Equinor (EQNR) to Work for CCS Project in the North Sea

Equinor ASA EQNR teamed up with Wintershall Dea to seek the development of an extensive carbon capture and storage (“CCS”) project, planned to develop a pipeline to safely transport and store carbon dioxide (CO2) from Germany to Norway.

Germany is the largest CO2 emitter in Europe. Notably, the companies plan to connect Germany and Norway. Norway holds Europe’s largest CO2 storage potential. They will create technical and commercial solutions by engaging with governments to develop a regulatory system.

Equinor and Germany-based Wintershall Dea intend to construct a 900-kilometer pipeline to transport CO2 from northern Germany to storage sites offshore Norway by 2032. The pipeline is likely to have a carrying capacity of 20-40 million tons of CO2 per year. This is equivalent to 20% of all industrial emissions in Germany per year.

Moreover, the project would consider another solution, wherein CO2 is transported by ship from Germany to Norway. The companies plan to apply for offshore CO2 storage licenses to store between 15-20 million tons per year under the North Sea.

Oil and gas companies are getting actively involved in CCS projects as it offers a transition pathway for the rapid and effective reduction of CO2 emissions beyond what can be achieved by alternative methods like electrification and renewable fuels. Thus, the use of carbon capture and storage in reducing industrial emissions offers an excellent opportunity.

Wintershall Dea seeks to become net zero across upstream operations by 2030. The company aims to expand its gas-weighted portfolio in Norway, and develop a CCS and hydrogen business. It has gained expertise in the Greensand Project in the Danish North Sea. It is also a partner in Equinor’s Snohvit CCS project.

The latest partnership bolsters European industrial clusters’ need to accelerate decarbonization. Equinor and Wintershall Dea are committed to energy transition and will utilize their expertise to help reach the net-zero target.

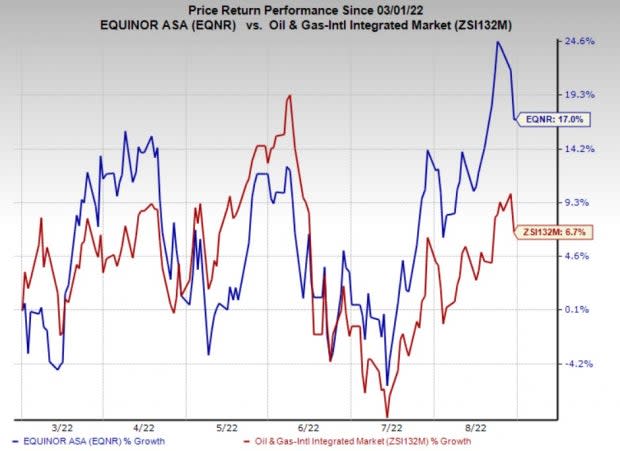

Price Performance

Shares of Equinor have outperformed the industry in the past six months. The stock has gained 17% compared with the industry’s 6.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TotalEnergies SE TTE is among the top five publicly traded global integrated oil and gas companies. TTE is managing long-term debt quite efficiently and trying to keep the same at manageable levels. As of Jun 30, 2022, cash and cash equivalents were $32,848 million. This was enough to address the current borrowings of $14,589 million.

TotalEnergies has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and Growth, and B for Momentum. TTE is expected to see earnings growth of 107% in 2022.

Petrobras S.A. PBR is the largest integrated energy firm in Brazil. As the company focuses on regaining its financial footing by selling assets and curtailing debt load, it successfully managed to lower gross debt below its 2022 target of $60 billion in the third quarter of 2021, well ahead of time. Post the latest quarter earnings, the figure stands at $53.6 billion.

Petrobras has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and B for Growth. PBR is expected to see earnings growth of 128.2% in 2022.

Marathon Petroleum Corporation MPC is a leading independent refiner, transporter and marketer of petroleum products. The company repurchased shares worth $4.1 billion in the May-July 2022 period and has completed more than 80% of its target to buy back common stock worth $15 billion.

Marathon Petroleum has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and Growth. MPC is expected to see earnings growth of 745.7% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance