If You Like EPS Growth Then Check Out Melcor Real Estate Investment Trust (TSE:MR.UN) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Melcor Real Estate Investment Trust (TSE:MR.UN), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Melcor Real Estate Investment Trust

How Fast Is Melcor Real Estate Investment Trust Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Melcor Real Estate Investment Trust's EPS went from CA$0.031 to CA$0.44 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

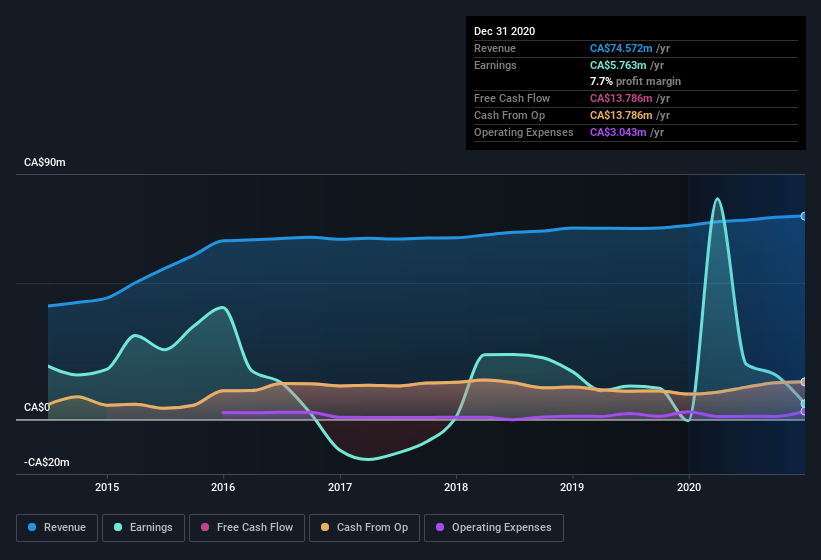

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Melcor Real Estate Investment Trust maintained stable EBIT margins over the last year, all while growing revenue 4.8% to CA$75m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Melcor Real Estate Investment Trust EPS 100% free.

Are Melcor Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Melcor Real Estate Investment Trust insiders spent CA$230k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Timothy Melton for CA$78k worth of shares, at about CA$3.90 per share.

Does Melcor Real Estate Investment Trust Deserve A Spot On Your Watchlist?

Melcor Real Estate Investment Trust's earnings per share have taken off like a rocket aimed right at the moon. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. What about risks? Every company has them, and we've spotted 4 warning signs for Melcor Real Estate Investment Trust (of which 1 makes us a bit uncomfortable!) you should know about.

The good news is that Melcor Real Estate Investment Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance