Enterprise Group Q3 Revenue up 69%, YTD Revenues up 32%, Potential Up a Lot

Over the last several quarters, Enterprise has worked strategically to streamline operations and remained transparent; telling the investing world what it was doing and why. No corporate pity party, no smoke. Just solid growth.

Just as most resource related shares got bombed by the 2014-15 oil price decline, Enterprise may well do the reverse as the oil price stabilizes and/or rises. Enterprise subsidiaries CT Underground, Artic Therm, Hart Oilfield Rentals and Westar Oilfield Rentals serve the oil and gas sector (50%) through Infrastructure and custom rental solutions . The balance of its business mix is industrial, both public, private and from all levels of government in Western Canada.

"As we continue the trend of the last few quarters and significantly grow revenues and cut costs, management also believes that a balanced and diversified position between infrastructure and utilities construction and specialized equipment rental is the best path to generating shareholder value," stated Desmond O'Kell, Senior VP. "By diversifying our customer base and reducing costs, Enterprise will also be introducing other measures to ensure continued growth in all business metrics and of course, shareholder value."

You Should be Impressed

- Revenue for the three months ended September 30, 2017, of $11,039,666 increased by $4,488,381 or 69% compared to the prior period

- The increase in gross margin and EBITDA for the three months ended September 30, 2017, is consistent with increased activity over the comparative period

- Revenue for the nine months ended September 30, 2017, of $26,989,358 increased by $6,592,419 or 32% compared to the prior period.

- YTD Margins increased to 29%

- YTD EBITDA increased to $4.5 million from $2.2 million for same period 2016

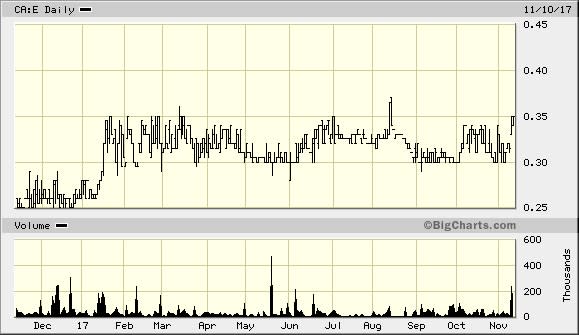

Q3 is not an orphan or a one off. Q2 revenues were up double digits over Q1 and EPS for Q3 2017 yielded C$0.01 a share. In the heady days of pre-2014-15, EPS hit $0.14 cents and E shares peaked at $3.15. The last profound share price move was from the $0.33 cents level in January 2012 to $3.15 in February 2014.

Given that it is a stronger company than pre-2014, with $49 million assets over debt, the 5% share buyback and an increased breakup value of $0.88, management strategy alone likely warrants owning or watching the shares. Or both.

North American trading has also been robust with E shares volumes increasing monthly with August 2017 showing 710k, September 1.2m, October 1.3m. By Friday November 10th, trading already exceeds 550k.

Enterprise management, along with the folks running its subsidiaries have proven what actions to take when faced with unwelcome market adversity.

While 2017 saw the corporate execution bear fruit, those same tenets—looking for opportunity within and without as well as strategic cost cutting will remain in place through 2018 and beyond.

For context, here is the YTD chart for the IGF ETF; the largest infrastructure vehicle. Two things of note; price growth is steady and the juniors are lagging as they always do when a sector picks up. The rise in infrastructure is as near as the next—God forbid—bridge or building collapse.

Society officials say the poor quality of U.S. infrastructure hampers economic growth and costs people thousands of dollars a year in extra travel time and car repairs from rutted streets.

The overall US infrastructure grade was a D+.

Faites vos jeux.

When the article on October 19th regarding selling a bit of Tesla (as the only vehicle related to Musk's 'The Boring Company') and buying some Enterprise based on some similarities turned out quite well. Tesla shares dropped from around US$352 then to US$302 now. Enterprise rose from C$0.32 a share to C$0.35. The exchange rates don't matter. You'd be ahead.

You're welcome. No charge.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated ten thousand dollars for its efforts in distributing the TSX:E profile on its web site and distributing it to its database of subscribers. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Yahoo Finance

Yahoo Finance