Enterprise Bancorp Inc (EBTC) Q1 2024 Earnings Analysis: Navigating Economic Challenges

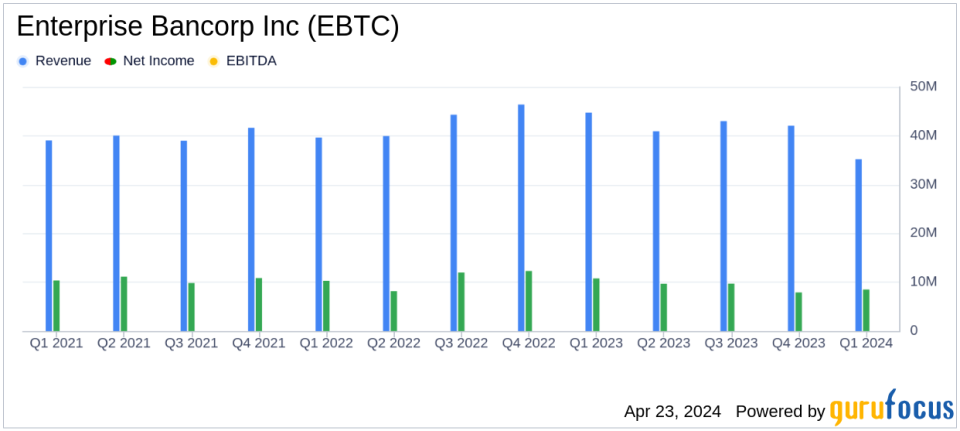

Net Income: $8.5 million for Q1 2024, a decrease from $10.8 million in Q1 2023.

Earnings Per Share: $0.69 per diluted share in Q1 2024, down from $0.88 in the same quarter last year.

Net Interest Income: Decreased by 12% year-over-year to $35.2 million, primarily due to higher deposit interest expenses.

Total Loans: Increased by 2.4% to $3.65 billion compared to the end of Q4 2023.

Total Deposits: Grew by 3.2% to $4.11 billion from December 31, 2023.

Wealth Management Assets: Under management and administration rose to $1.37 billion, marking a 4% increase from the previous quarter.

Net Interest Margin: Declined to 3.20% in Q1 2024 from 3.76% in Q1 2023, influenced by higher funding costs and competitive deposit rates.

On April 23, 2024, Enterprise Bancorp Inc (NASDAQ:EBTC) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported net income of $8.5 million, or $0.69 per diluted common share, reflecting a decrease from the $10.8 million, or $0.88 per diluted share, recorded in the same quarter the previous year. This performance highlights the impacts of an evolving economic landscape characterized by higher deposit costs and an inverted yield curve.

Company Overview

Enterprise Bancorp Inc operates primarily through its subsidiary, Enterprise Bank, focusing on attracting deposits and investing in loans and securities. The bank offers a variety of financial products and services, including commercial, residential, and consumer loan products, alongside wealth management and cash management services. Its market spans across several counties in Massachusetts and New Hampshire, maintaining a robust presence with 27 full-service branches.

Financial Performance Highlights

The first quarter saw a mix of growth and challenges. Total loans and deposits exhibited growth, increasing by 2.4% and 3.2% respectively, compared to the end of 2023. This growth underscores the bank's ability to attract and retain customer deposits and expand its loan portfolio despite economic headwinds. However, the bank's net interest margin declined to 3.20% from 3.76% a year earlier, primarily due to increased funding costs and competitive pressures for deposits.

Analysis of Income Statements and Balance Sheets

Net interest income for the quarter was $35.2 million, a decrease of 12% year-over-year, driven largely by a significant rise in deposit interest expenses. Conversely, non-interest income saw a healthy increase of 16%, bolstered by gains in equity securities and wealth management fees. On the expenditure front, non-interest expenses rose modestly by 3%, with notable increases in salaries and benefits.

From a balance sheet perspective, total assets grew by approximately 4% to $4.62 billion. The bank's capital position remains strong, with total shareholders' equity increasing slightly to $333.4 million.

Credit Quality and Risk Management

Credit quality metrics showed mixed signals. The allowance for credit losses stood at 1.66% of total loans, slightly up from 1.65% at the end of 2023. Non-performing loans increased, highlighting potential vulnerabilities in the loan portfolio amidst economic uncertainties. However, the bank maintains a conservative credit culture, which is critical in managing potential defaults and safeguarding financial stability.

Strategic Initiatives and Market Outlook

CEO Jack Clancy and Executive Chairman George Duncan emphasized the bank's strategic focus on enhancing customer relationships and capitalizing on market opportunities despite higher interest rates and economic challenges. The growth in wealth management assets, both under management and administration, reflects the bank's ongoing efforts to diversify its revenue streams and enhance its service offerings.

Conclusion

Enterprise Bancorp Inc's first-quarter results reflect a resilient business model capable of navigating economic fluctuations. While challenges such as rising deposit costs and a competitive banking environment persist, the bank's strategic initiatives and strong fundamentals position it well for future growth. Investors and stakeholders will likely watch closely how EBTC adapts to the evolving economic landscape and leverages its strengths in the coming quarters.

Explore the complete 8-K earnings release (here) from Enterprise Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance