If You Like EPS Growth Then Check Out Power Financial (TSE:PWF) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Power Financial (TSE:PWF). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Power Financial

Power Financial's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Power Financial boosted its trailing twelve month EPS from CA$2.55 to CA$3.07, in the last year. I doubt many would complain about that 21% gain.

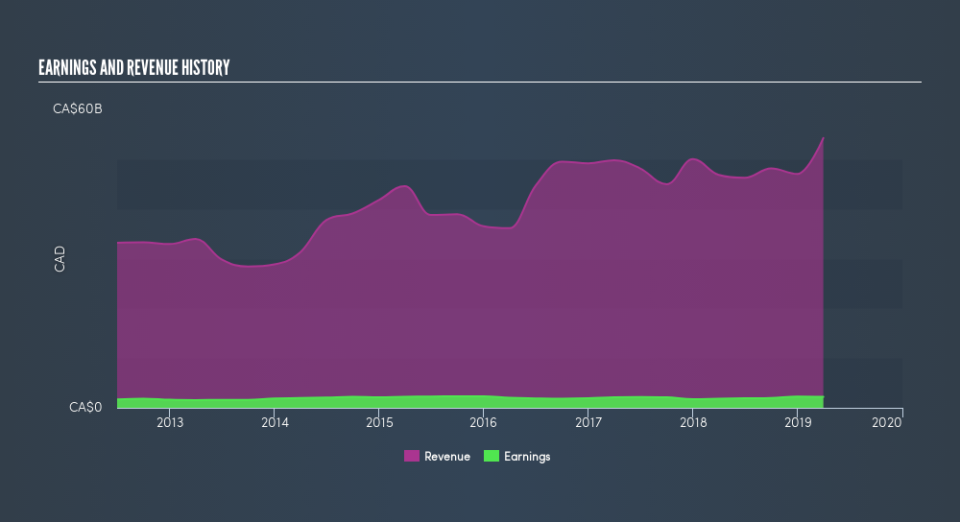

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Power Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Power Financial maintained stable EBIT margins over the last year, all while growing revenue 16% to CA$54b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Power Financial.

Are Power Financial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Power Financial insiders reported share sales in the last twelve months. But the really good news is that Pierre Beaudoin spent CA$498k buying stock stock, at an average price of around CA$28.46. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Should You Add Power Financial To Your Watchlist?

One important encouraging feature of Power Financial is that it is growing profits. While some companies are struggling to grow EPS, Power Financial seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Power Financial. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But Power Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance