Equitable Holdings (EQH) to Acquire Penn Investment Advisors

Equitable Holdings, Inc. EQH recently announced that its principal franchise, Equitable, has struck a deal to acquire Penn Community Bank’s subsidiary Penn Investment Advisors, Inc. The move is expected to enhance EQH’s wealth management business, Equitable Advisors.

At the second quarter-end, Equitable Advisors had $70.8 billion of assets under administration. It also had 4,200 financial professionals. Per the agreement, Equitable Advisors’ Philadelphia co-head David Fleisher is expected to oversee the new entity.

The deal is expected to conclude in the December quarter of 2022. The financial details of the move are yet to be disclosed. Penn Investment Advisors is expected to enrich Equitable Advisors with its $600 million in assets under administration. The investment advisor arm of Penn Community Bank offers services to 950 customers.

The acquiree’s management, including president Christian Wagner, COO Sean Schmid, and its financial advisors’ team are expected to join the acquirer. Strategic acquisitions like this enable EQH to register significant growth. The latest deal marks EQH’s second strategic relationship with an institution in the Philadelphia region.

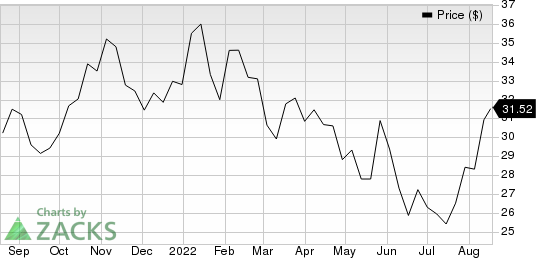

Equitable Holdings, Inc. Price

Equitable Holdings, Inc. price | Equitable Holdings, Inc. Quote

Zacks Rank & Key Picks

Equitable Holdings currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader finance space are Berkshire Hathaway Inc. (BRK.B), SmartFinancial, Inc. SMBK and Paramount Group, Inc. PGRE, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in Omaha, NE, Berkshire Hathaway is a holding company, which owns more than 90 subsidiaries in insurance, railroads, utilities, manufacturing services, retail and home building. The Zacks Consensus Estimate for Berkshire Hathaway’s 2022 bottom line indicates 5.3% year-over-year growth.

Based in Knoxville, TN, SmartFinancial is a leading financial services provider for individuals and corporate clients. The Zacks Consensus Estimate for SMBK’s 2022 earnings indicates 18% year-over-year growth.

New York-based Paramount Group works as a fully-integrated real estate investment trust. The Zacks Consensus Estimate for PGRE’s 2022 bottom line indicates 4.4% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Paramount Group, Inc. (PGRE) : Free Stock Analysis Report

SmartFinancial, Inc. (SMBK) : Free Stock Analysis Report

Equitable Holdings, Inc. (EQH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance