With EPS Growth And More, Kier Group (LON:KIE) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kier Group (LON:KIE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kier Group with the means to add long-term value to shareholders.

Check out our latest analysis for Kier Group

Kier Group's Improving Profits

Over the last three years, Kier Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Kier Group's EPS skyrocketed from UK£0.054 to UK£0.09, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 67%.

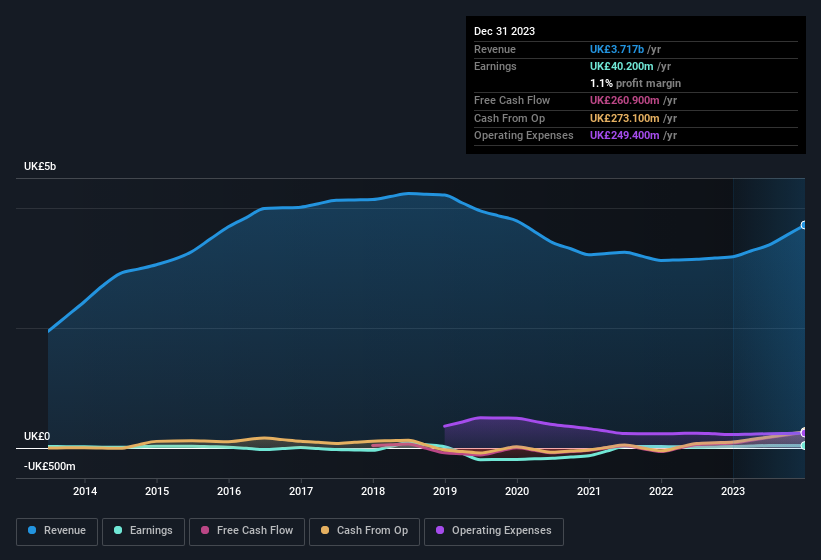

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Kier Group maintained stable EBIT margins over the last year, all while growing revenue 17% to UK£3.7b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Kier Group.

Are Kier Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Kier Group insiders spent UK£65k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

Is Kier Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Kier Group's strong EPS growth. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. So on this analysis, Kier Group is probably worth spending some time on. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kier Group , and understanding these should be part of your investment process.

The good news is that Kier Group is not the only growth stock with insider buying. Here's a list of growth-focused companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance