Enbridge (ENB) Wins Canada's Support for Line 5 Pipeline

Enbridge Inc.’s ENB Line 5 pipeline has faced sustained criticism for years over the risk of an oil leak since a section of the pipeline runs underwater through the Straits of Mackinac.

For the second time in less than a year, Canada invoked a 1977 pipeline treaty with the United States to prevent a shutdown of Enbridge’s Line 5 pipeline in Wisconsin. The 1977 pipeline treaty manages the free flow of oil between Canada and the United States.

Last year, Canada invoked it to negotiate with the United States to resolve a dispute with Michigan state, which seeks to shut down Line 5 on environmental aspects.

In Wisconsin, Line 5 runs directly through the Bad River Reservation, more than 500 square kilometers of pristine wetlands, streams and wilderness. This is home to the Bad River Band of the Lake Superior Chippewa, a native American tribe in northern Wisconsin.

The Bad River Band demands Line 5’s shutdown and removal from its reservation due to the risk of a leak and expired easements. Easements are land use agreements between Enbridge and the Bad River Band.

Canada expressed concerns that a potential shutdown of Line 5 will cause an extensive economic and energy disruption, thereby impacting energy prices. These are unsatisfactory outcomes when global inflation is making it difficult for families to cope.

Line 5, which is part of Enbridge’s larger Mainline and Lakehead systems, extends from Wisconsin through Michigan and into Ontario. The pipeline is a major source of 540,000 barrels per day of propane and crude oil supply for Michigan and nearby areas.

In May, Enbridge filed an application in a U.S. district court saying federal law forbids attempts to halt the pipeline’s operations. The application was intended to dismiss some of the Bad River Band’s claims. The company remains prepared to resolve the matter favorably. It was pursuing permits to re-route Line 5 around the Bad River Reservation.

Price Performance

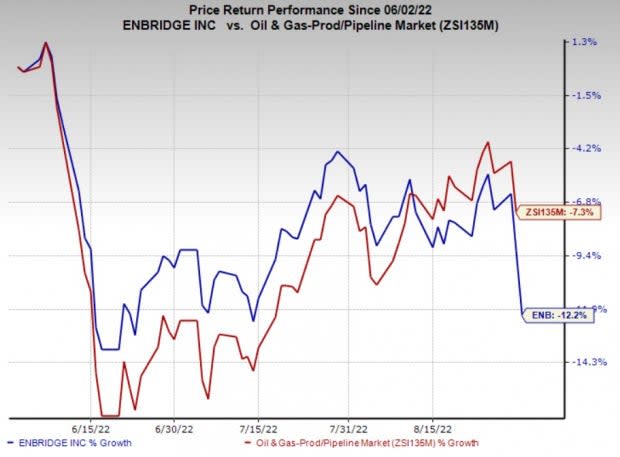

Shares of Enbridge have underperformed the industry in the past three months. The stock has lost 12.2% compared with the industry’s 7.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Enbridge currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cenovus Energy Inc. CVE is a leading integrated energy firm. CVE’s bottom line beat the Zacks Consensus Estimate in two of the prior four quarters and missed the same twice.

Cenovus has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Growth and B for Value. CVE is expected to see earnings growth of 321% for 2022.

TotalEnergies SE TTE is among the top five publicly traded global integrated oil and gas companies. TTE is managing long-term debt quite efficiently and trying to keep the same at manageable levels. As of Jun 30, 2022, its cash and cash equivalents were $32,848 million. This was enough to address the current borrowings of $14,589 million.

TotalEnergies has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value, Growth, and Momentum. TTE is expected to see earnings growth of 107% in 2022.

Liberty Energy LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s debt-to-capitalization stands at just 16% compared with many of its peers that are hugely burdened with debts, accounting for around 50% of their total capital structure.

Liberty Energy has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Growth and B for Value. LBRT is expected to see earnings growth of 266.7% for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enbridge Inc (ENB) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance