If EPS Growth Is Important To You, Caribbean Utilities Company (TSE:CUP.U) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Caribbean Utilities Company (TSE:CUP.U). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Caribbean Utilities Company

How Quickly Is Caribbean Utilities Company Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Caribbean Utilities Company managed to grow EPS by 10% per year, over three years. That's a good rate of growth, if it can be sustained.

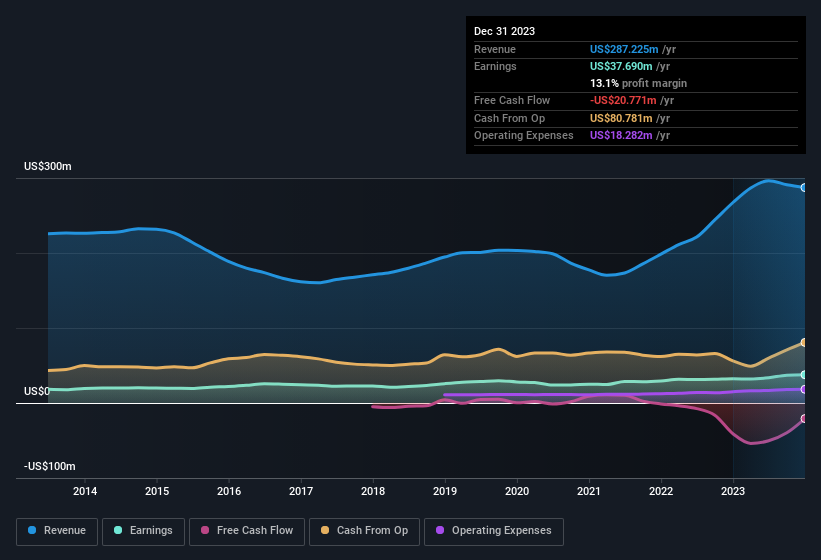

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Caribbean Utilities Company achieved similar EBIT margins to last year, revenue grew by a solid 7.4% to US$287m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Caribbean Utilities Company's balance sheet strength, before getting too excited.

Are Caribbean Utilities Company Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Caribbean Utilities Company shares, in the last year. With that in mind, it's heartening that Jennifer Frizelle, the Independent Director of the company, paid US$6.0k for shares at around US$11.98 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Caribbean Utilities Company.

It's reassuring that Caribbean Utilities Company insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Caribbean Utilities Company has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Caribbean Utilities Company, with market caps between US$200m and US$800m, is around US$1.3m.

The Caribbean Utilities Company CEO received US$671k in compensation for the year ending December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Caribbean Utilities Company Worth Keeping An Eye On?

One positive for Caribbean Utilities Company is that it is growing EPS. That's nice to see. And there's more to Caribbean Utilities Company, with the insider buying and modest CEO pay being a great look for those with an eye on the company. All things considered, Caribbean Utilities Company is certainly displaying its merits and is worthy of taking research to the next step. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Caribbean Utilities Company (1 is significant) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Caribbean Utilities Company, you'll probably love this curated collection of companies in CA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance