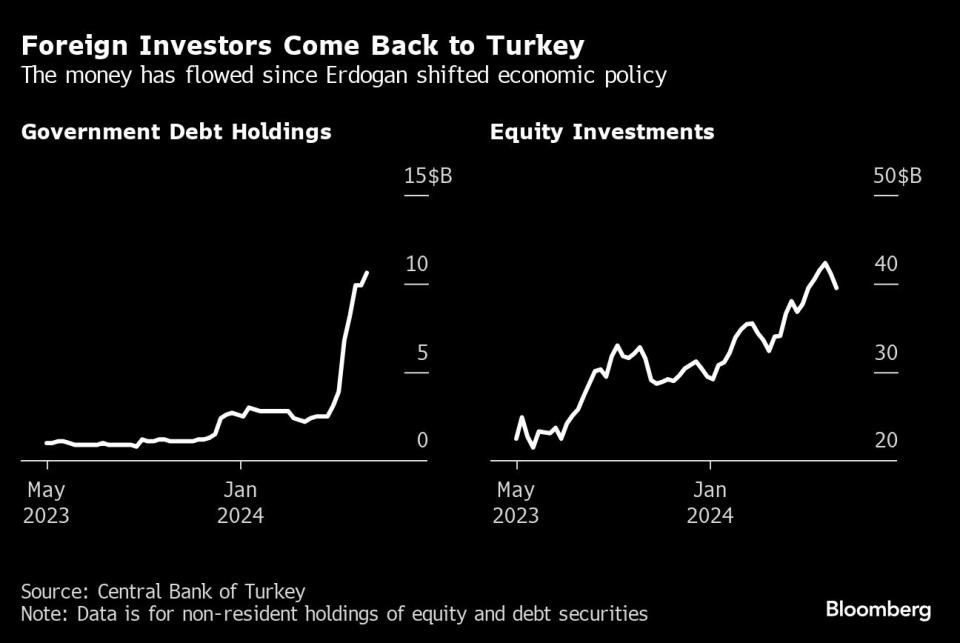

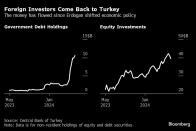

Tighter monetary and fiscal policies are critical to sustaining the renaissance in Turkish stocks and bonds. The benchmark stock index returned more than 40% in dollar terms since Erdogan won re-election last May, among the best performances in the world. Lira bonds absorbed a record $6.5 billion of foreign inflows last month.

Borrowing in dollars and investing in the Turkish currency has also become a go-to move for foreign investors. It was the most profitable so-called carry trades in emerging markets last month.

Bloomberg Economics estimates that since the end of March, almost $20 billion in carry trade — where investors borrow where rates are low and invest in places where they are high — has poured into the country.

“Investors are more convinced than the average citizen of the country, as they face the burden of inflation, which is normal,” said David Austerweil, deputy portfolio manager for emerging markets at Van Eck Associates Corp. “It takes a lot longer for a country’s people to regain trust. Inflation seems more like a political issue now.”

The IMF said last year that almost 30% of the population were lifted out of poverty since the early 2000s.

To keep the economy advancing, Erdogan, 70, ditched conventional wisdom with a five-year push for ultra-loose monetary policy that championed growth by fueling cheap money.

Inflation soared and the currency plunged to record lows, but the Turkish middle classes gorged on low borrowing costs to buy property and cars or accumulate hard currency. Many of them are yet to pay off those loans, while taking out new ones is now much more expensive.

Amid warnings that the nation was on the brink of a balance-of-payments crisis, the president appointed a more market-friendly team of officials following last year’s election victory. He installed former Merrill Lynch economist and long-time confidante Mehmet Simsek as finance minister to devise an economic overhaul.

The screws were turned on the credit boom with a tightening of lending rules. The central bank raised its flagship interest rate to 50% from 8.5%. Since last May, consumer loan costs have doubled to 72%. Interest on credit cards — which Turks are heavily reliant on — have also soared. Non-performing loans as a result are starting to pick up.

Murat Kose, an office assistant at a state university in Ankara, said he tries not to overburden his credit card given the surge in borrowing costs while also servicing a mortgage he took out during the era of cheap money. The biggest change was to take his daughter out of university because he could no longer afford the fees.

“If we hadn’t bought the house, we’d probably be out on the streets by now,” said Kose, 46. “Food prices are the worst. We can’t eat red meat properly, maybe once or twice a month.”

Turks aren’t alone in feeling the effects of collapsing disposable incomes. Spending habits from emerging-market peers such as Egypt to more developed countries in Europe are also changing because of inflation and higher interest rates, with political consequences.

With no significant elections scheduled for the next four years, foreign investors are capitalizing on the shift to more orthodox economics coupled with one of the highest nominal interest rates in the world.

The Finance Ministry has announced a series of spending cuts and now mulling new tax measures to aid with disinflation efforts. Central bank Governor Fatih Karahan has said price stability will ultimately help restore social welfare.

Yet there’s a risk that Erdogan will run out of patience over the social impact of the shift in economic policies, said Wolfango Piccoli, the co-president of consulting firm Teneo. That could prompt the central bank to cut rates prematurely to avoid a political backlash, he said.

Erdogan indicated that the outlook will improve later in the year as the country takes “steps” on interest rates. “We will wait for the fourth quarter” to see full relief from high inflation, the Sabah newspaper cited Erdogan as saying last weekend.

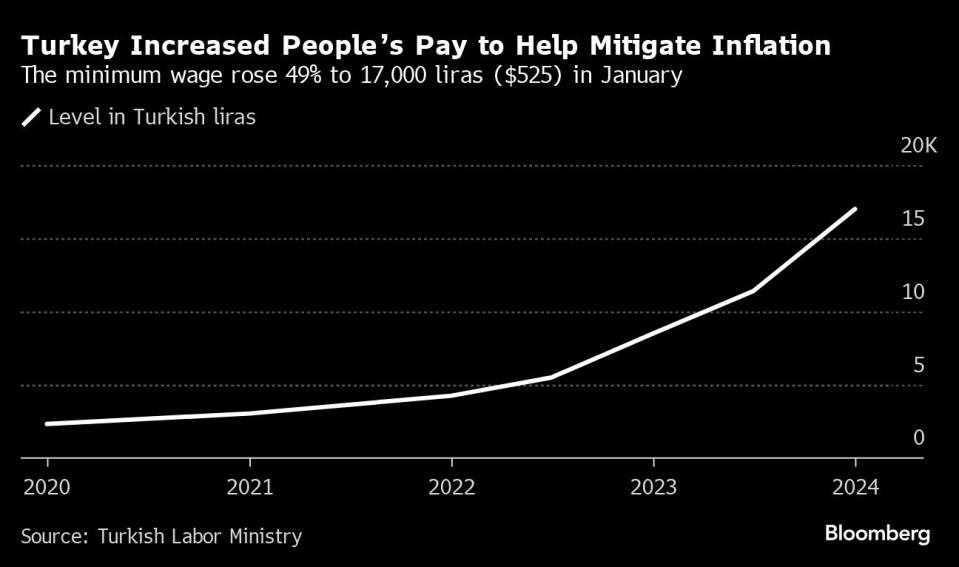

Another wildcard is what the government does to help mitigate the rising cost of living following a 49% increase in the minimum wage at the start of the year. More than half of Turkey’s workforce earns the minimum wage or just over it. Eyes are on whether ministers deliver another increase in July, in line with previous years.

Doing nothing would be another marker for investors, a determination to curb inflation, they say. In April, Labor Minister Vedat Isikhan ruled out raising the wage, though banks including Goldman Sachs Group Inc. still see it as a risk.

“If the government increases the minimum wage, then people could spend a bit more and increase activity in the economy,” said Mehmet Tutarli, 28, who helps run his family’s spicy sausage and bacon factory. “But that would only last a few months.”

--With assistance from Tugce Ozsoy and Paul Abelsky.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance