Eni (E) Signs Deal to Supply HVOlution to the Spinelli Group

Eni SPA E signed an agreement with the Spinelli Group to power the latter’s fleet with HVOlution for two years.

The Spinelli Group’s fleet involves more than 300 heavy-duty vehicles. Of the total, 150 are the latest-generation Euro 6d trucks compatible with pure biofuel.

The agreement is part of Eni’s plan to develop sustainable transport services via its new company, Eni Sustainable Mobility. It reflects how Eni can back big transport players on the path toward decarbonization.

HVOlution is a diesel fuel produced from 100% renewable raw materials. The biofuel is produced from waste raw materials, vegetable residue and oils, which are processed in Eni’s bio-refineries in the Sicilian town of Gela and in Venice.

The renewable raw materials are produced from crops that do not compete with the food chain. They are supplied to Eni through a network of agri-hubs, currently being developed in several African countries.

The supply of biofuel to the Spinelli Group will be accomplished by Eni Sustainable Mobility’s network of retail outlets. The product is available in 57 service stations and is likely to be available in 150 sales points in Italy by the end of March.

Established in 1963, the Spinelli Group manages the entire supply chain for the container sector, from the arrival of containers in ports to their delivery to the final customer. It provides shipping companies with integrated solutions including multimodal transport, storage and customs forwarding activities.

The agreement represents an important move for the Spinelli Group as this type of biofuel can immediately decarbonize the transport supply chain.

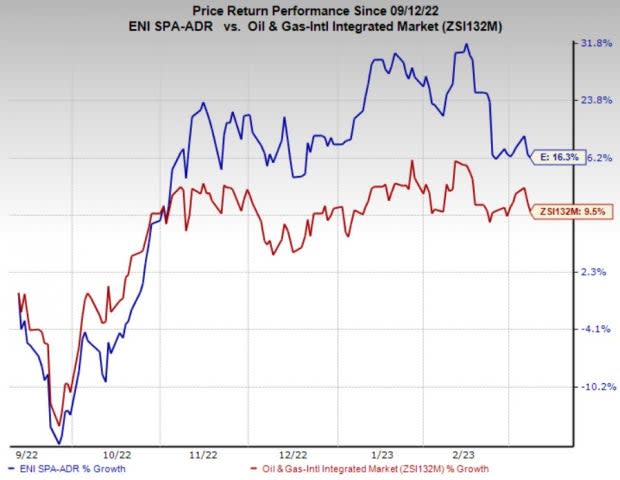

Price Performance

Shares of Eni have outperformed the industry in the past six months. The stock has gained 16.3% compared with the industry’s 9.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Antero Midstream Corporation AM reported fourth-quarter 2022 adjusted earnings per share of 20 cents, beating the Zacks Consensus Estimate of 17 cents. The strong quarterly results were primarily driven by higher freshwater delivery volumes and increased average freshwater distribution fees.

For 2023, Antero Midstream expects a net income of $340-$380 million, indicating an increase from the $326.2 million reported in 2022.

PBF Energy Inc.’s PBF fourth-quarter 2022 earnings of $4.41 per share missed the Zacks Consensus Estimate of earnings of $4.95. Quarterly earnings were primarily driven by lower contributions from the Logistics segment, and higher costs and expenses.

For 2023, PBF Energy’s total refining system throughput is expected to be 935,000-995,000 barrels per day. For the first quarter, the company anticipates throughput volumes of 845,000-905,000 barrels per day.

Murphy USA Inc.’s MUSA fourth-quarter 2022 earnings per share of $5.21 missed the Zacks Consensus Estimate of $6.16. The underperformance can be attributed to lower-than-expected petroleum product sales.

Murphy USA projects a 2023 fuel volume of 240-245 thousand gallons on an APSM basis. Further, Murphy USA’s 2023 guidance includes up to 45 new stores, up to 30 raze-and-rebuilds, and $795-$815 million in merchandise margin contribution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance