Equity Residential (EQR) Tops Q2 FFO Estimates, Ups 2022 View

Equity Residential’s EQR second-quarter 2022 normalized funds from operations (FFO) per share of 89 cents outpaced the Zacks Consensus Estimate of 85 cents. Rental income of $687 million also exceeded the consensus mark of $670.6 million.

On a year-over-year basis, FFO per share grew 23.6% from 72 cents, while the rental income increased 14.9%.

Results reflect strong physical occupancy and sustained growth in pricing power. This residential REIT also benefited from the favorable real estate tax and payroll expenses. EQR also raised its full-year guidance for same-store revenues, net operating income (“NOI”) and normalized FFO per share. Management noted that robust demand and continued strong cost controls have driven guidance improvements.

Quarter in Detail

Same-store revenues were up 13.6% year over year, reflecting strong physical occupancy and sustained growth in pricing power. The same-store expense increase was limited to 3.1% and reflected the favorable real estate tax and payroll expenses. As a result, same-store NOI surged 19.1% year over year.

The average rental rate increased 13.0% year over year to $2,900 during the quarter ended June, while the physical occupancy expanded 0.6% to 96.7% for the same-store portfolio.

In the second quarter, Equity Residential sold a 354-unit apartment property in New York for $265.7 million at a disposition yield of 3.3%. This produced an unlevered IRR of 6.6%. However, EQR did not acquire any properties in the quarter.

Balance Sheet

Equity Residential exited the second quarter of 2022 with cash and cash equivalents of $45.0 million, down from the $123.8 million recorded at the end of 2021.

The net debt to normalized EBITDAre was 5.01X compared with 5.38X in the previous quarter, while unencumbered NOI as a percentage of the total NOI increased to 88.4% from the 87.5% reported in the prior quarter.

Guidance

For full-year 2022, Equity Residential revised its guidance and now projects normalized FFO per share in the band of $3.48-$3.58, suggesting an 8-cent increase at the midpoint from the prior guidance. The 2022 guidance is ahead of the Zacks Consensus Estimate, which is currently pegged at $3.45.

The company’s full-year guidance incorporates same-store revenue growth of 10.0-11.0%, implying a 1.5% increase at the midpoint from the prior-guided range. Expenses are expected to increase 2.5-3.5%, same as guided earlier. Consequently, NOI is estimated to expand 13.75-14.75%, suggesting a 2.25% uptick at the midpoint from earlier projections. Physical occupancy is expected at 96.5%, same as guided earlier.

For the third quarter of 2022, the company projects normalized FFO per share in the band of 89-93 cents. The Zacks Consensus Estimate for the same is currently pegged at 89 cents.

Equity Residential currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

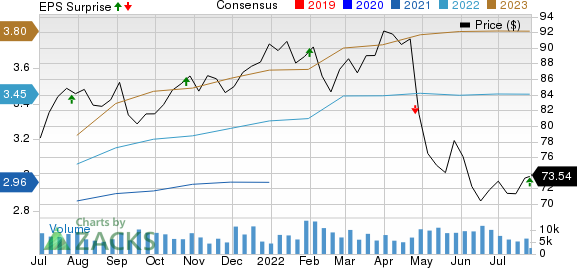

Equity Residential Price, Consensus and EPS Surprise

Equity Residential price-consensus-eps-surprise-chart | Equity Residential Quote

Performance of a Residential REIT

Essex Property Trust Inc. ESS reported second-quarter 2022 core FFO per share of $3.68, beating the Zacks Consensus Estimate of $3.55. The figure also surpassed the high-end of the company’s guidance range. The figure also improved 21.1% from the year-ago quarter. The results of Essex Property Trust highlighted better-than-expected operating results and lower property taxes in Washington. Following better-than-expected second-quarter results, ESS also raised the full-year 2022 guidance for the third time this year.

Upcoming Releases

We now look forward to the earnings releases of other residential REITs — AvalonBay Communities, Inc. AVB and Mid-America Apartment Communities, Inc. MAA — scheduled for today after the closing bell.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

MidAmerica Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance