EOG Resources (EOG) to Report Q1 Earnings: What's in Store?

EOG Resources, Inc. EOG is slated to report first-quarter 2020 results on May 7, after the closing bell.

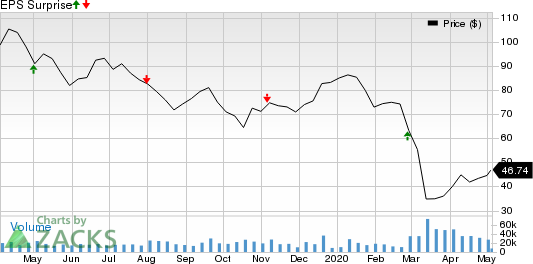

In the last reported quarter, the company came up with adjusted earnings of $1.35 per share that beat the Zacks Consensus Estimate of $1.16 due to higher oil equivalent production volumes, and lower lease and well operating expenses. This was partially offset by a drop in price realizations of commodities. In the last four quarters, EOG Resources beat estimates twice and missed on the other two occasions, with the average positive surprise being 7.4%, as shown in the chart below.

EOG Resources, Inc. Price and EPS Surprise

EOG Resources, Inc. price-eps-surprise | EOG Resources, Inc. Quote

Let’s see how things have shaped up prior to the announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for first-quarter earnings per share of 73 cents has witnessed one upward revision and seven downward movements in the past 30 days. This estimate is indicative of a 38.7% decrease from the year-ago reported figure.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $3.9 billion, suggesting a decrease of 4.4% from the year-ago reported figure.

Factors to Consider

The upstream energy player has an attractive portfolio of acreages in oil shale plays like the Permian, Bakken and Eagle Ford, which are likely to have supported first-quarter production. The Zacks Consensus Estimate for the company’s first-quarter crude oil equivalent volumes is pegged at 872 thousand barrels of oil equivalent per day (MBoe/d), suggesting a rise from the year-ago quarter’s 774 MBoe/d on higher production from resources in the United States.

The consensus mark for crude oil and condensate production volume for the quarter is pegged at 483 MBbls/d, implying a rise from the year-ago period’s 436 MBbls/d. As EOG Resources is an exploration and production company whose total production primarily constitutes oil, the potential increase in production volumes is likely to have driven the bottom line in the first quarter.

The Zacks Consensus Estimate for the explorer’s average realized crude oil and condensate prices is pegged at $51 per barrel, indicating a decline from $56 in the year-ago quarter. Moreover, realized prices for natural gas liquids are estimated to be $11.25 per barrel, signalling a decline from the year-ago level of $20.28. Also, the Zacks Consensus Estimate for natural gas realized prices is pegged at $1.72 per thousand cubic feet, indicating a decline from $2.85 in the year-ago period. Lower realized commodity prices are expected to have offset the gains from higher production volumes.

Earnings Whispers

Our proven model does not indicate an earnings beat for EOG Resources this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here as you will see below.

Earnings ESP: The company’s Earnings ESP is -4.60% as the Most Accurate Estimate is pegged at 70 cents per share, lower than the Zacks Consensus Estimate of 73 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: EOG Resources currently carries a Zacks Rank #5 (Strong Sell).

Stocks That Warrant a Look

Though an earnings beat looks uncertain for EOG Resources, here are a few firms that you may want to consider on the basis of our model. These have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Comstock Resources, Inc. CRK has an Earnings ESP of +2.63% and is a Zacks #2 Ranked player. The company is scheduled to release first-quarter results after the market closes on May 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sunoco LP SUN has an Earnings ESP of +14.75% and a Zacks Rank of 3. It is scheduled to report first-quarter results on May 11.

Canadian Natural Resources Limited CNQ has an Earnings ESP of +36.36% and holds a Zacks Rank #3. It is set to report first-quarter results on May 7.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance