Enterprise fintech soaked up about 70% of VC funding in the space in 2023

I’m worried about fintech.

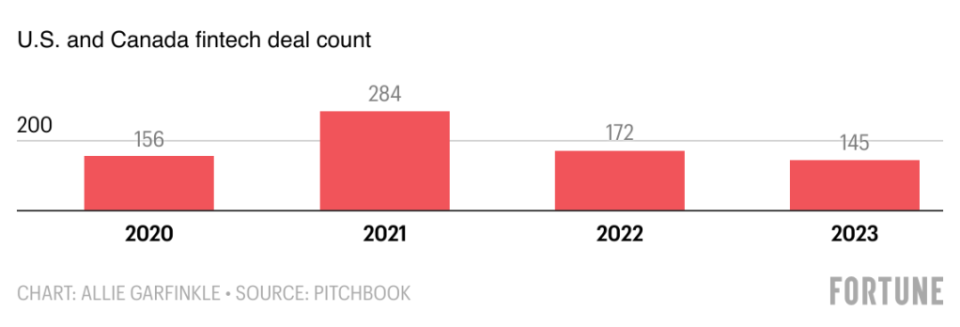

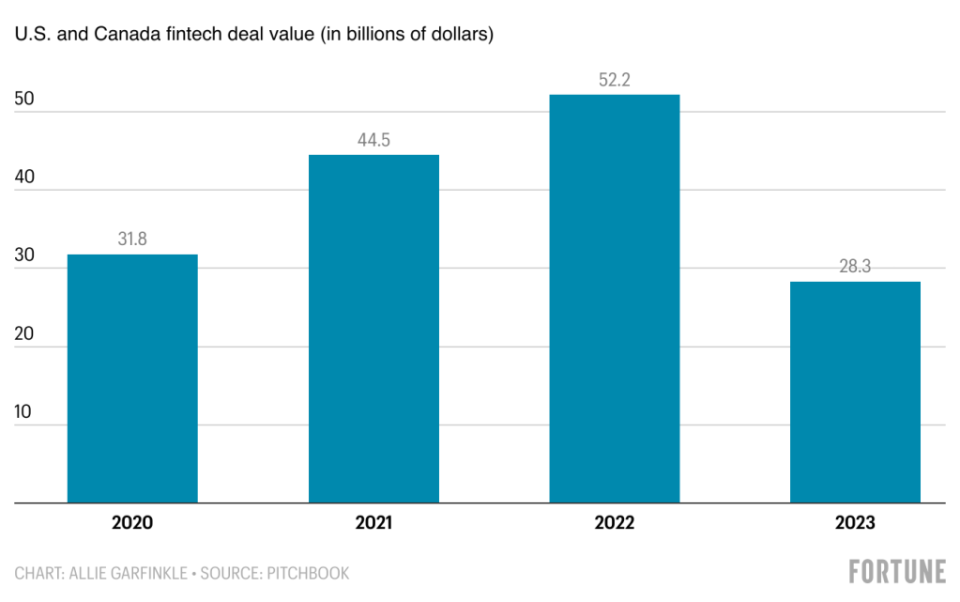

The data coming out of 2023 paints a picture of a sector that’s fallen precipitously out of favor. A recent PitchBook report shows that fintech M&A has been on a demonstrable, multiyear decline in the U.S. and Canada—in 2023, fintech deal value was down 45.8% from 2022, and is down 36.5% from 2021. Consumer fintech is especially going through a pullback as enterprise fintech soaks up whatever venture dollars are out there–in 2023, enterprise fintech startups secured 70.1% of fintech venture capital, up from 40.6% in 2019.

Most troubling was a prediction from the report, written by PitchBook’s Kyle Stanford and Vincent Harrison: “Fintech failures to continue for another three years: We believe we are in the fifth inning of fintech’s failure wave.”

I’m no baseball expert, but I’m pretty sure that means we’re only about halfway through the game.

If you’re a fintech founder raising money right now, that’s scary. With the Fed’s interest rate cuts still in the future (and the zero-rate environment unlikely to return anytime soon), you might be feeling less like you’re in a baseball game than in a grueling marathon, with no finish line in sight.

The good news is that fintech itself isn’t going anywhere long-term: The industry aims to solve real problems and has a giant total addressable market that exists—in some form or another—throughout the world.

At its best, fintech can foster financial flexibility and provide expert information to the public. There are so many fintechs devoted to helping people improve their credit scores, build their savings, and more easily access their money. (Of course, fintech also has its darker side—at its worst, fintech can enable predatory lending or facilitate fraud.)

But while the overall fintech sector will survive, startups are feeling the pressure and many are being forced to make tough decisions. In January, fintech behemoth Brex, valued north of $12 billion, laid off 20% of its staff. Over the last few months, we've seen layoffs at a wide range of smaller fintechs too, including a16z-backed Synapse and unicorn Zepz. Over in the public markets, Block (formerly Square) is also slashing its headcount. We've even seen full-fledged fintech-related shutdowns, as startups like Ness or ZestMoney shut their doors.

Fintech isn’t the only sector in the crosshairs right now. Consider crypto or web3, which once were hot and have now considerably cooled. But though there are connections between fintech and crypto, especially when it comes to the future of payments, fintech has long stood on its own, singular for its accessible potential.

Fintech has demonstrably made my life more frictionless—I barely carry cash anymore and among my millennial friends, we just pass money back and forth using digital payments apps. Even the hot dog carts outside every venue in Los Angeles take Venmo, PayPal, and Cash App.

The only time I consistently pay with cash is when I visit the Turkish coffee stand on the Venice Boardwalk. But they take Venmo too.

Which is all to say, I’m worried about fintech. Because the best fintech startups are essential. But, in the next few gutting years, the market is going to decide who those are.

Elsewhere...Nvidia's first-quarter earnings simply crushed it. The company's Q1 revenues were up 265% from this time last year, and its adjusted EPS in that time—get this—is up more than 760%. Read more here.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today's newsletter.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance